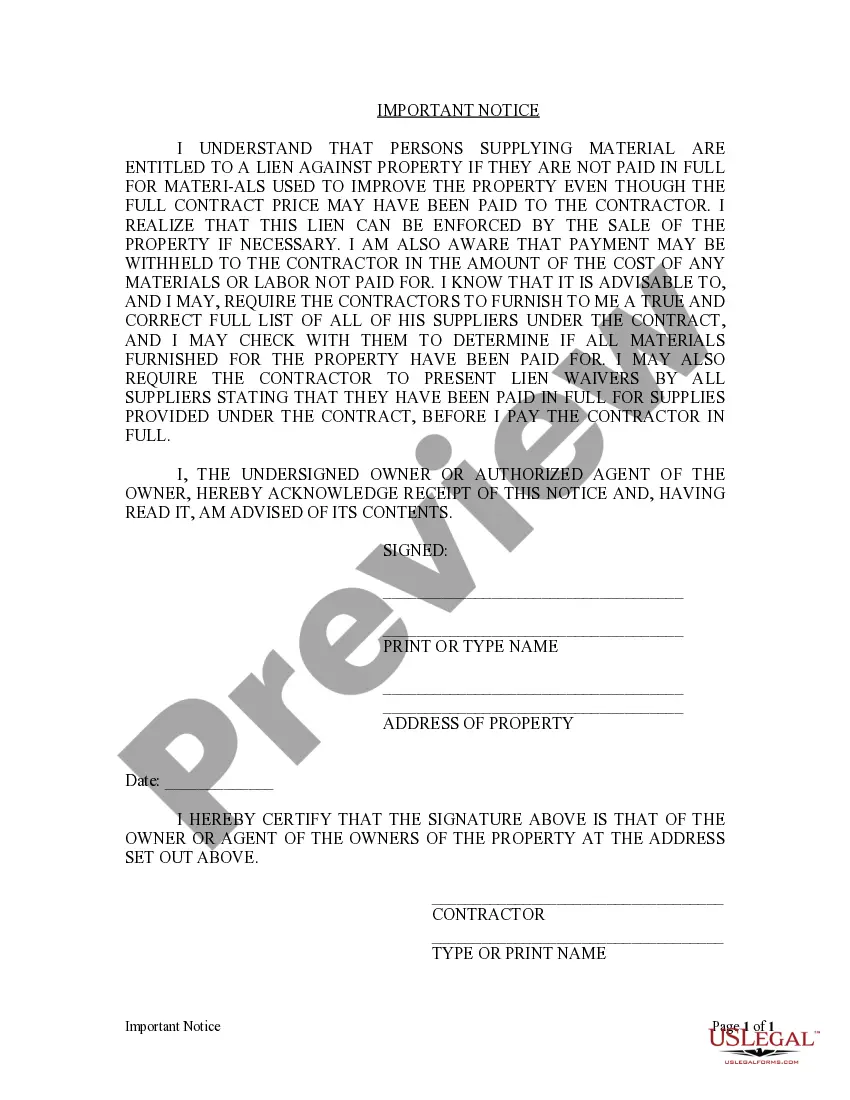

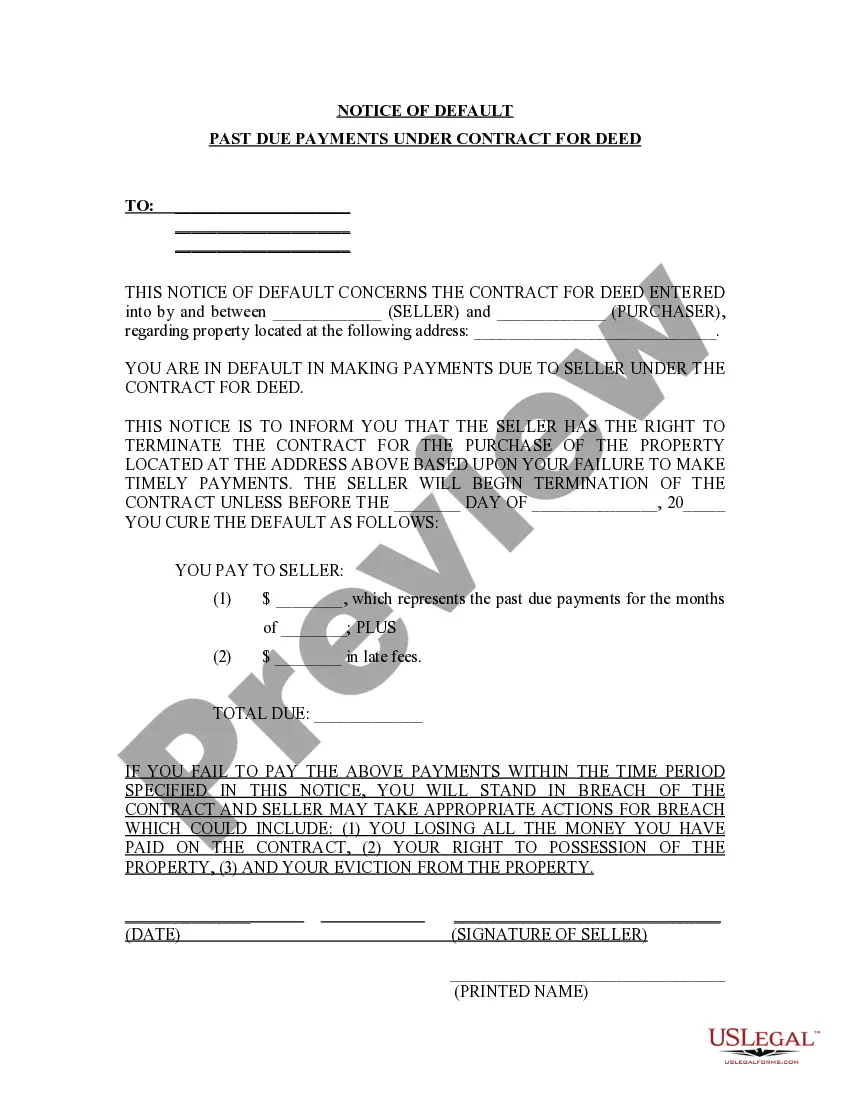

If you wish to comprehensive, download, or printing lawful file templates, use US Legal Forms, the biggest selection of lawful forms, that can be found on the Internet. Utilize the site`s simple and hassle-free search to get the files you require. A variety of templates for company and specific reasons are sorted by groups and states, or keywords. Use US Legal Forms to get the Nebraska Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement with a handful of clicks.

In case you are already a US Legal Forms client, log in in your account and then click the Acquire key to get the Nebraska Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement. You can even accessibility forms you formerly acquired from the My Forms tab of your own account.

If you are using US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Make sure you have chosen the form for that correct city/country.

- Step 2. Use the Review solution to check out the form`s content. Do not overlook to learn the explanation.

- Step 3. In case you are unsatisfied with all the type, make use of the Research area at the top of the display to locate other types of your lawful type format.

- Step 4. Upon having located the form you require, click the Buy now key. Select the costs strategy you favor and add your credentials to register to have an account.

- Step 5. Procedure the financial transaction. You can use your Мisa or Ьastercard or PayPal account to complete the financial transaction.

- Step 6. Choose the formatting of your lawful type and download it on your gadget.

- Step 7. Complete, edit and printing or signal the Nebraska Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement.

Each lawful file format you get is your own property eternally. You have acces to every single type you acquired with your acccount. Go through the My Forms segment and decide on a type to printing or download once more.

Contend and download, and printing the Nebraska Receipt of Beneficiary for Early Distribution from Estate and Indemnity Agreement with US Legal Forms. There are thousands of expert and condition-certain forms you can utilize to your company or specific requirements.