Nebraska Lease of Computer Equipment with Equipment Schedule and Option to Purchase

Description

How to fill out Lease Of Computer Equipment With Equipment Schedule And Option To Purchase?

Are you in a situation where you require documents for potential organization or particular applications nearly every day.

There are numerous authorized document formats available online, but acquiring templates you can trust is not straightforward.

US Legal Forms offers a wide array of document templates, such as the Nebraska Lease of Computer Equipment with Equipment Schedule and Option to Purchase, which are designed to comply with federal and state regulations.

Once you find the correct template, click on Acquire now.

Choose a payment plan you prefer, fill out the required information to create your account, and finalize the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Nebraska Lease of Computer Equipment with Equipment Schedule and Option to Purchase template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and make sure it is for the correct city/state.

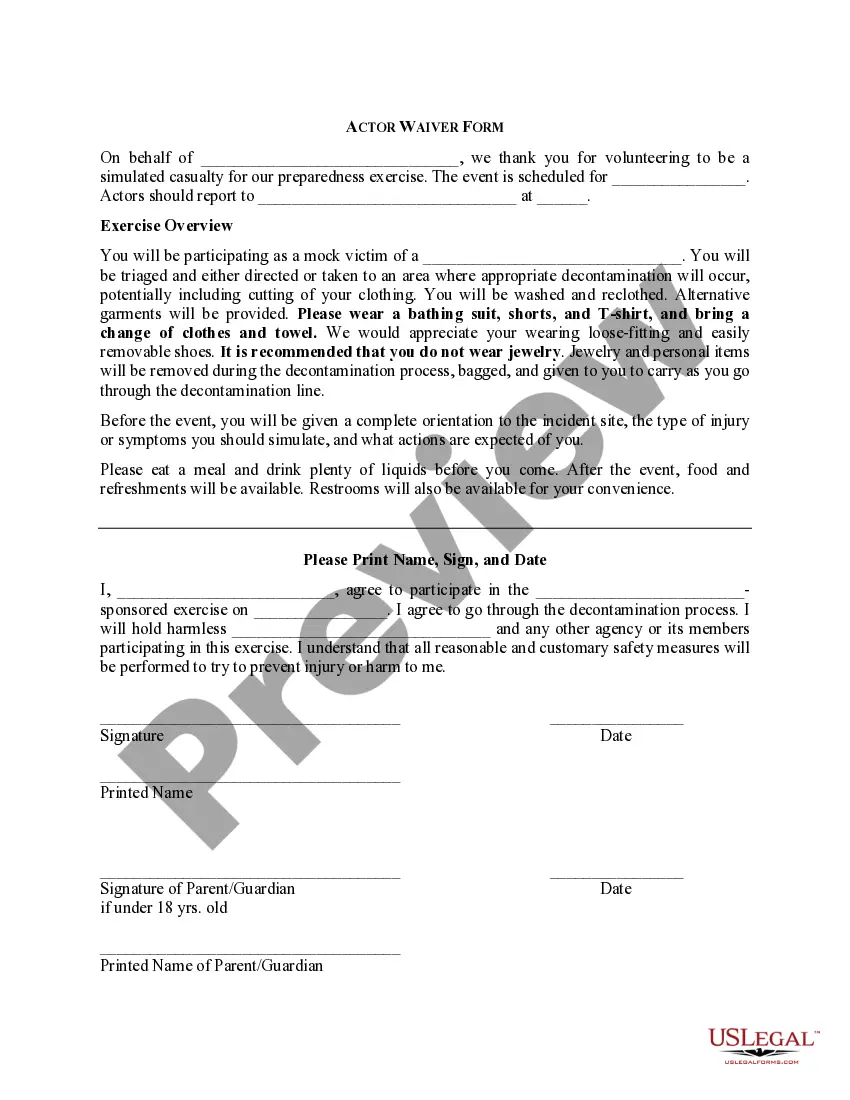

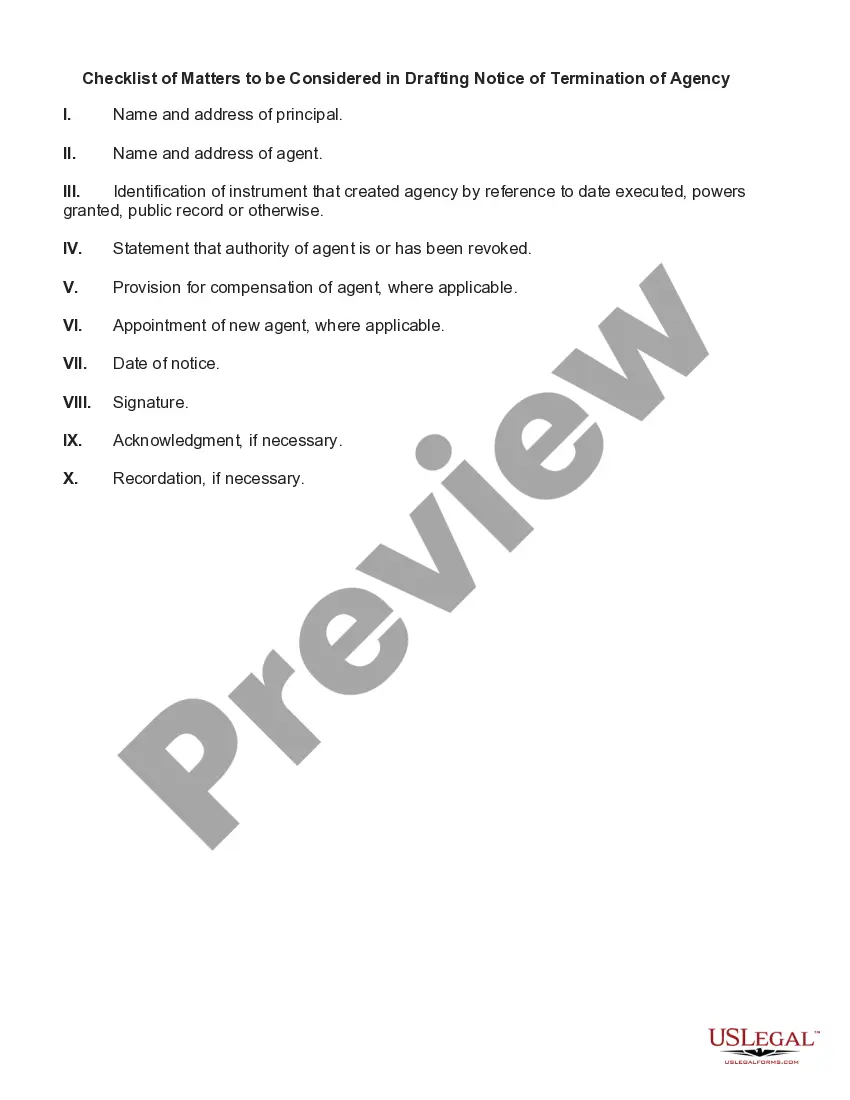

- Use the Preview button to review the document.

- Check the outline to confirm that you have selected the right document.

- If the document is not what you are looking for, use the Search box to find the template that meets your needs and requirements.

Form popularity

FAQ

FORM. 17. Section A Purchasing Agent Appointment. Name and Address of Contractor. Name and Address of Exempt Governmental Unit or Exempt Organization.

Contractor labor, generally. Repair labor on tax-exempt goods. Labor for items to be shipped out-of-state. Labor and repairs or remodeling of real property.

In the state of Nebraska, in the case of leases for the length of at least one year, lessors have the option to pay tax on the cost of the vehicle instead of collecting tax on the lease proceeds. Any rentals for a maximum of 31 days will be subject to an additional fee.

Services are generally taxed at the location where the service is provided to the customer. Refer to Sales Tax Regulation 1-006, Retail Sale or Sale at Retail, and Local Sales and Use Tax Regulation 9-007, Cities Change or Alteration of City Boundaries.

Option 3 contractors are consumers of all manufacturing machinery and equipment purchased and annexed by them. Option 3 contractors must pay tax on purchases of machinery and equipment even if the machinery and equipment will be used by a manufacturer.

Traditional Goods or Services Goods that are subject to sales tax in Nebraska include physical property, like furniture, home appliances, and motor vehicles. Medicine, groceries, and gasoline are all tax-exempt.

A contractor who elects Option 2 is the consumer of building materials and fixtures purchased and annexed to real estate. Option 2 contractors must: 2714 Obtain a Nebraska Sales Tax Permit by filing a Nebraska. Tax Application, Form 20, provided the Option 2. contractor makes over-the-counter retail sales or sales.

A contractor who elects Option 1 is a retailer of building materials and fixtures purchased and annexed to real estate.

The charges paid by the customers for the use of the equipment are rent, and are subject to tax, unless the company paid tax on its purchase of the equipment.