Nebraska Sworn Statement regarding Proof of Loss for Automobile Claim

Description

How to fill out Sworn Statement Regarding Proof Of Loss For Automobile Claim?

Discovering the right legal papers web template can be a have difficulties. Of course, there are a lot of templates accessible on the Internet, but how would you get the legal kind you require? Take advantage of the US Legal Forms internet site. The service offers a huge number of templates, such as the Nebraska Sworn Statement regarding Proof of Loss for Automobile Claim, which you can use for enterprise and private requirements. All of the types are examined by professionals and meet up with federal and state requirements.

Should you be already authorized, log in for your profile and click the Obtain option to have the Nebraska Sworn Statement regarding Proof of Loss for Automobile Claim. Utilize your profile to look from the legal types you might have acquired previously. Go to the My Forms tab of your respective profile and obtain another backup in the papers you require.

Should you be a new consumer of US Legal Forms, listed here are straightforward directions for you to comply with:

- Initial, make sure you have chosen the appropriate kind for your town/county. You may look through the shape utilizing the Review option and study the shape description to make sure this is the right one for you.

- When the kind does not meet up with your preferences, utilize the Seach field to discover the proper kind.

- When you are certain that the shape is suitable, click the Acquire now option to have the kind.

- Choose the rates plan you desire and enter the required details. Build your profile and pay for the order with your PayPal profile or bank card.

- Pick the data file structure and obtain the legal papers web template for your product.

- Comprehensive, edit and print and signal the attained Nebraska Sworn Statement regarding Proof of Loss for Automobile Claim.

US Legal Forms may be the most significant collection of legal types for which you can see a variety of papers templates. Take advantage of the service to obtain skillfully-made papers that comply with state requirements.

Form popularity

FAQ

Further, although Nebraska law has a five-year statute of limitations for contracts, Nebraska's limitation was not found to prohibit contractual limitation periods arising from policies issued in other states, just those policies issued in Nebraska.

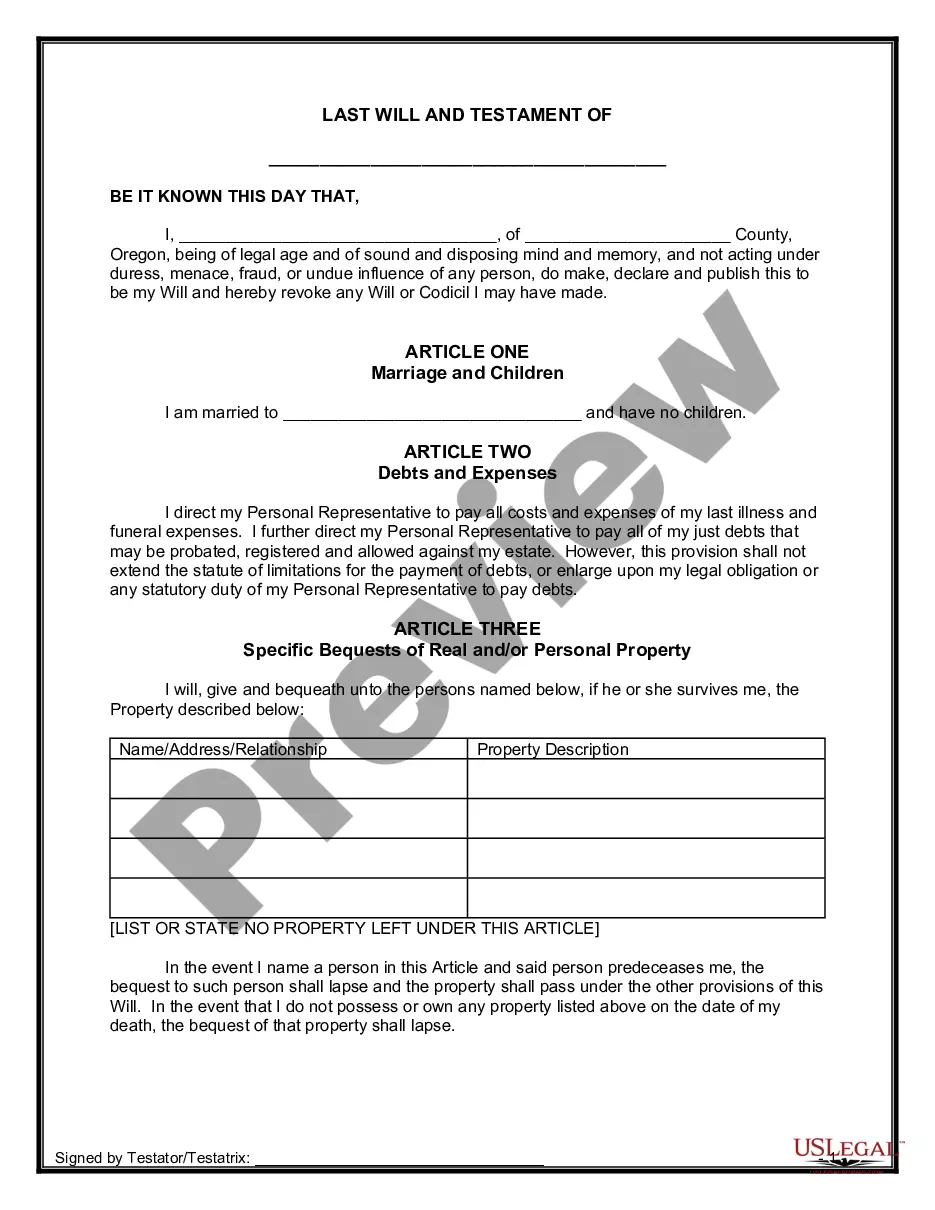

In most cases, the Proof of Loss must include the following: Amount of loss that the policyholder is claiming. Documentation that supports the amount of claimed loss. Date that the loss occurred. Cause of the loss. Identity of party claiming the loss.

010.01(B) When a loss requires replacement of items and the replacement items do not reasonably match in quality, color or size, the insurer shall replace all items in the area so as to conform to a reasonably uniform appearance.

If this has happened to you, you may be able to recover your damages from your insurer through a bad faith lawsuit. In a successful insurance bad faith lawsuit, you could receive compensation for the losses you suffered as well as recover your attorney fees.

A proof of loss form is evidence of any damages from an accident. Without this form, your insurer would not be able to process your claim. This would put repairs on hold, and prevent you from receiving accident benefits.

Stat. § 44-2012. An insured seeking damages for a bad faith settlement of a first-party insurance claim must prove the insurer had no reasonable basis for denying the claim and that the insurer knew of, or recklessly disregarded, the lack of reasonable basis for the denial.

Nebraska Among States Adopting Pro-Insured Matching Regulations.

Nebraska Administrative Code 210-60-007. 15 Days ? Your insurer must advise you of the acceptance or denial of the claim within 15 days after receipt by the insurer of properly executed proofs of loss.