Nebraska Pool Services Agreement - Self-Employed

Description

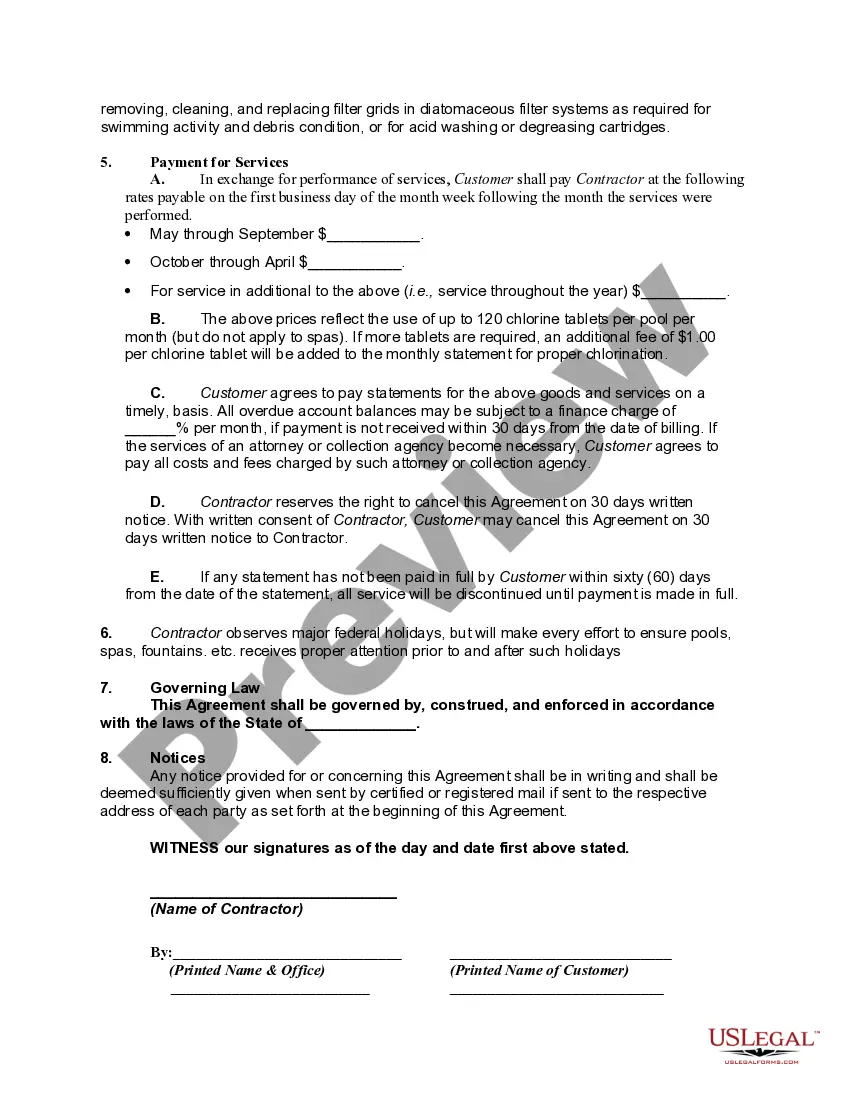

How to fill out Pool Services Agreement - Self-Employed?

Selecting the most suitable legal document format can be quite challenging.

Of course, there are numerous templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Nebraska Pool Services Agreement - Self-Employed, that can be utilized for both business and personal purposes.

You can preview the form using the Preview option and read the form description to confirm it is suitable for you.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Obtain button to download the Nebraska Pool Services Agreement - Self-Employed.

- Use your account to search through the legal forms you have bought previously.

- Visit the My documents section of your account and obtain another copy of the documents you need.

- If you are a new client of US Legal Forms, here are simple instructions for you to follow.

- First, ensure that you have selected the correct form for the area/region.

Form popularity

FAQ

Typically, you do not need to register specifically as an independent contractor in Nebraska. However, you may need to obtain necessary licenses or permits depending on your field, including pool services. The Nebraska Pool Services Agreement - Self-Employed can guide you through any required legal steps, ensuring your operations are compliant and professional.

Yes, construction services are generally taxable in Nebraska. This includes labor and materials used in construction projects unless specific exemptions apply. When entering into agreements, such as the Nebraska Pool Services Agreement - Self-Employed, you should be aware of these tax implications to ensure compliance and avoid unexpected costs.

Form 20 is a document used in Nebraska for various official purposes, including tax filings and regulatory compliance. It may relate to different business activities, including those tied to self-employment. When engaging in services like pool maintenance or construction, understanding how Form 20 relates to the Nebraska Pool Services Agreement - Self-Employed is important for compliance and accuracy.

Yes, independent contractors must file as self-employed when tax season arrives. This means you will report your income and expenses on Schedule C of your tax return. Using a structured document like the Nebraska Pool Services Agreement - Self-Employed can help you maintain clarity in your business dealings, ensuring you report correctly and efficiently.

To reduce your self-employment tax, consider tracking your business expenses carefully. Deductible costs can include materials, travel, and necessary business supplies. Additionally, utilizing the Nebraska Pool Services Agreement - Self-Employed ensures proper record-keeping, helping you maximize your deductions. Consulting a tax professional also provides tailored strategies to minimize your tax burden.

Yes, if you receive a 1099 form, it typically indicates that you are self-employed. This means you work as an independent contractor and are responsible for reporting your own income. The Nebraska Pool Services Agreement - Self-Employed can help clarify your obligations and rights in this arrangement. It is crucial to understand the implications of your self-employment status.

To become an independent contract worker, you first need to understand the legal requirements in your state. In Nebraska, one effective approach is to create a Nebraska Pool Services Agreement - Self-Employed, which outlines your services and responsibilities. This agreement can help clarify your relationship with clients and ensure that you comply with local regulations. By using uslegalforms, you can access user-friendly templates that simplify the process and provide legal protection as you embark on your independent contracting journey.

To start a pool service business, you will need the right tools, reliable transportation, and a solid business plan. Additionally, securing the necessary licenses and understanding the Nebraska Pool Services Agreement - Self-Employed is crucial for setting up legal protections. Marketing your services effectively and establishing a loyal client base will also contribute to your success. Utilizing platforms like uslegalforms can assist in drafting your contracts and ensuring all legal requirements are met.

Creating an independent contractor agreement involves outlining essential elements such as project details, compensation, and work deadlines. To ensure you meet legal standards, refer to the Nebraska Pool Services Agreement - Self-Employed, which provides key insights. You can manually draft this agreement or utilize an online service like uslegalforms, which offers templates tailored to your needs. This will help you create a comprehensive and compliant agreement.

Establishing an LLC can be advantageous for independent contractors, as it provides personal liability protection and may offer tax benefits. Operating under an LLC may enhance your professionalism when working with clients on the Nebraska Pool Services Agreement - Self-Employed. Before making this decision, assess your business needs, potential risks, and future growth plans. It might be helpful to seek guidance from a legal professional regarding this choice.