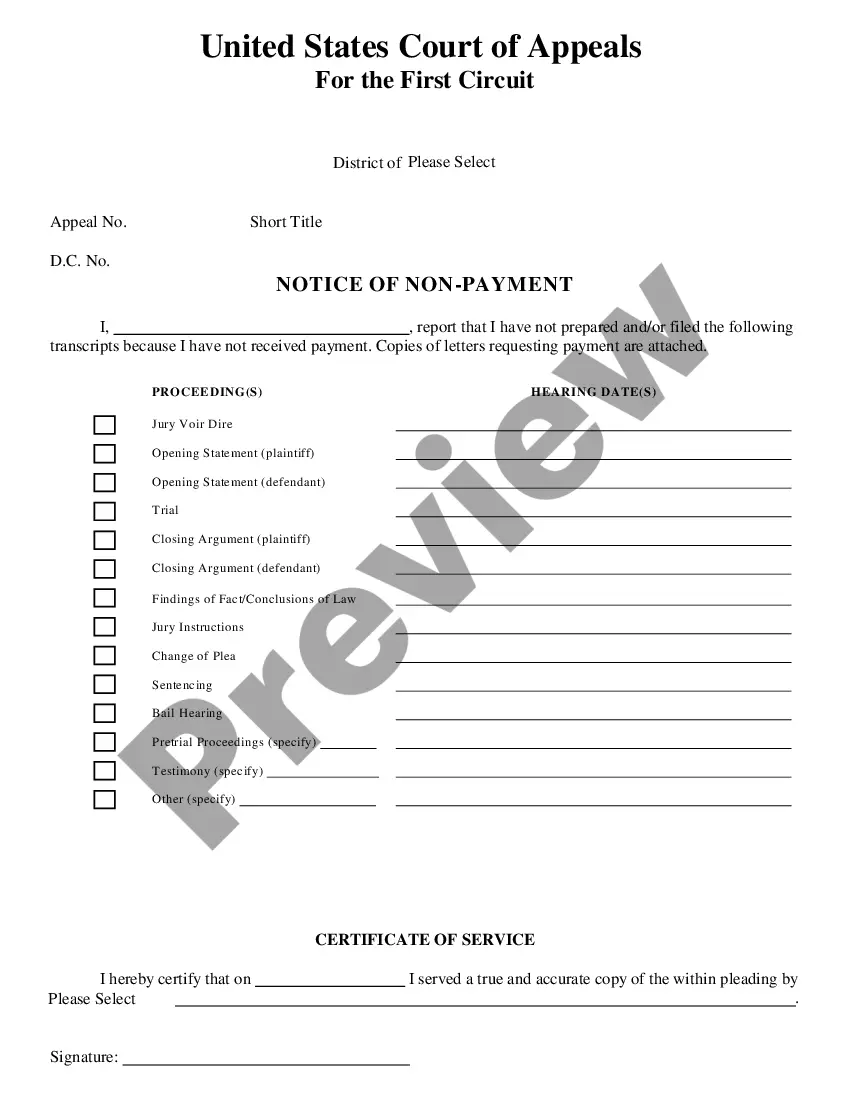

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

Nebraska Notice of Default in Payment Due on Promissory Note

Description

How to fill out Notice Of Default In Payment Due On Promissory Note?

Selecting the correct authentic document template can be a challenge.

It's clear that there are numerous web templates accessible online, but how can you discover the genuine type you require.

Utilize the US Legal Forms website.

First, ensure you have selected the correct form for your locality. You can review the form using the Preview option and read the form description to confirm this is indeed the proper one for you.

- This service provides thousands of web templates, such as the Nebraska Notice of Default in Payment Due on Promissory Note, suitable for business and personal purposes.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click on the Download option to retrieve the Nebraska Notice of Default in Payment Due on Promissory Note.

- Use your account to browse the legal forms you have purchased previously.

- Visit the My documents tab in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

Form popularity

FAQ

When a borrower defaults on a promissory note, it can trigger serious consequences. Typically, the lender will issue a Nebraska Notice of Default in Payment Due on Promissory Note to inform the borrower of the default. This notice may lead to negotiations to avoid further actions, including foreclosure or legal proceedings. If unresolved, the lender may pursue recovery of the owed amounts through legal means.

You can find a Nebraska Notice of Default in Payment Due on Promissory Note through legal databases or your local county's records office. Additionally, platforms like US Legal Forms offer templates and samples that can help you understand what this notice entails. It is essential to refer to official sources to obtain the most accurate and relevant information. Be sure to check for any variations or specific requirements based on local regulations.

A Nebraska Notice of Default in Payment Due on Promissory Note is a formal notification that the borrower has failed to meet payment obligations. This document serves as an official warning, indicating that the lender is aware of the missed payments. It's important for both parties to understand that this notice initiates the process of addressing the default. Receiving this notice often prompts the borrower to take action to remedy the situation.

When someone defaults on a promissory note, the first step is to review the terms outlined in the document. Communication with the borrower can sometimes resolve the issue amicably. If this fails, you may need to initiate legal action, possibly referencing the Nebraska Notice of Default in Payment Due on Promissory Note. Tools from US Legal Forms can guide you in drafting necessary documents and understanding your next steps.

Generally, non-payment of a promissory note is not a criminal matter; it typically leads to civil actions rather than criminal charges. However, ignoring court orders related to debt collection can lead to legal consequences. If you're facing a Nebraska Notice of Default in Payment Due on Promissory Note, it is crucial to seek legal advice. This way, you can understand your rights and responsibilities.

Absolutely, a promissory note can be enforced in Nebraska as long as it is valid and legally binding. If someone fails to make payments, the lender can pursue enforcement through legal channels, which may involve filing a claim based on the Nebraska Notice of Default in Payment Due on Promissory Note. Utilizing resources like US Legal Forms can provide you with templates and legal guidance to streamline this process.

Yes, promissory notes can hold up in court, provided they meet certain legal standards. In Nebraska, if a promissory note is properly executed and enforceable, it becomes a binding contract. If you find yourself navigating a Nebraska Notice of Default in Payment Due on Promissory Note, it’s essential to ensure all terms are clear and the document is duly signed. This clarity helps protect your rights in case of a dispute.

A key difference lies in the procedures and outcomes for each type of foreclosure. In a judicial foreclosure, the lender must file a lawsuit, while in a strict foreclosure, the lender receives immediate ownership of the property without a public sale. Understanding these differences is vital when dealing with the Nebraska Notice of Default in Payment Due on Promissory Note, as it guides homeowners through their options.

Foreclosing on a house in Nebraska typically takes around two to five months. The duration can vary based on factors such as the lender's efficiency and the homeowner's response. The process begins with the Nebraska Notice of Default in Payment Due on Promissory Note, which outlines the borrower's default and initiates the time frame for the foreclosure.

No, Nebraska is not classified as a judicial foreclosure state. Instead, it allows for non-judicial foreclosures, which can expedite the process for lenders. This system benefits many homeowners, as it requires the Nebraska Notice of Default in Payment Due on Promissory Note to kickstart the procedure without lengthy court battles.