US Legal Forms - one of many biggest libraries of legal types in the USA - delivers a wide array of legal document templates you are able to acquire or produce. Using the internet site, you can find a huge number of types for company and personal functions, categorized by groups, states, or search phrases.You can get the newest versions of types like the Nebraska Complaint for Wrongful Repossession of Automobile and Impairment of Credit within minutes.

If you currently have a subscription, log in and acquire Nebraska Complaint for Wrongful Repossession of Automobile and Impairment of Credit in the US Legal Forms collection. The Obtain key will appear on every single develop you see. You have accessibility to all in the past downloaded types in the My Forms tab of your account.

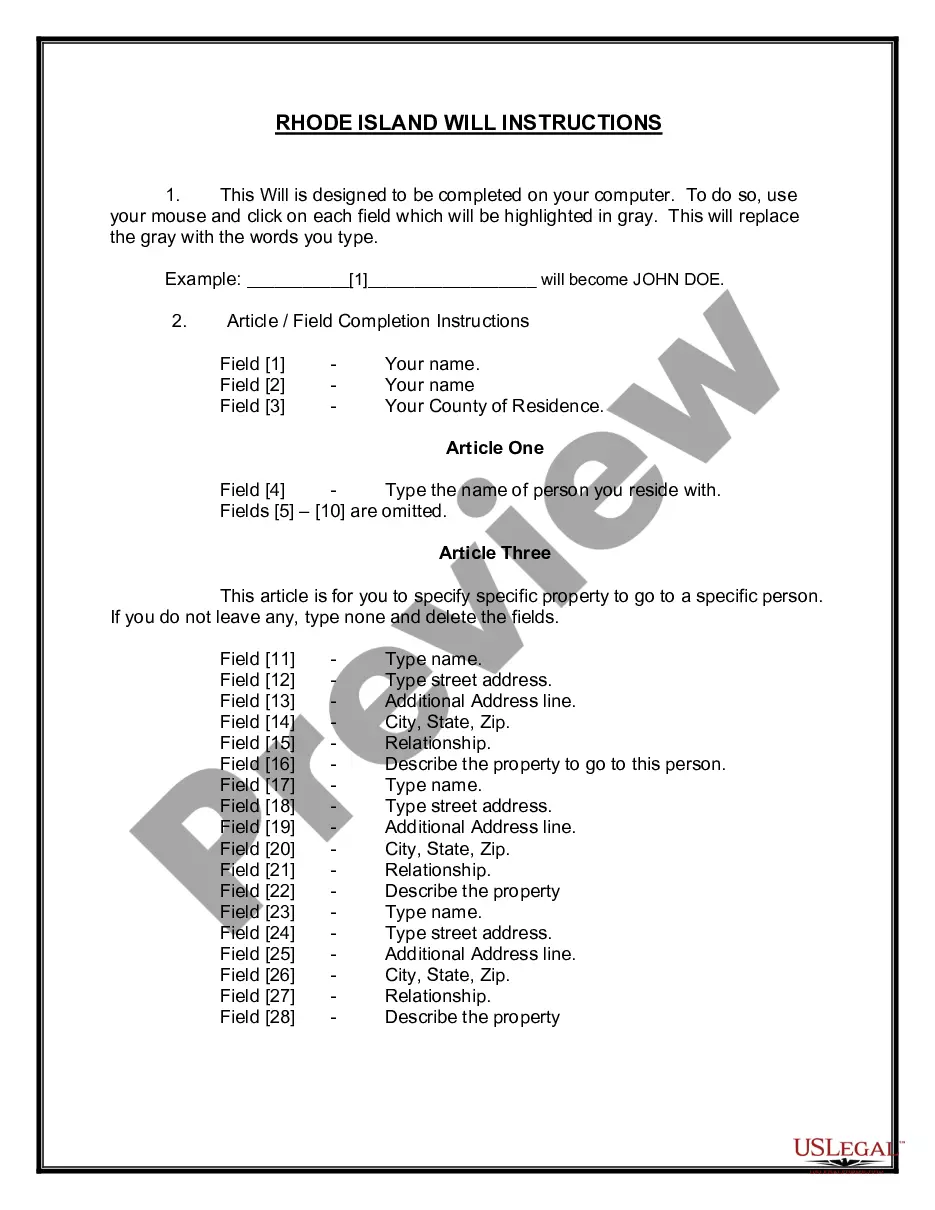

In order to use US Legal Forms initially, here are straightforward recommendations to get you began:

- Ensure you have picked out the correct develop for your city/area. Click the Review key to analyze the form`s articles. See the develop description to actually have chosen the correct develop.

- In the event the develop doesn`t fit your specifications, use the Lookup area near the top of the display to get the one who does.

- If you are pleased with the form, confirm your option by clicking on the Get now key. Then, select the costs prepare you like and give your qualifications to sign up for the account.

- Procedure the transaction. Use your credit card or PayPal account to perform the transaction.

- Choose the file format and acquire the form in your gadget.

- Make adjustments. Complete, change and produce and signal the downloaded Nebraska Complaint for Wrongful Repossession of Automobile and Impairment of Credit.

Every template you put into your bank account does not have an expiry day and is also your own property eternally. So, in order to acquire or produce an additional backup, just proceed to the My Forms segment and click on in the develop you will need.

Gain access to the Nebraska Complaint for Wrongful Repossession of Automobile and Impairment of Credit with US Legal Forms, probably the most substantial collection of legal document templates. Use a huge number of expert and condition-specific templates that satisfy your small business or personal demands and specifications.