No particular language is necessary for this type of report so long as the report clearly conveys the necessary information.

Nebraska Report to Creditor by Collection Agency Regarding Judgment Against Debtor

Description

How to fill out Report To Creditor By Collection Agency Regarding Judgment Against Debtor?

Choosing the best lawful file template can be quite a have a problem. Obviously, there are a lot of layouts accessible on the Internet, but how will you find the lawful kind you want? Utilize the US Legal Forms internet site. The support provides thousands of layouts, for example the Nebraska Report to Creditor by Collection Agency Regarding Judgment Against Debtor, which you can use for organization and private needs. Every one of the varieties are inspected by professionals and fulfill federal and state specifications.

In case you are already listed, log in to the accounts and then click the Down load key to find the Nebraska Report to Creditor by Collection Agency Regarding Judgment Against Debtor. Make use of accounts to search through the lawful varieties you possess ordered previously. Go to the My Forms tab of your respective accounts and have another version of your file you want.

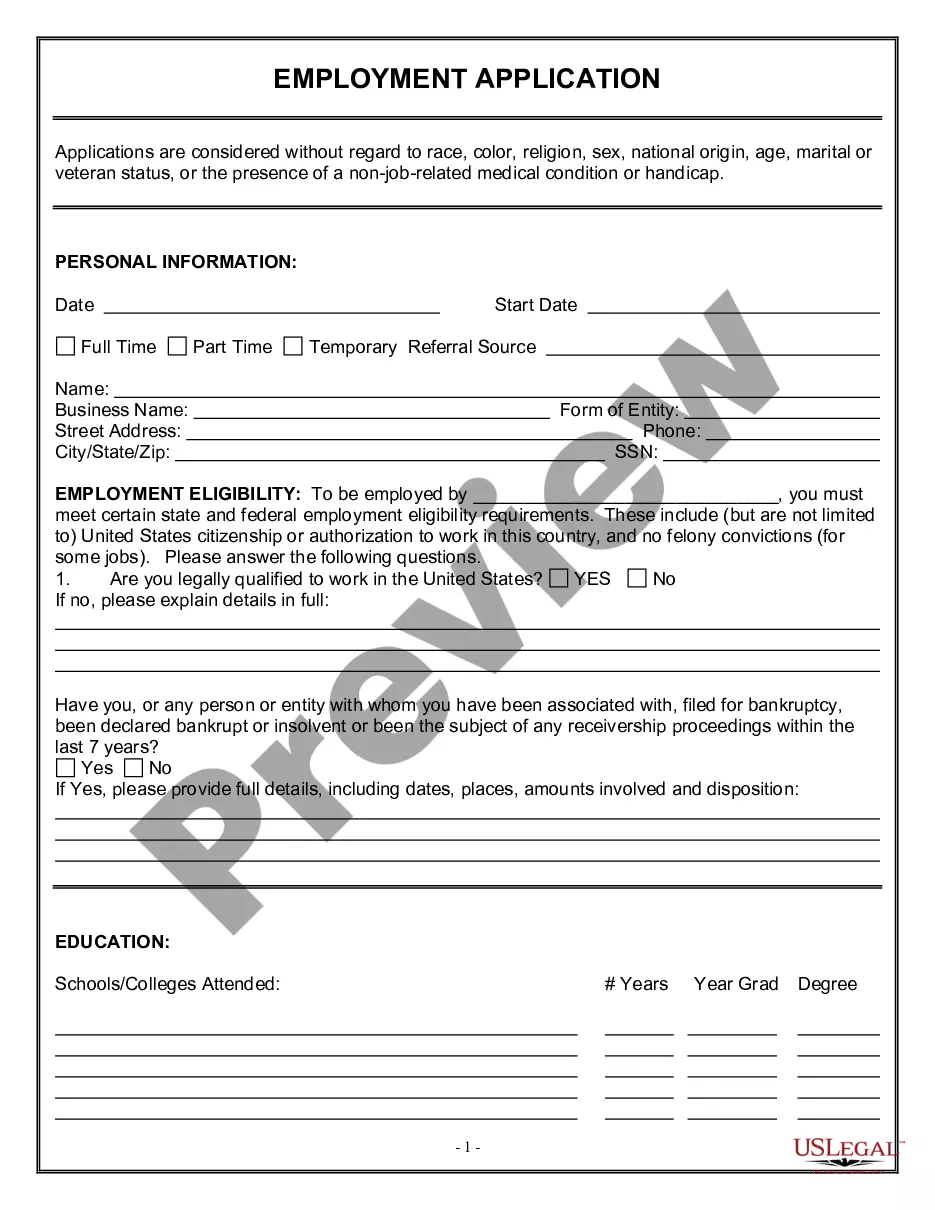

In case you are a whole new customer of US Legal Forms, listed here are basic recommendations for you to stick to:

- Initial, be sure you have selected the right kind to your area/region. You may look over the shape while using Preview key and study the shape explanation to make certain it is the best for you.

- If the kind will not fulfill your preferences, make use of the Seach industry to discover the right kind.

- When you are sure that the shape is suitable, click the Get now key to find the kind.

- Opt for the rates plan you desire and type in the required information and facts. Create your accounts and pay for the order with your PayPal accounts or credit card.

- Opt for the data file format and down load the lawful file template to the product.

- Comprehensive, revise and print and sign the received Nebraska Report to Creditor by Collection Agency Regarding Judgment Against Debtor.

US Legal Forms may be the largest catalogue of lawful varieties for which you will find a variety of file layouts. Utilize the company to down load professionally-made documents that stick to express specifications.

Form popularity

FAQ

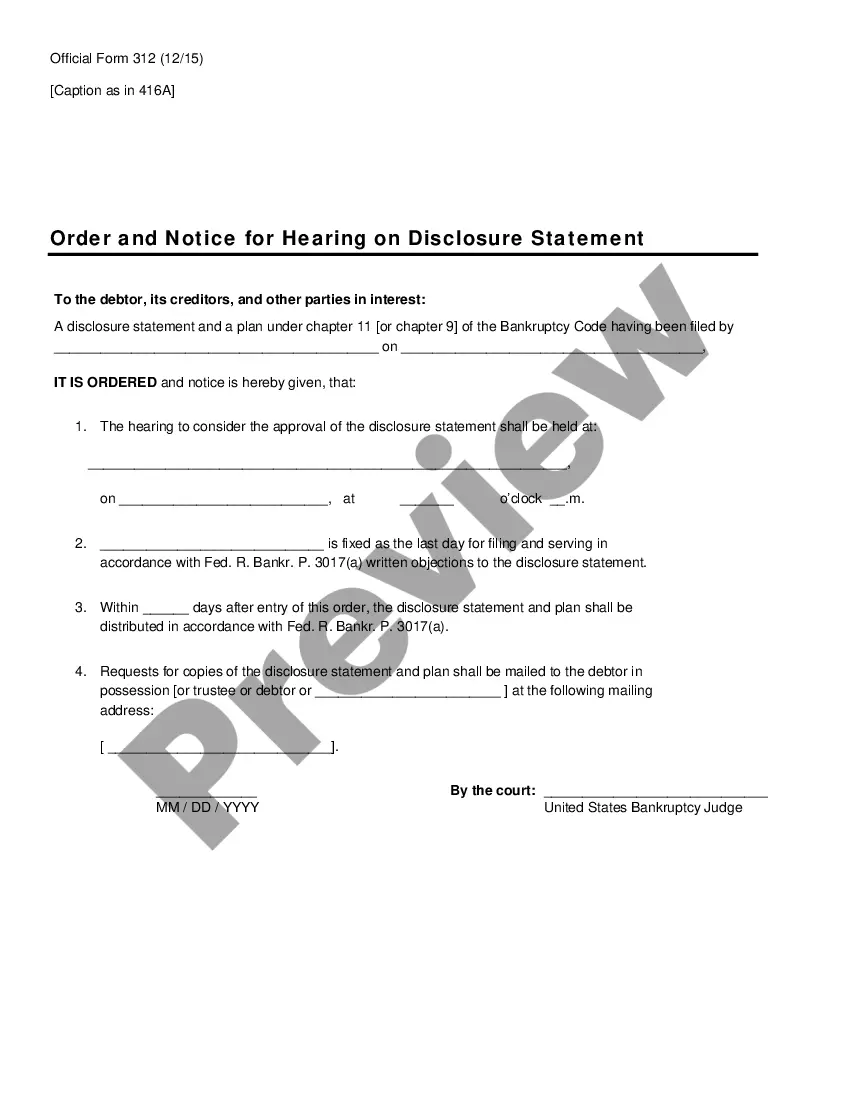

Nebraska Civil Statutes of Limitations at a Glance There is also a four-year limit for fraud, trespassing, oral contracts, and some other causes of action. For judgments and written contracts, there is a five-year statute of limitations.

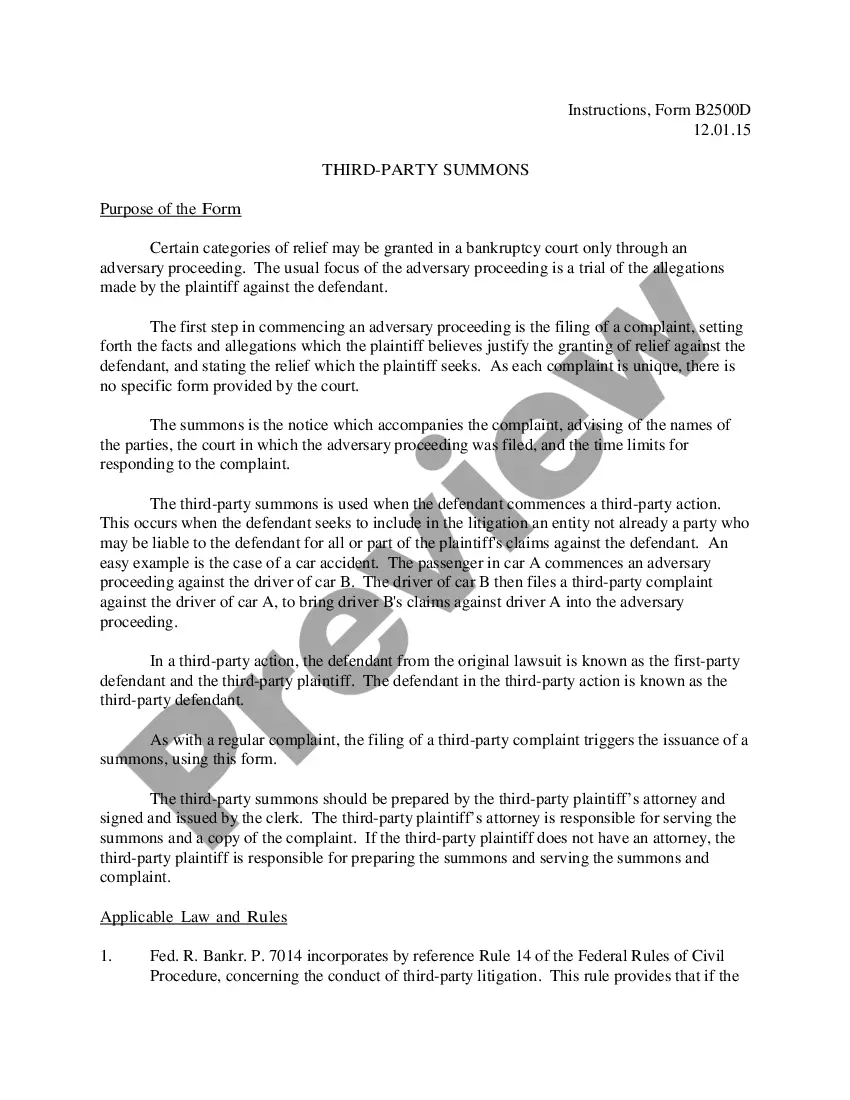

Yes, you can settle a debt even if a lawsuit has already been filed against you. Some lenders may allow you to pay off your debt through either a repayment plan or partial lump-sum settlement.

In debt collection lawsuits, the judge may award the creditor or debt collector a judgment against you. You are likely to have a judgment entered against you for the amount claimed in the lawsuit if you: Ignore the lawsuit, or. Don't respond to the lawsuit in a timely manner.

A judgment is a court order stating that you owe the debt collector money because of a lawsuit. You may have received a judgment because the court decided in favor of the debt collector in a trial, or because you did not respond to a lawsuit that was filed against you.

Most common way to respond is to file an Answer In an Answer, you say what you think is not true in the Complaint (make a denial) and you say what your defenses are or might be (new matters you are bringing up). If you file an Answer, the other side must prove their case and you can defend your case in court.

If you paid your debt after the judgment was already established on your credit report, the agency won't remove the judgment, but it will - at the very least - mark your debt as paid, which is helpful though not ideal.

A collection lawsuit submits the issue to a judge who decides whether you owe money to the creditor and, if so, the exact amount due. A judgment is the court's final decision as to the outcome of litigation. This signals the end of the case and provides the last word on liability.

You must fill out an Answer, serve the other side's attorney, and file your Answer form with the court within 30 days. If you don't, the creditor can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you.