US Legal Forms - one of several largest libraries of authorized varieties in America - offers a wide array of authorized document layouts it is possible to download or produce. While using site, you will get a large number of varieties for company and individual uses, sorted by categories, says, or keywords.You will find the newest variations of varieties much like the Nebraska Certificate of Trust with Real Property as Part of the Corpus in seconds.

If you currently have a registration, log in and download Nebraska Certificate of Trust with Real Property as Part of the Corpus from your US Legal Forms collection. The Obtain key will show up on each form you see. You gain access to all previously saved varieties in the My Forms tab of your respective profile.

If you would like use US Legal Forms initially, listed below are simple instructions to help you get began:

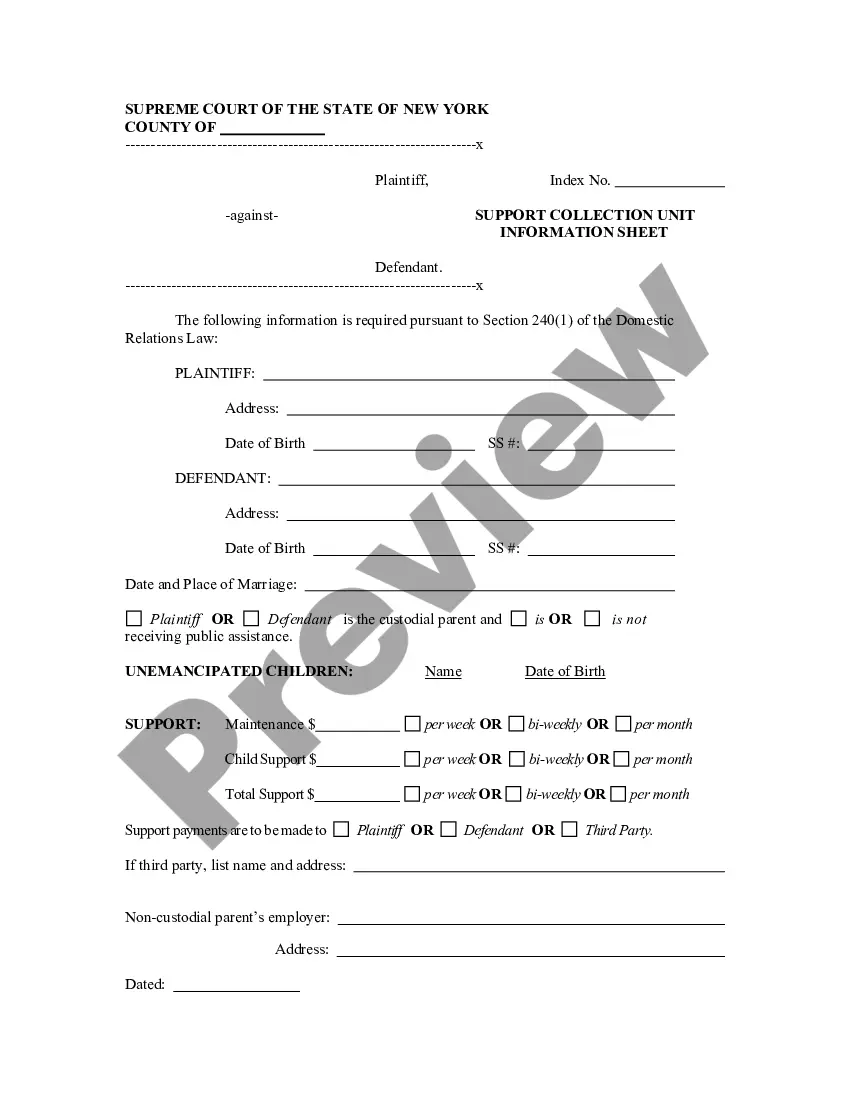

- Be sure to have picked the proper form for your city/state. Select the Preview key to analyze the form`s information. See the form description to actually have selected the right form.

- In the event the form doesn`t match your needs, use the Research area on top of the screen to find the the one that does.

- If you are pleased with the form, verify your selection by visiting the Acquire now key. Then, opt for the pricing plan you want and offer your references to sign up for an profile.

- Method the transaction. Make use of credit card or PayPal profile to perform the transaction.

- Select the format and download the form in your gadget.

- Make modifications. Fill up, modify and produce and sign the saved Nebraska Certificate of Trust with Real Property as Part of the Corpus.

Each and every template you put into your money lacks an expiry day which is the one you have permanently. So, in order to download or produce one more version, just proceed to the My Forms section and click about the form you need.

Obtain access to the Nebraska Certificate of Trust with Real Property as Part of the Corpus with US Legal Forms, by far the most comprehensive collection of authorized document layouts. Use a large number of skilled and state-particular layouts that fulfill your organization or individual demands and needs.