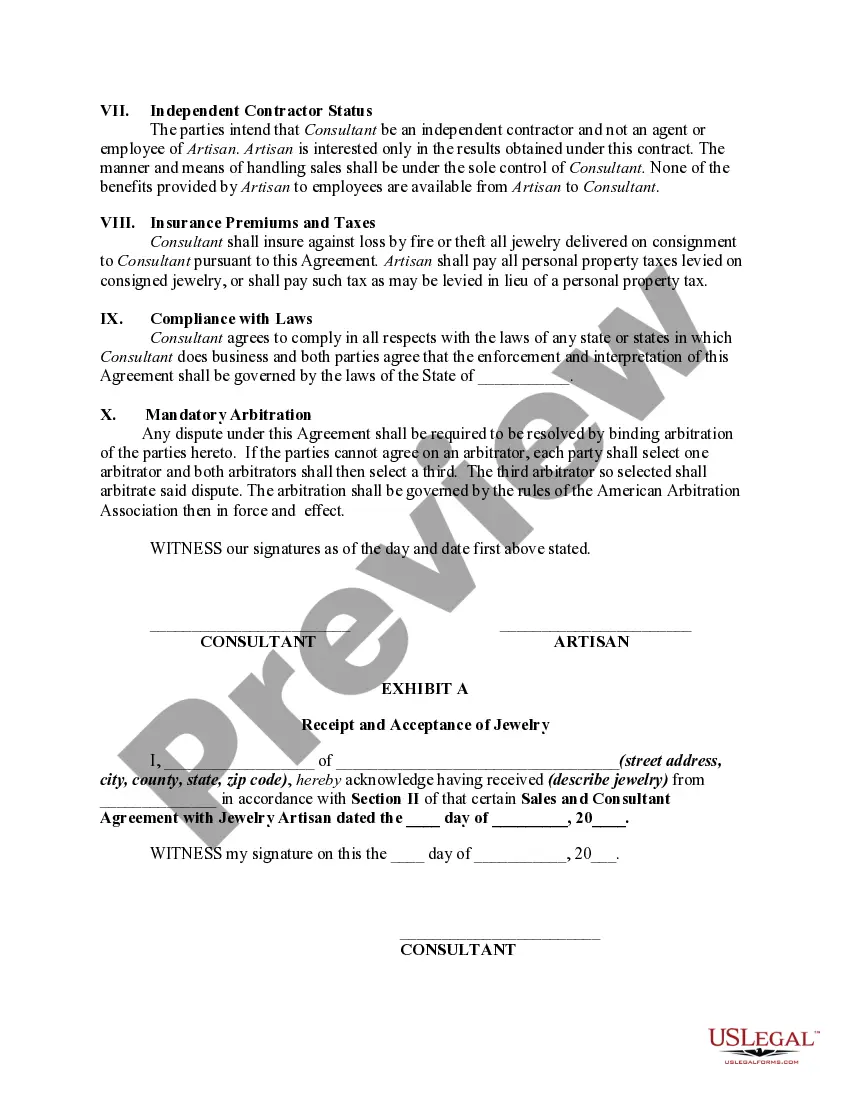

This form is a sample of an agreement to promote and sell jewelry between an artisan, who designs and creates fine jewelry, and an image consultant for various clients who have requested consultant's assessment of their wardrobe with regard to jewelry.

Nebraska Sales and Marketing Consultant Agreement with Jewelry Artisan

Description

How to fill out Sales And Marketing Consultant Agreement With Jewelry Artisan?

You might spend hours online searching for the legal document template that meets the state and federal requirements you desire.

US Legal Forms offers thousands of legal forms that are vetted by professionals.

You can easily obtain or print the Nebraska Sales and Marketing Consultant Agreement with Jewelry Artisan from the service.

To find another version of the form, use the Search box to find the template that fits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, modify, print, or sign the Nebraska Sales and Marketing Consultant Agreement with Jewelry Artisan.

- Every legal document template you purchase is yours permanently.

- To get another copy of a purchased form, go to the My documents tab and then click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/town you choose.

- Read the form description to make sure you have selected the right form.

Form popularity

FAQ

To obtain a business tax ID in Nebraska, you typically need to register your business with the Nebraska Secretary of State. This process can be completed online and requires basic information about your business structure. If you are setting up a Nebraska Sales and Marketing Consultant Agreement with Jewelry Artisan, acquiring your tax ID promptly will help in managing your finances and compliance.

Form 20 is a state tax form related to the reporting of business income in Nebraska. It helps businesses disclose their earnings and expenses for taxation purposes. If your business is part of a Nebraska Sales and Marketing Consultant Agreement with Jewelry Artisan, using Form 20 correctly will ensure accurate tax reporting.

County 20 is often referenced in contexts involving tax classifications and insurance rates. It pertains to specific regulations that might affect businesses in that region. Understanding local considerations, like those in County 20, is essential when drafting a Nebraska Sales and Marketing Consultant Agreement with Jewelry Artisan.

Yes, Nebraska generally requires businesses to obtain a business license based on the type of service provided. Licensing requirements may differ by city and county. If you are entering into a Nebraska Sales and Marketing Consultant Agreement with Jewelry Artisan, checking the local regulations will help you avoid legal issues.

Any individual or business earning income in Nebraska must file a state income tax return. This requirement includes residents and non-residents alike. If you are operating under a Nebraska Sales and Marketing Consultant Agreement with Jewelry Artisan, be sure to understand your tax obligations to ensure compliance.

A Category 20 employer in Nebraska is classified as an employer that primarily engages in services related to personal and business services. This category helps determine the proper unemployment insurance tax rates and requirements. If you're developing a Nebraska Sales and Marketing Consultant Agreement with Jewelry Artisan, being aware of your classification is beneficial for compliance.

In Nebraska, certain beauty services are taxable. However, services related to the cleaning, cutting, or coloring of hair and the application of make-up are generally subject to sales tax. If you are involved in any agreements, such as a Nebraska Sales and Marketing Consultant Agreement with Jewelry Artisan, it is crucial to understand how these tax regulations apply to your services.