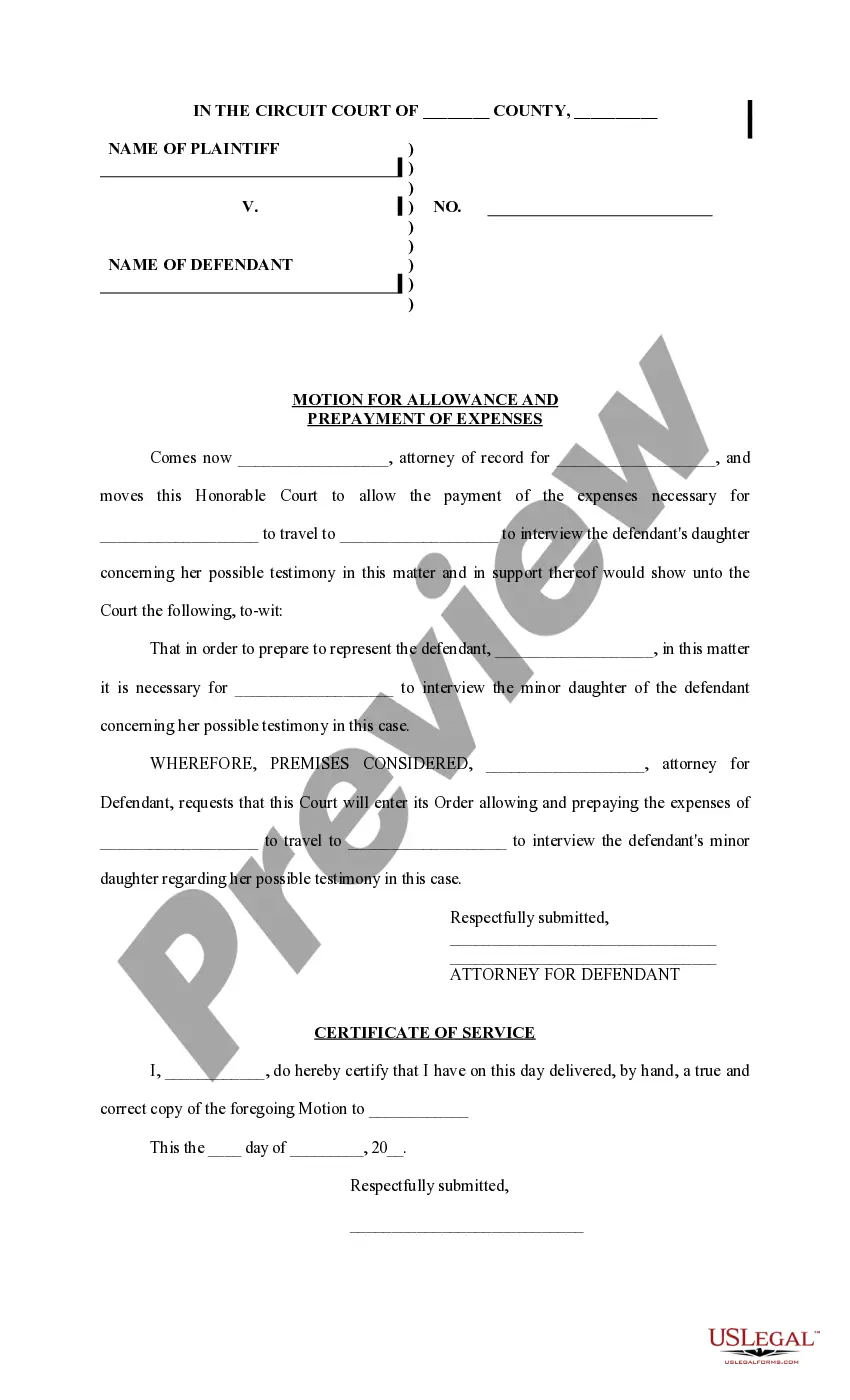

Nebraska Motion for Allowance and Prepayment of Expenses

Description

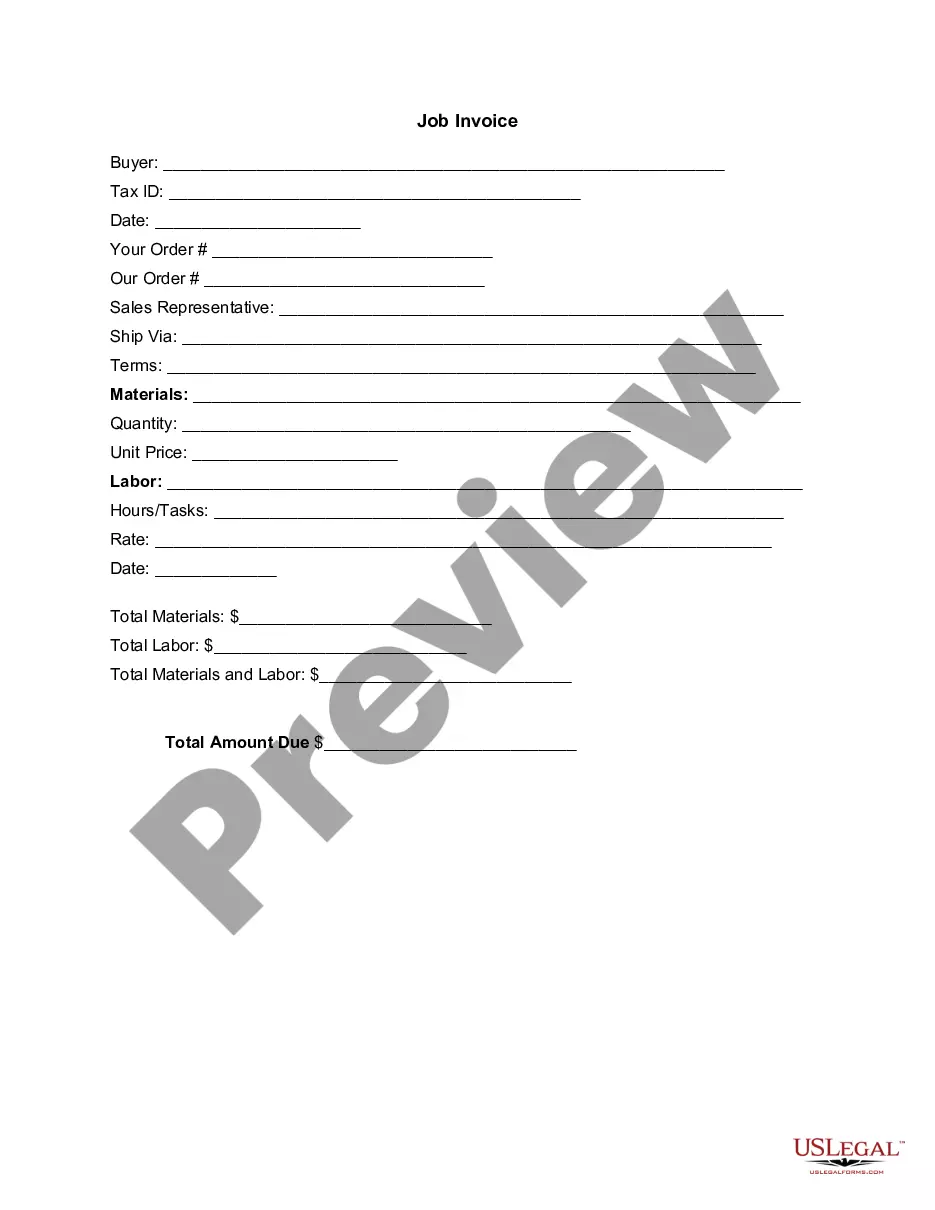

Prepayment of Expenses.

How to fill out Motion For Allowance And Prepayment Of Expenses?

If you wish to full, down load, or produce lawful document layouts, use US Legal Forms, the biggest variety of lawful varieties, that can be found online. Take advantage of the site`s basic and practical search to obtain the paperwork you want. Numerous layouts for organization and individual functions are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to obtain the Nebraska Motion for Allowance and Prepayment of Expenses in a few mouse clicks.

Should you be presently a US Legal Forms customer, log in to your accounts and then click the Obtain switch to find the Nebraska Motion for Allowance and Prepayment of Expenses. You may also accessibility varieties you formerly saved in the My Forms tab of the accounts.

If you work with US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the form to the appropriate metropolis/nation.

- Step 2. Make use of the Review solution to examine the form`s articles. Don`t neglect to read the outline.

- Step 3. Should you be unsatisfied using the type, take advantage of the Research field towards the top of the screen to find other variations of your lawful type design.

- Step 4. After you have identified the form you want, go through the Buy now switch. Select the pricing program you favor and add your credentials to sign up for the accounts.

- Step 5. Procedure the deal. You may use your Мisa or Ьastercard or PayPal accounts to finish the deal.

- Step 6. Pick the formatting of your lawful type and down load it on your product.

- Step 7. Full, change and produce or signal the Nebraska Motion for Allowance and Prepayment of Expenses.

Every lawful document design you buy is your own property forever. You might have acces to each type you saved in your acccount. Go through the My Forms area and choose a type to produce or down load once more.

Contend and down load, and produce the Nebraska Motion for Allowance and Prepayment of Expenses with US Legal Forms. There are many skilled and condition-particular varieties you can use to your organization or individual requires.

Form popularity

FAQ

Nebraska Sales Tax Exemptions SaleDocumentation Required (in addition to the normal books and records of the retailer)Medicines & medical equipmentPrescription from health care professional (except insulin)NewspapersNonePolitical Campaign FundraisersNoneRepair laborNone9 more rows

The general rule under this section is that, should a court determine a medical treatment for a condition unrelated to a work-related injury is medically reasonable and necessary to treat the underlying work-related injury, the medical treatment is required by the nature of the injury and is compensable.

Nebraska Sales Tax Exemptions SaleDocumentation Required (in addition to the normal books and records of the retailer)Food for human consumptionNoneMeals provided by hospitals or other institutions to patients or inmatesNoneMeals provided to students and campersNoneSchools and school-related organizationsNone4 more rows

As provided in Nebraska Sales and Use Tax Regulation 1-101, taxable security services include services to protect property from theft, vandalism, or destruction or to protect individuals from harm.

A Nebraska Energy Source Exempt Sale Certificate Form 13E must be filed by every person claiming a sales and use tax exemption when it has been determined that more than 50 percent of the purchase of electricity, coal, gas, fuel, oil, diesel fuel, tractor fuel, coke, nuclear fuel, butane, propane, or compressed natural ...

013.01 A sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's business. The property may be resold either in the form or condition in which it was purchased, or as an ingredient or component part of other property.

13. Nebraska Resale or Exempt Sale Certificate. FORM. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the Nebraska sales tax for the following reason: Check One ? Purchase for Resale (Complete Section A.) ? Exempt Purchase (Complete Section B.)

The Nebraska Beginning Farmer Personal Property Tax Exemption Program enables property used in production agriculture or horticulture, valued up to $100,000, to be exempted for the beginning farmer or rancher.