Nebraska Personal Property Lease

Description

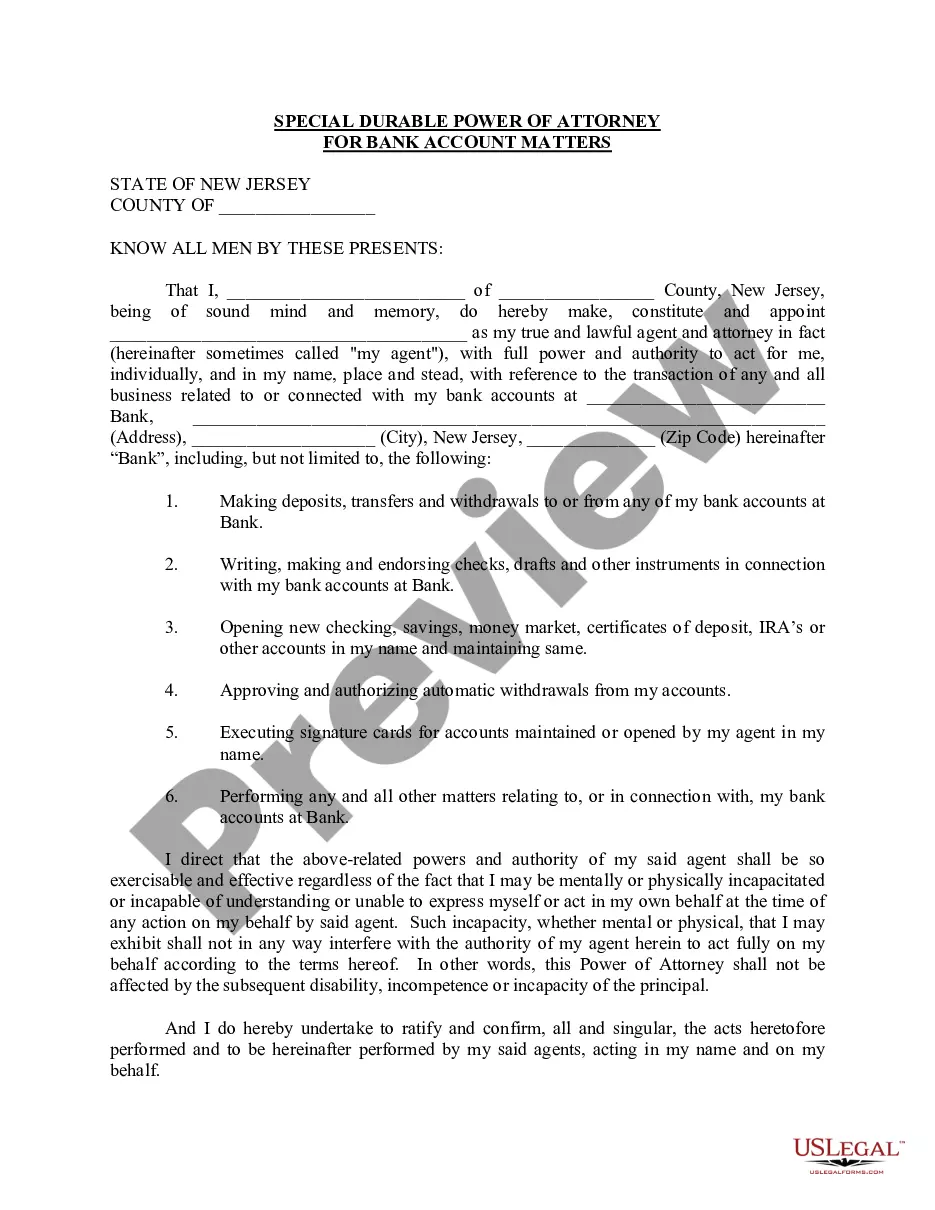

Article 2A of the UCC governs any transaction, regardless of its form, that creates a lease of personal property. Article 2A has been adopted, in different forms, by the majority of states, but it does not apply retroactively to transactions that occurred prior to the effective date of its adoption in a particular jurisdiction.

How to fill out Personal Property Lease?

Selecting the appropriate legal document template can be a challenge. Certainly, there are numerous templates available online, but how do you find the legal form you require.

Utilize the US Legal Forms website. This service offers a wide selection of templates, including the Nebraska Personal Property Lease, which can be used for both business and personal purposes.

All of the forms are vetted by professionals and comply with federal and state regulations.

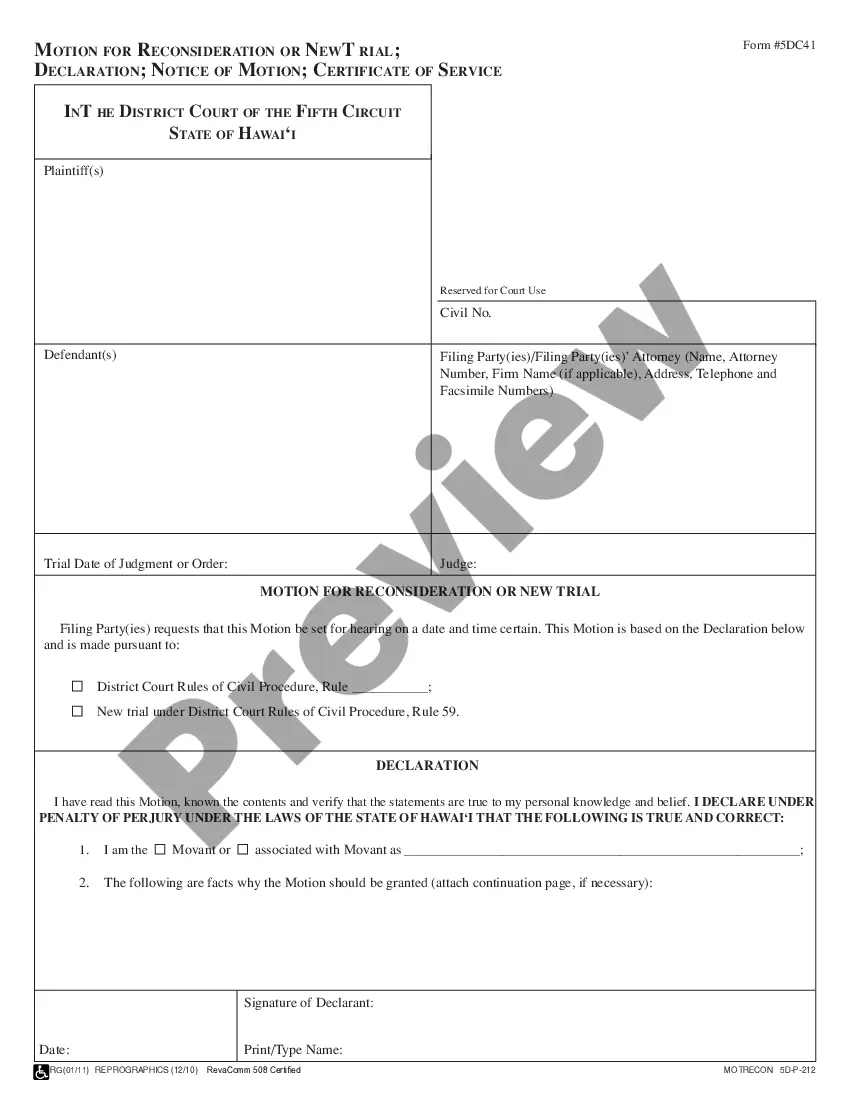

If the form does not meet your requirements, use the Search field to find the correct form. Once you are confident that the form is accurate, click the Purchase now button to acquire the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Nebraska Personal Property Lease. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Take advantage of the service to download professionally-crafted papers that meet state requirements.

- If you are already registered, Log In to your account and click the Download button to access the Nebraska Personal Property Lease.

- Use your account to search through the legal forms you have previously purchased.

- Visit the My documents tab in your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, make sure you have selected the correct form for your city/state.

- You can review the form using the Preview button and read the form description to ensure it is suitable for your needs.

Form popularity

FAQ

The Nebraska personal property tax rate can vary based on the county where you reside. Typically, the rate applies to personal property, including assets tied to a Nebraska Personal Property Lease. For exact figures and calculations, it’s wise to consult local tax authorities or reliable platforms like US Legal Forms for guidance tailored to your situation.

The property tax relief bill in Nebraska focuses on reducing the tax burden on homeowners and renters alike. This includes provisions that may benefit those involved in Nebraska Personal Property Lease agreements. Staying informed about any changes and how they might affect your lease is vital for efficient financial planning.

In Nebraska, there is no specific age at which you stop paying property tax. However, seniors may qualify for various property tax relief programs, especially those related to a Nebraska Personal Property Lease. Always check with local authorities to explore any exemptions or reductions available based on age or other qualifying factors.

In Nebraska, property owners who meet specific criteria may qualify for a property tax incentive credit. Generally, this includes individuals who own personal property under Nebraska Personal Property Lease agreements. Additionally, certain income thresholds and assessment valuations come into play, making it essential to review your eligibility based on your unique circumstances.

The tax on a car in Nebraska varies based on the vehicle's value and the county where you reside. Generally, car taxes are assessed at a percentage of the vehicle's market value and can differ significantly between different counties. When leasing a vehicle in Nebraska, being aware of these tax implications linked to your personal property lease is essential for budgeting. Use platforms like USLegalForms to help you navigate these regulations seamlessly.

A bill of sale in Nebraska serves as a legal document that transfers ownership of personal property. This document plays a crucial role, particularly in a Nebraska personal property lease agreement, as it outlines the terms of the sale or lease, protects both parties, and ensures clarity in transactions. Having a clear bill of sale can prevent disputes in the future. Make sure to keep your records organized when entering a lease.

The Personal Property Tax Relief Act in Nebraska aims to help property owners by reducing their personal property tax liability. This act provides a certain level of exemption for specific types of personal property, benefiting businesses that lease property. By utilizing this act, lessees can ease their tax burden when engaging in a Nebraska personal property lease. Understanding the details can optimize your financial planning.

Yes, Nebraska does impose a personal property tax. This tax applies to tangible personal property such as machinery, equipment, and certain vehicles. When you lease personal property in Nebraska, understanding your tax obligations can help you avoid unexpected costs. It's wise to consult with a tax professional to navigate Nebraska's personal property lease laws effectively.

Yes, rentals are generally taxable in Nebraska. When you enter into a Nebraska Personal Property Lease, you provide a property for lease, and the income generated from that lease is subject to taxation. It's important to understand the tax obligations associated with ownership and leasing. USLegalForms offers resources to help you navigate these tax responsibilities efficiently.

The category of personal property generally includes tangible items, which fall into various subclasses such as consumer goods, equipment, and inventory. Each type of personal property may be subject to different rules and regulations in Nebraska. When utilizing a Nebraska Personal Property Lease, clarity about these categories can enhance compliance and organization.