Nebraska Agreement for Prepaid Repair Services for Residential Property

Description

How to fill out Agreement For Prepaid Repair Services For Residential Property?

Do you find yourself in a situation where you require documentation for either business or personal purposes almost every day.

There are numerous legal document templates available online, but locating ones you can rely on is challenging.

US Legal Forms provides thousands of form templates, including the Nebraska Agreement for Prepaid Repair Services for Residential Property, designed to meet state and federal regulations.

Once you have obtained the correct form, click on Get now.

Select the pricing plan you want, fill in the necessary details to create your account, and purchase the order using your PayPal or credit card. Choose a preferred file format and download your copy. You can view all the document templates you have purchased in the My documents section. You can retrieve a new copy of the Nebraska Agreement for Prepaid Repair Services for Residential Property at any time, if needed. Just click the desired form to download or print the document template. Use US Legal Forms, the most comprehensive collection of legal forms, to save time and prevent errors. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Nebraska Agreement for Prepaid Repair Services for Residential Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

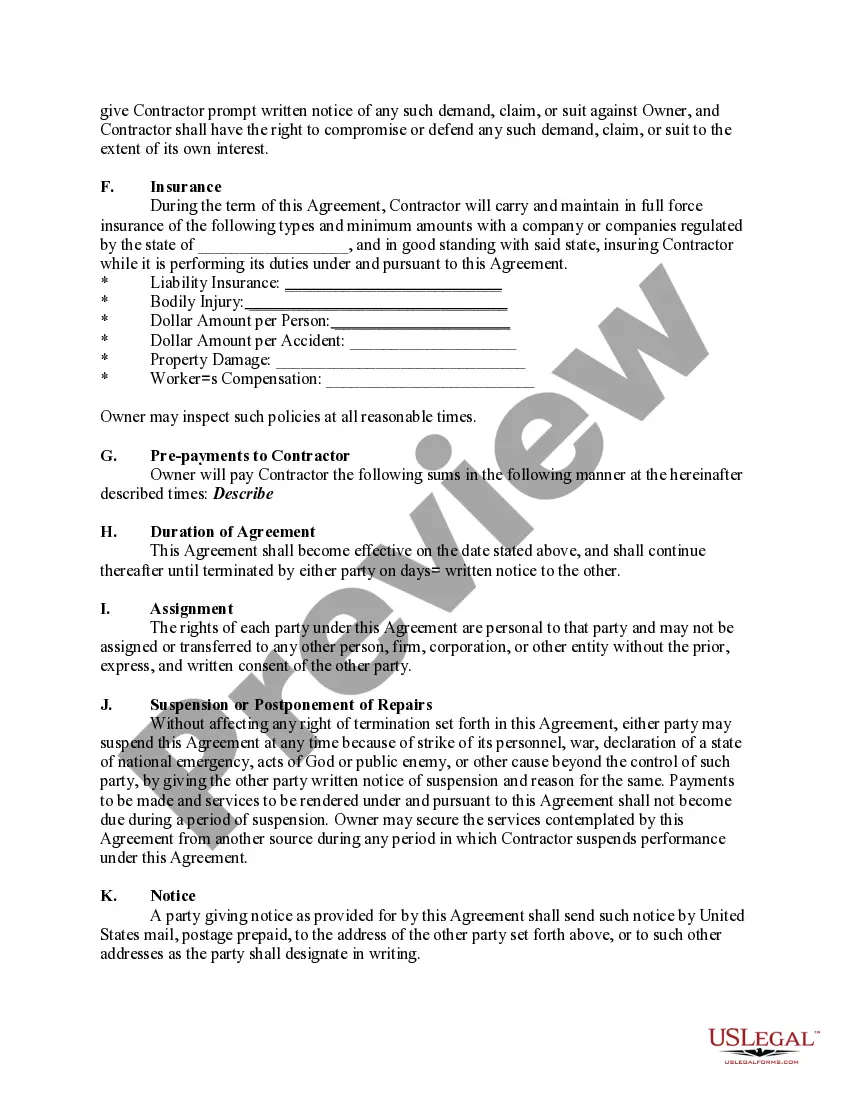

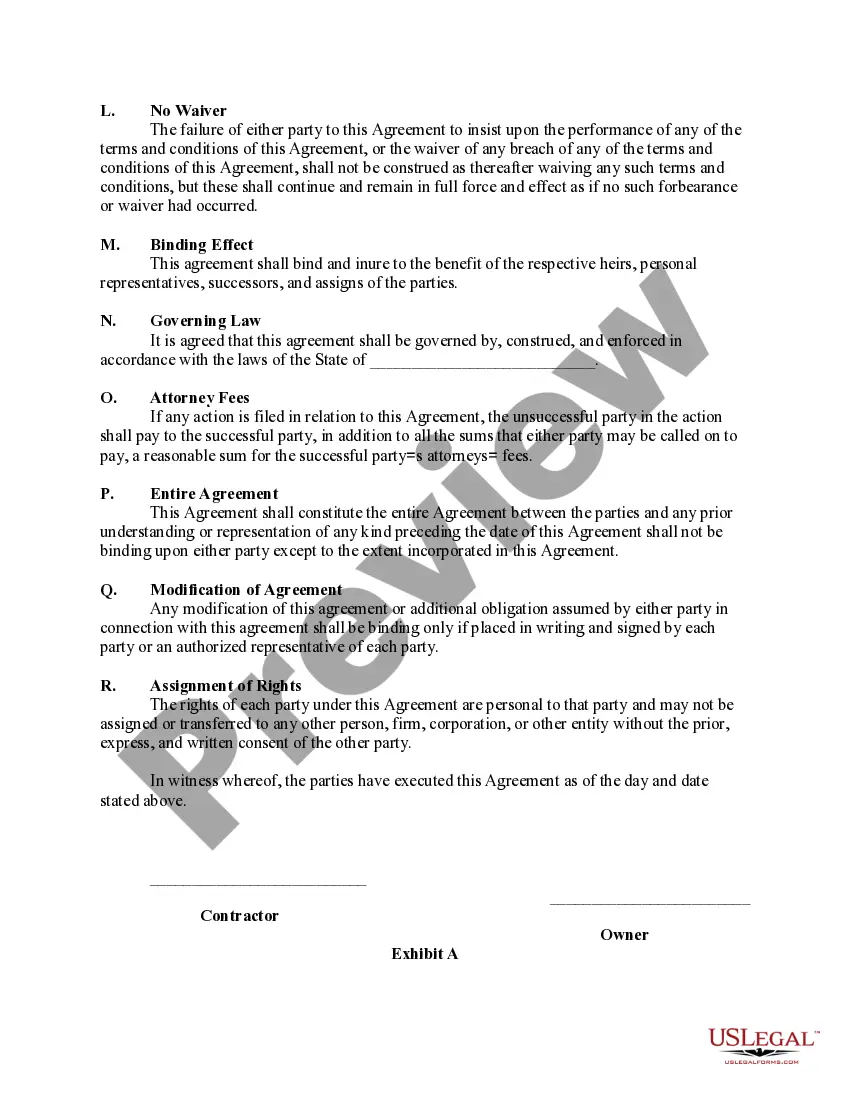

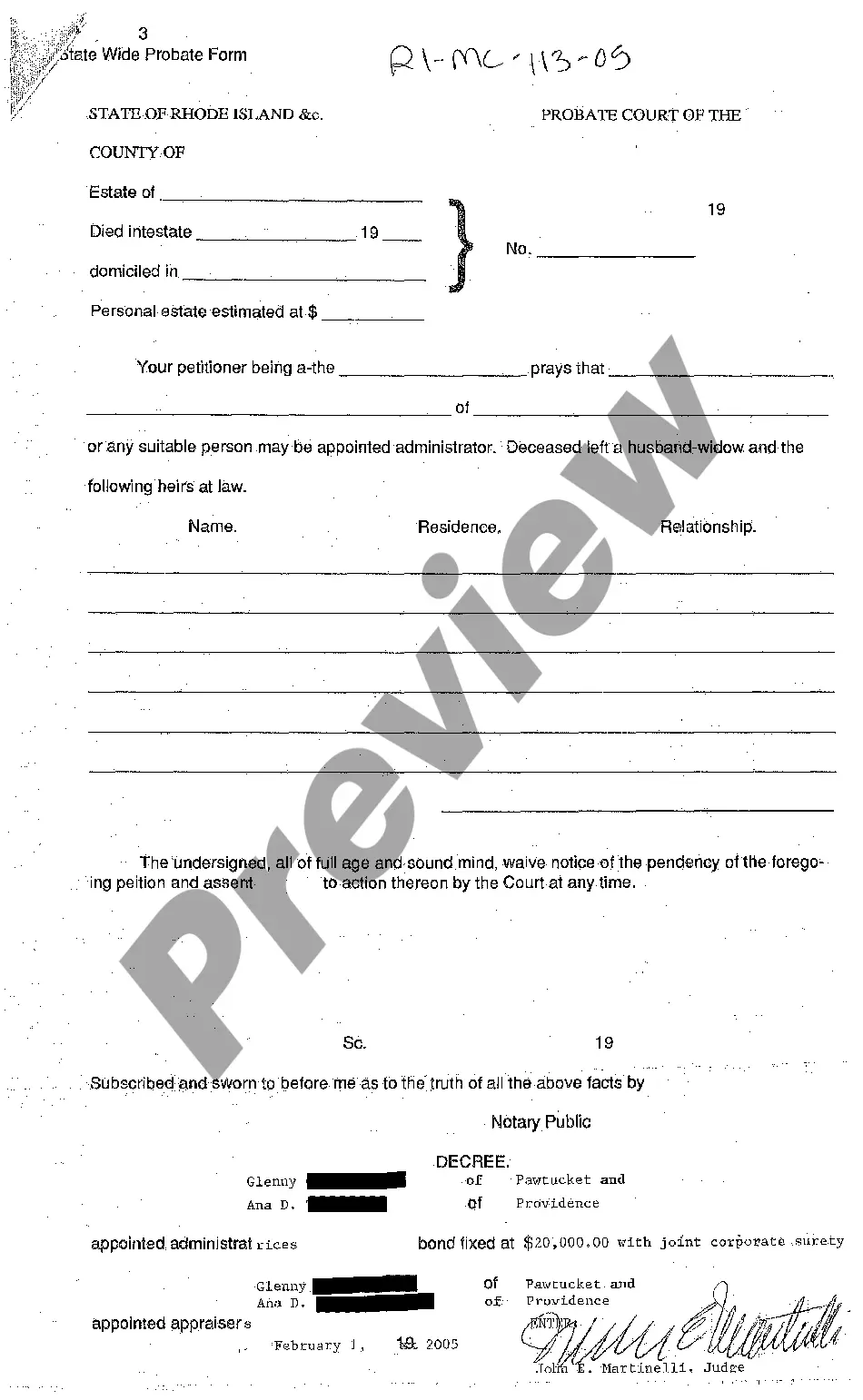

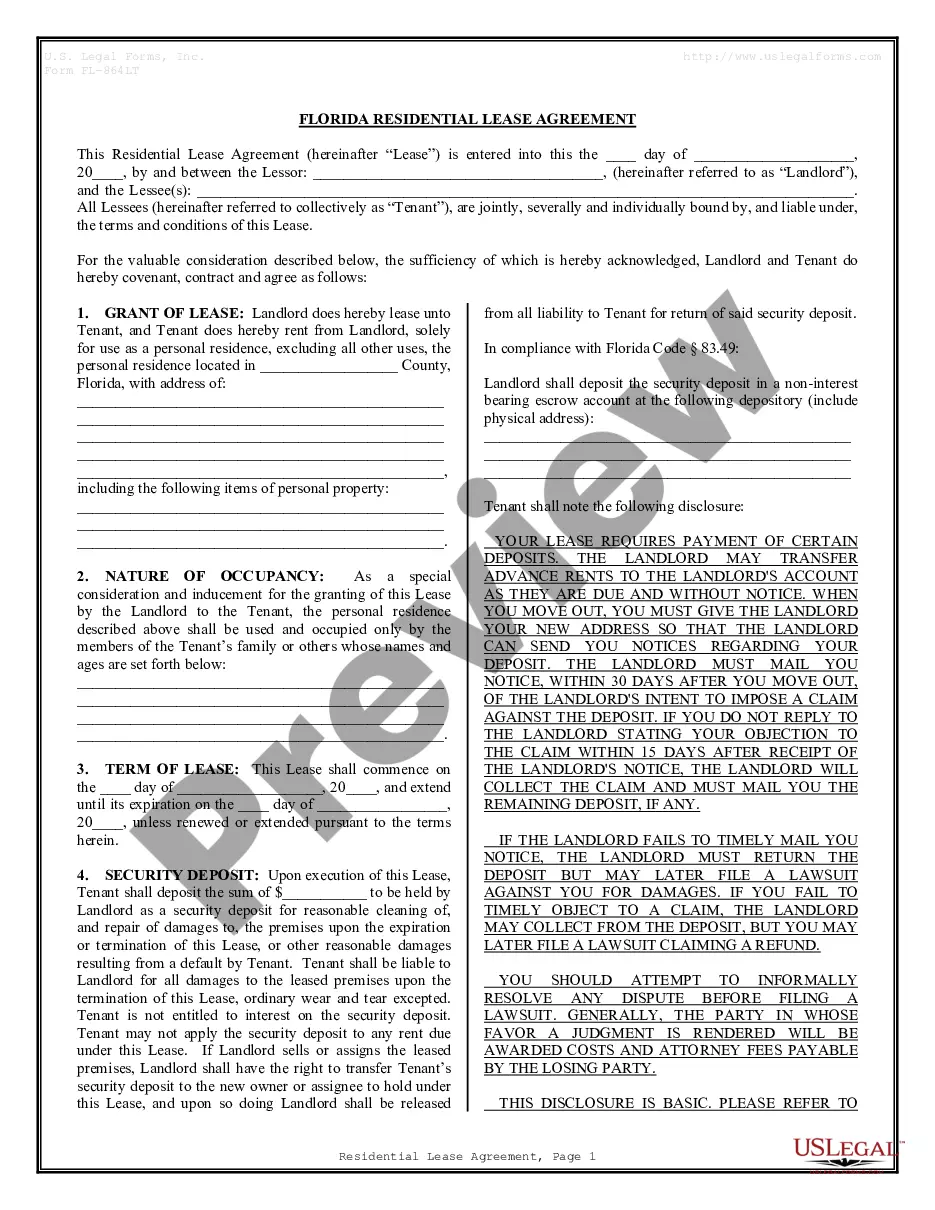

- Use the Review option to examine the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

A contractor who elects Option 1 is a retailer of building materials and fixtures purchased and annexed to real estate.

Deliveries into another state are not subject to Nebraska sales tax. Services are generally taxed at the location where the service is provided to the customer.

Goods that are subject to sales tax in Nebraska include physical property, like furniture, home appliances, and motor vehicles. Medicine, groceries, and gasoline are all tax-exempt. Some services in Nebraska are subject to sales tax.

A contractor who elects Option 2 is the consumer of building materials and fixtures purchased and annexed to real estate. Option 2 contractors must: 2714 Obtain a Nebraska Sales Tax Permit by filing a Nebraska. Tax Application, Form 20, provided the Option 2. contractor makes over-the-counter retail sales or sales.

Sales of warranties, guarantees, service agreements, and maintenance agreements are taxable when the items or property covered or services to be provided are taxable. Sales tax is due whether the agreement is sold with the item or sold separately.

However, in California many types of labor charges are subject to tax. Tax applies to charges for producing, fabricating, or processing tangible personal property for your customers. Generally, if you perform taxable labor in California, you must obtain a seller's permit and report and pay tax on your taxable sales.

Auto body specialists must collect sales tax from their customers on charges for parts, detailing, paint, motor vehicle painting labor, fabrication labor and installation labor. These charges are taxable to the customer regardless of how they are stated on the invoice.

Yes. Retail sales tax applies to a service contract or warranty sold to a consumer (WAC 458-20-257).

Charges for production and assembly labor are taxable. Charges for repair and installation labor are taxable when the property being repaired, replaced, or installed is taxable.

Medicine, groceries, and gasoline are all tax-exempt. Some services in Nebraska are subject to sales tax.