Nebraska Revocable Living Trust for Married Couple

Description

How to fill out Revocable Living Trust For Married Couple?

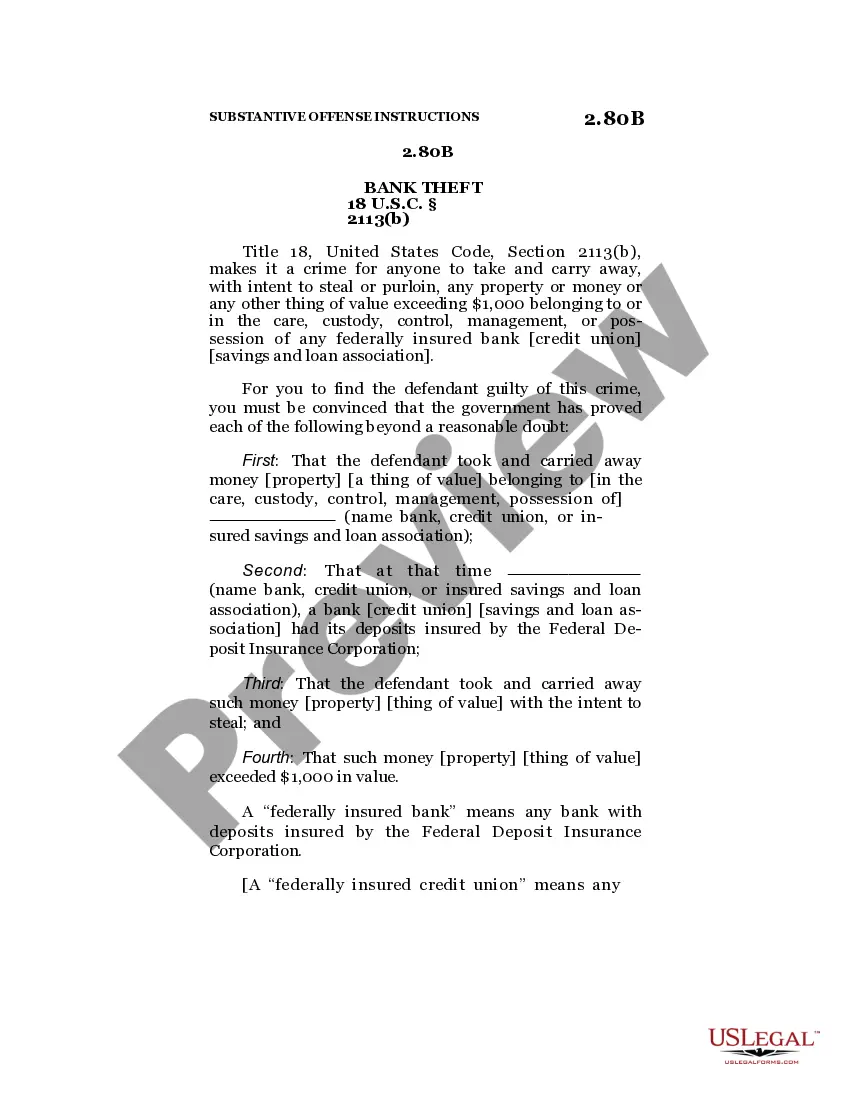

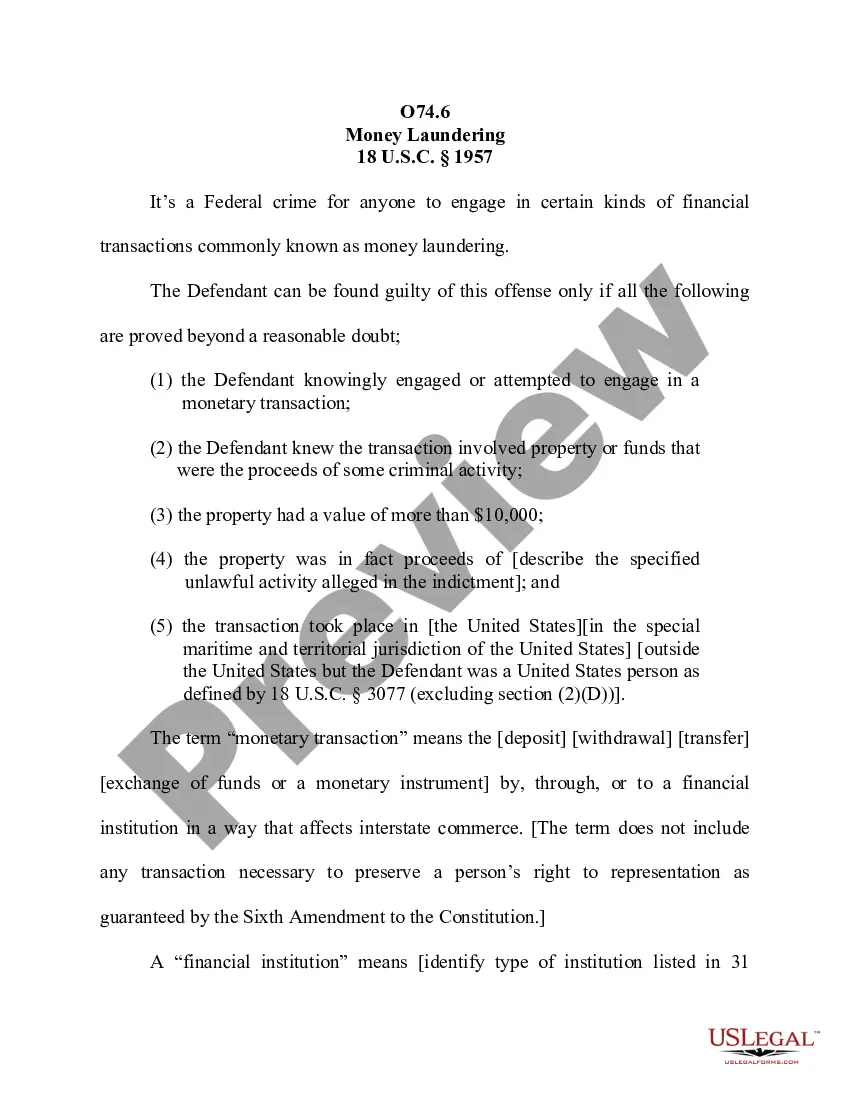

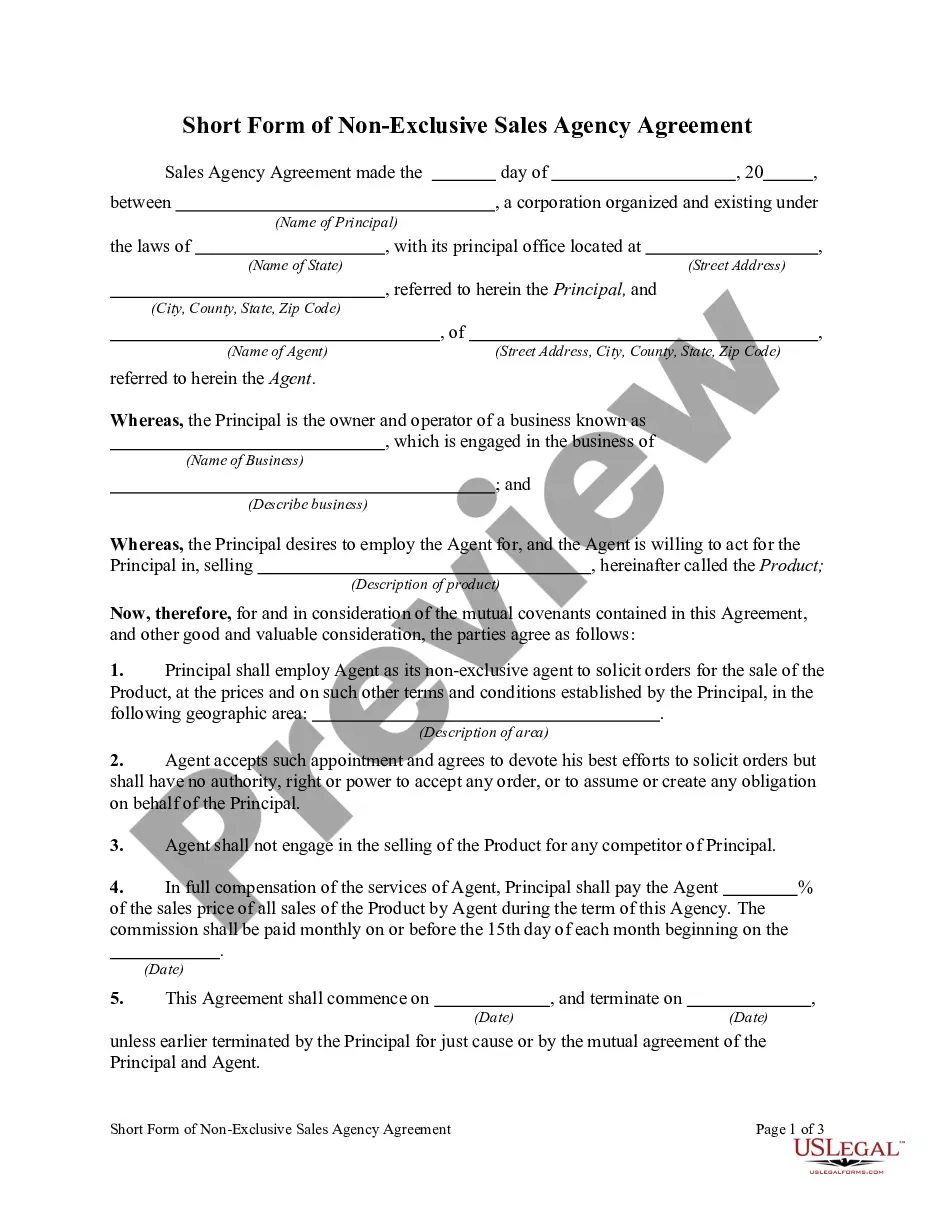

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast array of legal document templates that you can download or print.

By using the website, you will access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of documents such as the Nebraska Revocable Living Trust for Married Couple within moments.

If the document does not meet your needs, use the Search field at the top of the screen to find one that fits.

Once you are pleased with the document, confirm your choice by clicking the Purchase now button. Then, select your preferred pricing plan and enter your details to create an account.

- If you have an account, Log In and download the Nebraska Revocable Living Trust for Married Couple from your US Legal Forms collection.

- The Download button will appear on every document you view.

- You can access all previously saved forms from the My documents section of your profile.

- To use US Legal Forms for the first time, follow these simple instructions.

- Ensure you have chosen the correct form for the jurisdiction/region.

- Click the Review button to examine the document’s content.

Form popularity

FAQ

Filling out a revocable living trust requires careful attention to detail and organization of your assets. Start by gathering necessary information, including identification, asset descriptions, and beneficiary details. When using a Nebraska Revocable Living Trust for Married Couples, you can find helpful templates and guidance on platforms like USLegalForms. This resource can simplify the process and ensure you complete the trust accurately, paving the way for a smooth transfer of assets.

Whether to establish one trust or two largely depends on your financial situation and estate planning objectives. A Nebraska Revocable Living Trust for Married Couples allows for a single, unified trust, which simplifies management and facilitates easier coordination of assets. However, in some cases, separate trusts may provide specific tax benefits or asset protection depending on individual circumstances. Careful consideration of your joint and separate assets is crucial in making this decision.

Yes, both husband and wife can serve as co-trustees in a Nebraska Revocable Living Trust for Married Couples. This arrangement allows both partners to have equal authority in managing their assets and decision-making. Serving together can enhance communication and transparency in the management of the trust. Additionally, this setup ensures continuity in the event that one partner becomes incapacitated or passes away.

The best trust for a married couple often depends on their specific needs and goals. A Nebraska Revocable Living Trust for Married Couples provides flexibility, allowing both partners to manage the trust during their lifetime. This type of trust also simplifies the transfer of assets after death, as it bypasses probate. By creating this trust, couples can ensure that their estate plan reflects their wishes as circumstances change.

Yes, married couples can create a joint revocable trust, which allows them to combine their assets into one trust. This arrangement can simplify the estate planning process by centralizing management and distribution. However, consider the potential drawbacks, such as complications in asset division and management conflicts. Using a Nebraska Revocable Living Trust for Married Couple can provide flexibility and clarity in these situations.

When one spouse passes away, the joint revocable trust typically becomes irrevocable. The surviving spouse will then manage the remaining assets according to the terms of the trust. However, complications can arise, especially if the trust does not clearly outline distribution methods. A well-structured Nebraska Revocable Living Trust for Married Couple can prevent these issues, ensuring a smooth transition of assets.

The ideal trust for a married couple often depends on their specific financial goals and family dynamics. For many, the Nebraska Revocable Living Trust for Married Couple provides a flexible, straightforward option. It allows couples to customize their trust to fit their unique circumstances, ensuring that both partners feel secure about their estate planning.

Joint revocable trusts can pose various complexities for married couples. One significant issue is the potential for conflict regarding asset management, especially when spouses have differing financial goals. Moreover, if one spouse passes away, it may create confusion over how the remaining assets are handled, which can delay the inheritance process. A Nebraska Revocable Living Trust for Married Couple can help mitigate these challenges.

While it may seem logical for married couples to share a single trust, separate Nebraska Revocable Living Trusts for Married Couples can offer distinct advantages. This approach allows each spouse to manage their assets according to their wishes. Additionally, it simplifies the process of distributing individual assets in the event of a divorce or separation, protecting each person's financial interests.

While trust funds offer many benefits, they also come with challenges that should be considered. One danger is the potential for improper management or lack of oversight, which could lead to misuse of the trust's assets. Another concern is the tax implications that may arise, which can affect the beneficiaries. To navigate these complexities, using platforms like uslegalforms can provide essential guidance and resources to ensure everything is handled correctly.