Nebraska Corporate Resolution for EIDL Loan

Description

How to fill out Corporate Resolution For EIDL Loan?

If you wish to complete, retrieve, or generate valid document templates, utilize US Legal Forms, the largest assortment of valid forms available online.

Employ the site’s simple and convenient search to find the documents you need.

Various templates for business and personal applications are categorized by areas and jurisdictions or keywords.

Step 4. After finding the form you need, click the Get now button. Select the payment plan you wish and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to acquire the Nebraska Corporate Resolution for EIDL Loan in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Nebraska Corporate Resolution for EIDL Loan.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm that you have selected the correct form for your city/state.

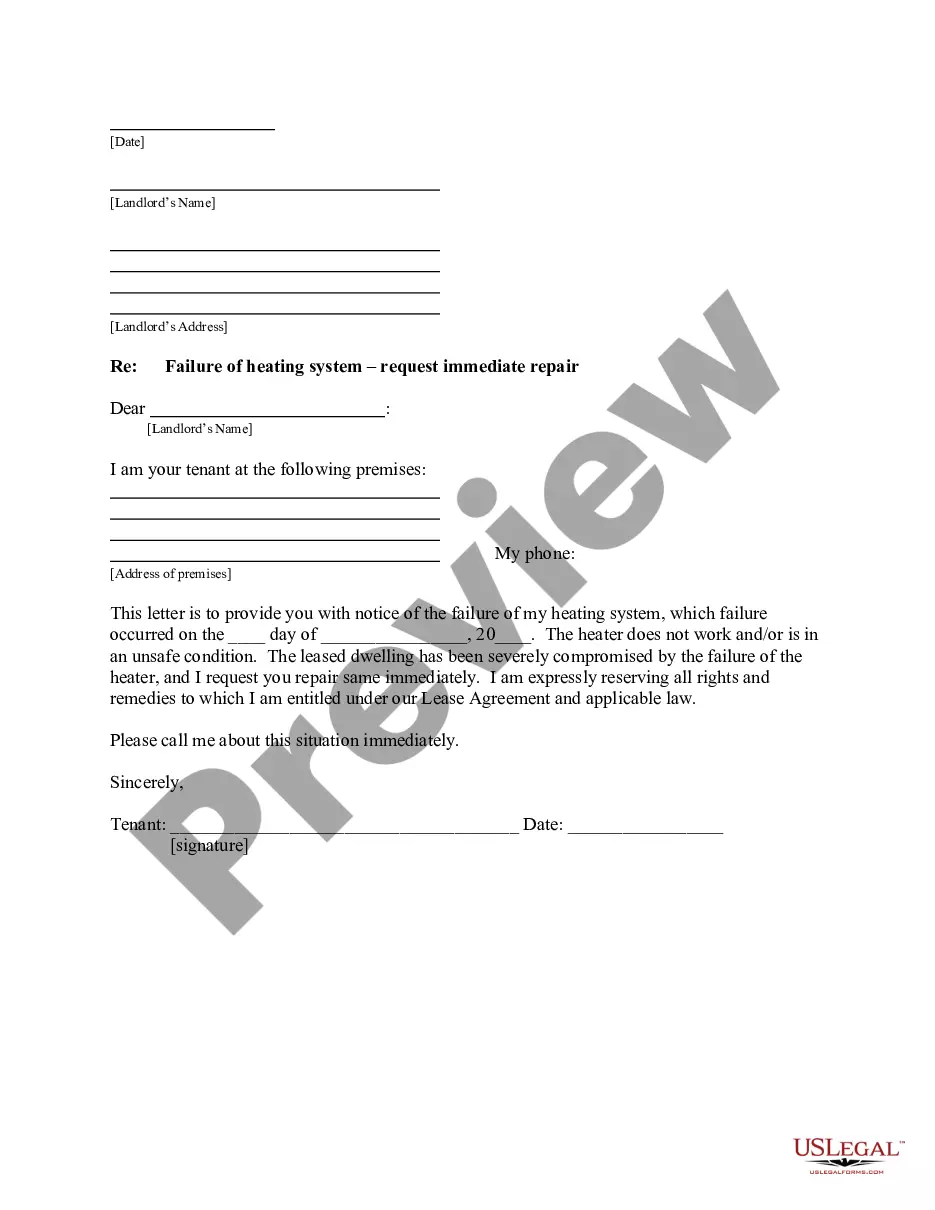

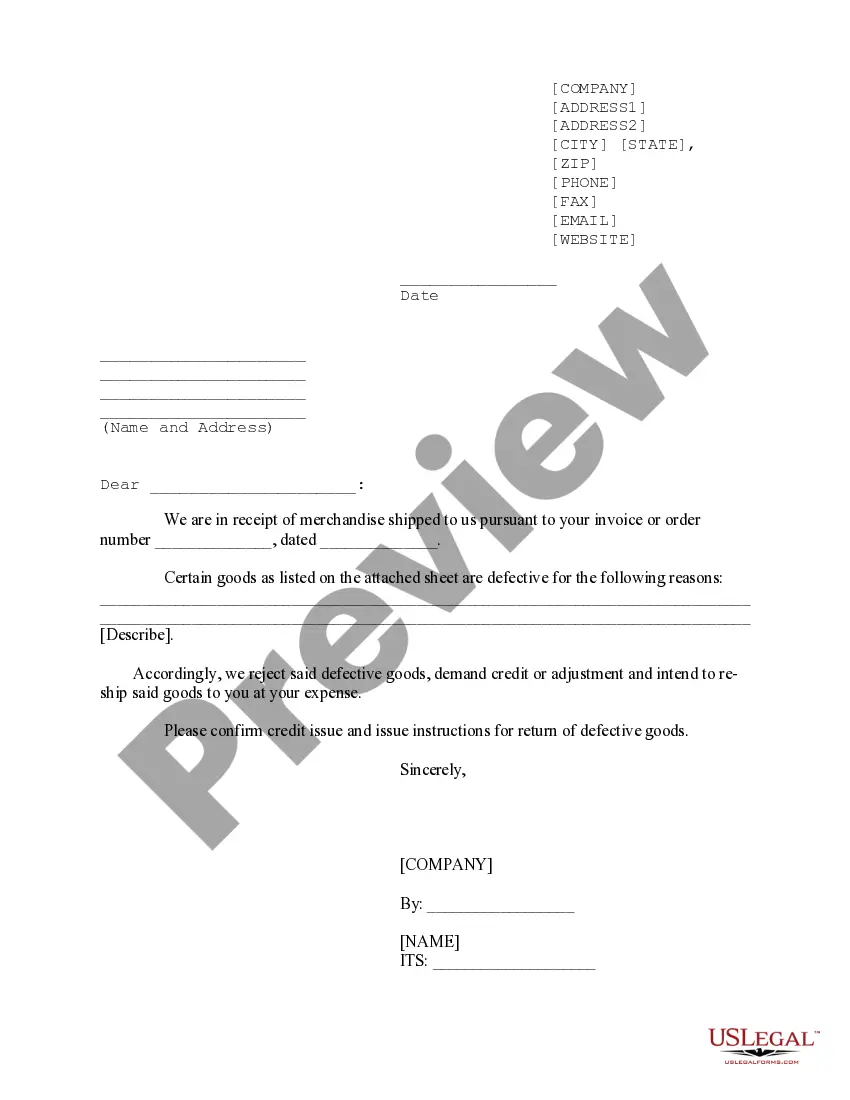

- Step 2. Use the Preview option to review the contents of the form. Don’t forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the valid form template.

Form popularity

FAQ

The loan may be forgiven if all employee retention criteria are met and funds were used for eligible expenses. Retain receipts and contracts for all loan funds spent for 3 years.

Types of Corporate Resolutions A resolution might outline the officers that are authorized to act (trade, assign, transfer or hedge securities and other assets) on behalf of the corporation. The resolution would outline who is authorized to open a bank account, withdraw money, and write checks.

The EIDL documents require a Board Resolution to be submitted within 6 months of loan disbursement. Proof of Hazard insurance is due within 1 year of loan disbursement.

SBA Form 160, Resolution of Board of Directors is a form issued by the Small Business Administration (SBA) and filed with SBA Business Expansion loans - including Direct, Guaranteed, or Participation loans.

EIDL Loan Forgiveness. EIDL loans cannot be forgiven. EIDL loans do have a deferment period, however. Loans made during the 2020 calendar year have a 24-month deferment window from the date of the note.

The US Small Business Administration (SBA) has extended the deferment period for COVID-19 Economic Injury Disaster Loan (EIDL) payments for the third time in 12 months.

A certified board resolution is a written document that provides an explanation of the actions of a company's board of directors that has been verified by the secretary of the organization and approved by the board's president.

EIDL Loan Forgiveness. EIDL loans cannot be forgiven. EIDL loans do have a deferment period, however. Loans made during the 2020 calendar year have a 24-month deferment window from the date of the note.

The Small Business Administration's Paycheck Protection Program doled out $790.9 billion in small-business loans to struggling businesses between April 2020 and , when the program closed. Nearly $661.5 billion of that loaned amount has been forgiven, as of January 2, 2022.

EIDL Filing RequirementsElectronic Loan Application (SBA Form 5C) Sole Proprietorship Only 3. Tax Authorization (IRS Form 4506-T) 20% Owners/GP/50% Affiliate 4. Most recent 3 Years of Business Tax Return(s) 5. Personal Financial Statement (SBA Form 413) 20% Owners/GP 6.