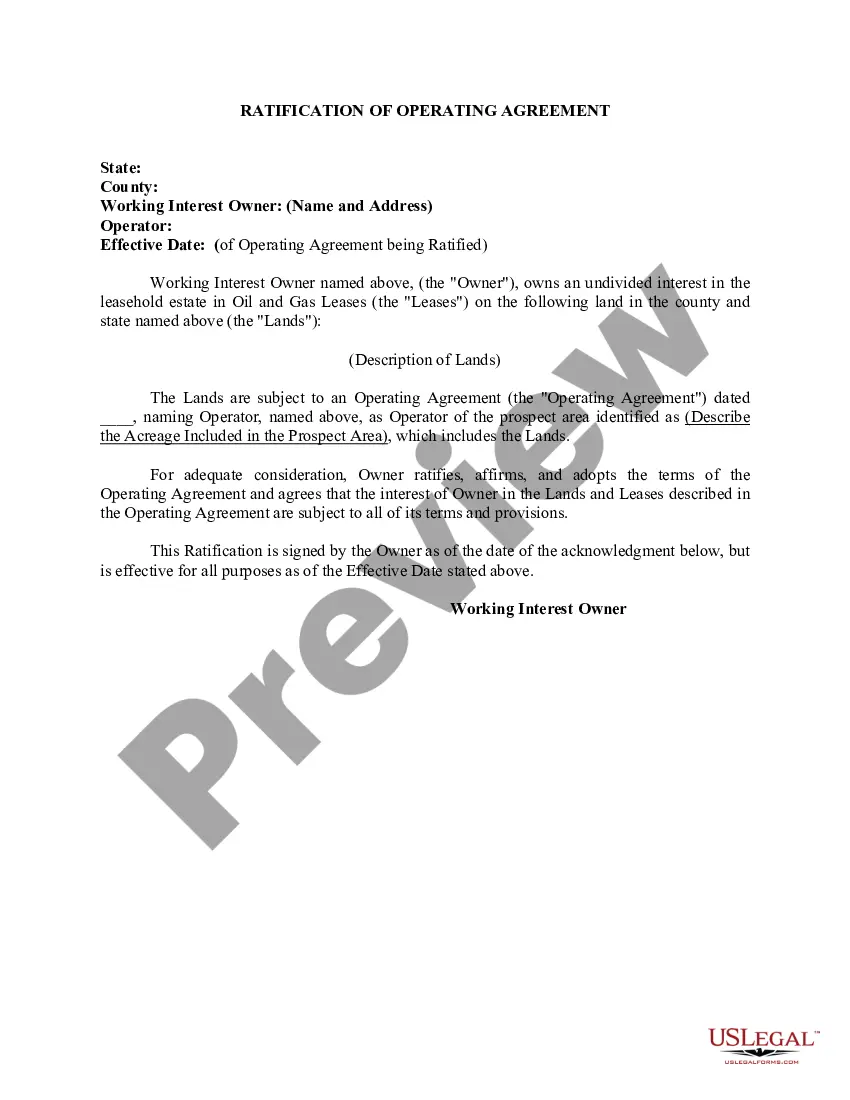

North Dakota Ratification of Operating Agreement

Description

How to fill out Ratification Of Operating Agreement?

You may devote hours on the Internet attempting to find the lawful file design which fits the federal and state needs you need. US Legal Forms supplies a huge number of lawful forms that happen to be reviewed by specialists. It is possible to down load or produce the North Dakota Ratification of Operating Agreement from the assistance.

If you already have a US Legal Forms bank account, it is possible to log in and click the Acquire option. Next, it is possible to complete, change, produce, or signal the North Dakota Ratification of Operating Agreement. Each and every lawful file design you get is the one you have eternally. To have another backup of any bought kind, go to the My Forms tab and click the corresponding option.

If you use the US Legal Forms internet site the first time, stick to the basic directions under:

- Initially, make sure that you have selected the best file design to the state/metropolis of your choosing. Browse the kind information to ensure you have picked the appropriate kind. If offered, use the Review option to appear from the file design at the same time.

- If you would like discover another version from the kind, use the Search field to get the design that meets your requirements and needs.

- Upon having identified the design you desire, just click Acquire now to continue.

- Find the prices strategy you desire, type in your accreditations, and register for an account on US Legal Forms.

- Comprehensive the deal. You should use your credit card or PayPal bank account to cover the lawful kind.

- Find the structure from the file and down load it for your product.

- Make changes for your file if necessary. You may complete, change and signal and produce North Dakota Ratification of Operating Agreement.

Acquire and produce a huge number of file layouts using the US Legal Forms Internet site, that offers the most important selection of lawful forms. Use professional and status-particular layouts to handle your organization or person requires.

Form popularity

FAQ

If you're running an LLC, you could elect to switch from an S Corp to a C Corp for some tax advantages the IRS points out, including a 21% flat corporate tax rate that might be lower than your individual rate, depending on your tax bracket. There's no form to switch from S Corp to C Corp status.

The operating agreement should include the following: Basic information about the business, such as official name, location, statement of purpose, and registered agent. Tax treatment preference. Member information. Management structure. Operating procedures. Liability statement. Additional provisions.

An operating agreement is not mandatory for LLCs in North Dakota.

Instead of using an operating agreement, which is specific to an LLC, an S corporation will rely on its corporate bylaws and articles of incorporation. All states require S corporations to use articles of incorporation.

An operating agreement for LLC taxed as S corporation is the entity's main governing document. By default, an LLC is treated like a partnership for taxation purposes. So, most standard operating agreement forms are designed as modified agreements for partnerships.

LLC taxed as an S corporation First, an LLC would need to elect to be taxed as a corporation by filing Form 8832, Entity Classification Election. After that, an LLC can then file a Form 2553, Election by a Small Business Corporation, to elect tax treatment as an S corporation.

To dissolve your North Dakota LLC by filing Articles of Dissolution by Organizers, there is a $20 fee. To file the Articles of Dissolution by Members, there is a $20 filing fee and you must also file the Notice of Dissolution which costs $10.

LLC to S Corp for Tax Purposes This means that the LLC will be taxed as a sole proprietorship, and the owner (member) will report the profits and losses of the LLC on his or her personal tax return. It also means that the owner will pay Social Security and Medicare tax.