North Dakota Underground Storage Lease and Agreement (Surface Only)

Description

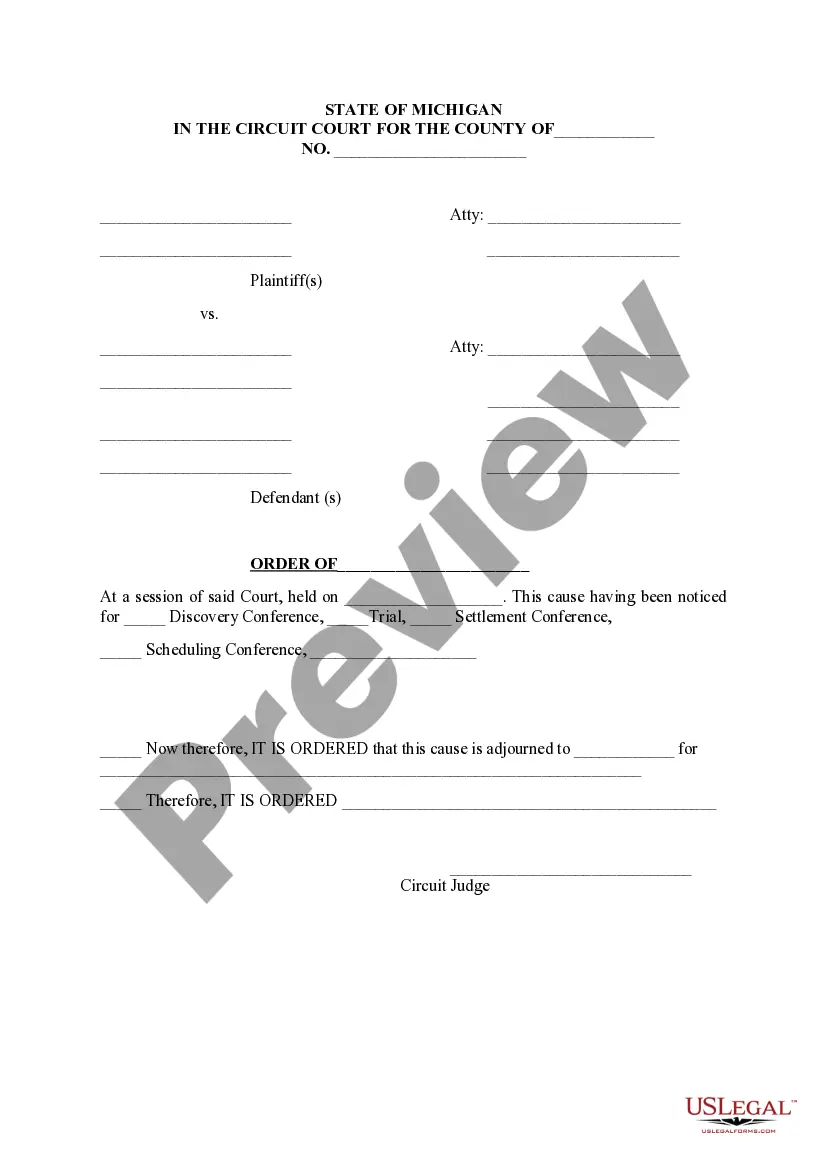

How to fill out Underground Storage Lease And Agreement (Surface Only)?

You are able to commit time on the web searching for the lawful file design which fits the state and federal demands you require. US Legal Forms offers 1000s of lawful forms that are reviewed by professionals. It is simple to obtain or produce the North Dakota Underground Storage Lease and Agreement (Surface Only) from your support.

If you have a US Legal Forms accounts, you are able to log in and then click the Acquire key. After that, you are able to complete, change, produce, or indication the North Dakota Underground Storage Lease and Agreement (Surface Only). Every lawful file design you purchase is the one you have for a long time. To get another version of the obtained kind, visit the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms web site the first time, stick to the basic recommendations listed below:

- Initial, be sure that you have selected the correct file design for the state/area of your liking. Look at the kind explanation to make sure you have selected the appropriate kind. If accessible, make use of the Preview key to look throughout the file design too.

- If you would like discover another model of the kind, make use of the Research area to find the design that suits you and demands.

- Once you have located the design you want, just click Purchase now to continue.

- Choose the costs strategy you want, enter your references, and sign up for a merchant account on US Legal Forms.

- Full the deal. You can use your credit card or PayPal accounts to purchase the lawful kind.

- Choose the structure of the file and obtain it to your system.

- Make alterations to your file if required. You are able to complete, change and indication and produce North Dakota Underground Storage Lease and Agreement (Surface Only).

Acquire and produce 1000s of file web templates making use of the US Legal Forms site, which provides the largest selection of lawful forms. Use specialist and status-specific web templates to deal with your small business or person demands.

Form popularity

FAQ

A mineral rights owner does not necessarily have to own the land property itself but must have a legal agreement with the property owner. In North Dakota, mineral rights can be transferred in three ways: deed, probate or court action.

Yes, mineral rights can expire. There's no one answer to when they'll expire or how long they last. All agreements have different term lengths.

How does mineral rights inheritance work in North Dakota? To inherit your mineral interests in North Dakota, North Dakota law has a rule that the grantor must have transferred them to an appointee or transferred directly to you to take effect at a certain time.

Statement of Claim: The owner of the surface estate in the land in or under which the mineral interest is located on the date of abandonment may record a statement of succession in interest indicating that the owner has succeeded to ownership of the minerals under this chapter.

You will need to contact the county recorder office for the county in which the lands reside. You may also need to file with them a statement of claim form. (Please be advised that this statement of claim form is available as a convenience.

Mineral interests last indefinitely as long as they are not abandoned. Minerals are considered abandoned when they have not been used or claimed for twenty or more years. Minerals are ?used? when some type of activity such as production, leasing, or conveying occurs under North Dakota law.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

First International Bank & Trust's MineralTracker recently produced and presented a 40-page summary to the North Dakota Land Board estimating the total value of North Dakota-owned oil and gas mineral rights at $2.8 billion, an 18% increase from prior year.