North Dakota Payroll Specialist Agreement - Self-Employed Independent Contractor

Description

How to fill out Payroll Specialist Agreement - Self-Employed Independent Contractor?

If you intend to finalize, obtain, or generate legitimate document templates, utilize US Legal Forms, the premier compilation of legal forms available online.

Employ the site's user-friendly and convenient search feature to locate the documents you need.

Numerous templates for business and personal uses are sorted by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose your preferred payment plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to acquire the North Dakota Payroll Specialist Agreement - Self-Employed Independent Contractor with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Download button to get the North Dakota Payroll Specialist Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your respective region/country.

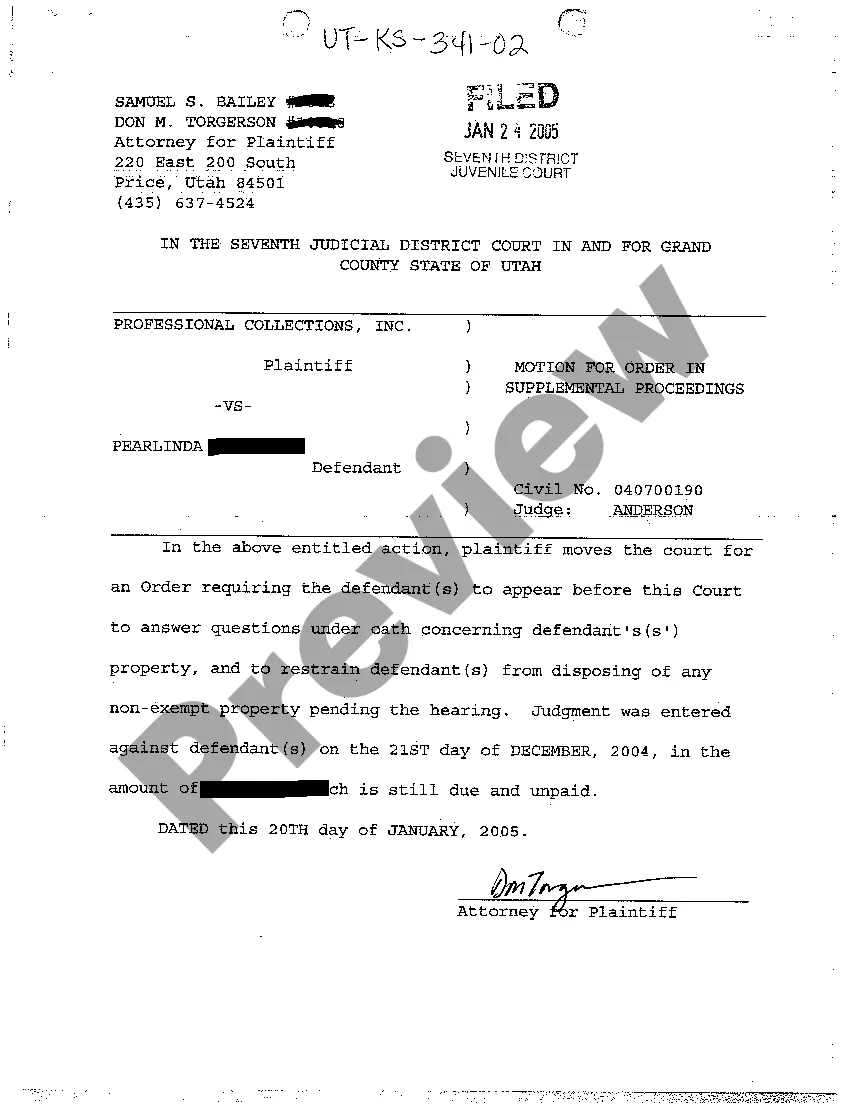

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Whether it is better to be on payroll or a 1099 contractor depends on individual preferences and financial situations. Being on payroll often provides more stability and benefits, while 1099 status offers flexibility and control over work hours. Understanding these differences is crucial, and utilizing the North Dakota Payroll Specialist Agreement - Self-Employed Independent Contractor can help you make an informed choice that suits your needs.

No, independent contractors are not typically on payroll like employees. They operate as separate business entities, billing clients for their services. Using a North Dakota Payroll Specialist Agreement - Self-Employed Independent Contractor can help clarify the distinctions and facilitate appropriate payment arrangements.

Independent contractors do not fall under traditional payroll systems because they are self-employed. Instead, they receive payment based on their services and are responsible for managing their own tax obligations. However, having a clear North Dakota Payroll Specialist Agreement - Self-Employed Independent Contractor helps clarify payment processes and responsibilities.

Creating an independent contractor agreement involves outlining the terms of the working relationship between you and the contractor. Start by detailing the scope of work, payment terms, and deadlines. You can use resources like the North Dakota Payroll Specialist Agreement - Self-Employed Independent Contractor template available on uslegalforms to ensure you cover all necessary elements and comply with local laws.

Filling out an independent contractor agreement involves detailing the key terms and conditions of the working relationship. You'll start by including the names of both parties, the scope of services, payment terms, and deadlines. Utilizing a platform like uslegalforms can simplify the process by providing templates, ensuring you cover all necessary components of the North Dakota Payroll Specialist Agreement - Self-Employed Independent Contractor.

Generally, a North Dakota Payroll Specialist Agreement - Self-Employed Independent Contractor does not need notarization. However, having a notary public can add an extra layer of authenticity to the agreement if both parties wish. It’s always good practice to confirm the specific requirements or preferences in your industry.

Setting up payroll for 1099 employees requires understanding that they are not traditional employees. You will prepare a North Dakota Payroll Specialist Agreement - Self-Employed Independent Contractor for each contractor, outlining the payment terms. You'll need to collect their W-9 form to report their earnings on a 1099-MISC form at the end of the year for tax purposes.

Payroll for independent contractors operates differently than for employees. Since independent contractors are considered self-employed, you don’t withhold taxes for them. Instead, they receive their full payment under a North Dakota Payroll Specialist Agreement - Self-Employed Independent Contractor and are responsible for reporting and paying their taxes.