North Dakota Term Loan Agreement

Description

How to fill out Term Loan Agreement?

If you wish to full, download, or produce legal document web templates, use US Legal Forms, the largest selection of legal kinds, that can be found online. Utilize the site`s easy and convenient look for to get the documents you want. Various web templates for company and person reasons are categorized by classes and states, or search phrases. Use US Legal Forms to get the North Dakota Term Loan Agreement within a few click throughs.

In case you are already a US Legal Forms client, log in in your account and click the Download option to obtain the North Dakota Term Loan Agreement. Also you can access kinds you in the past downloaded in the My Forms tab of your account.

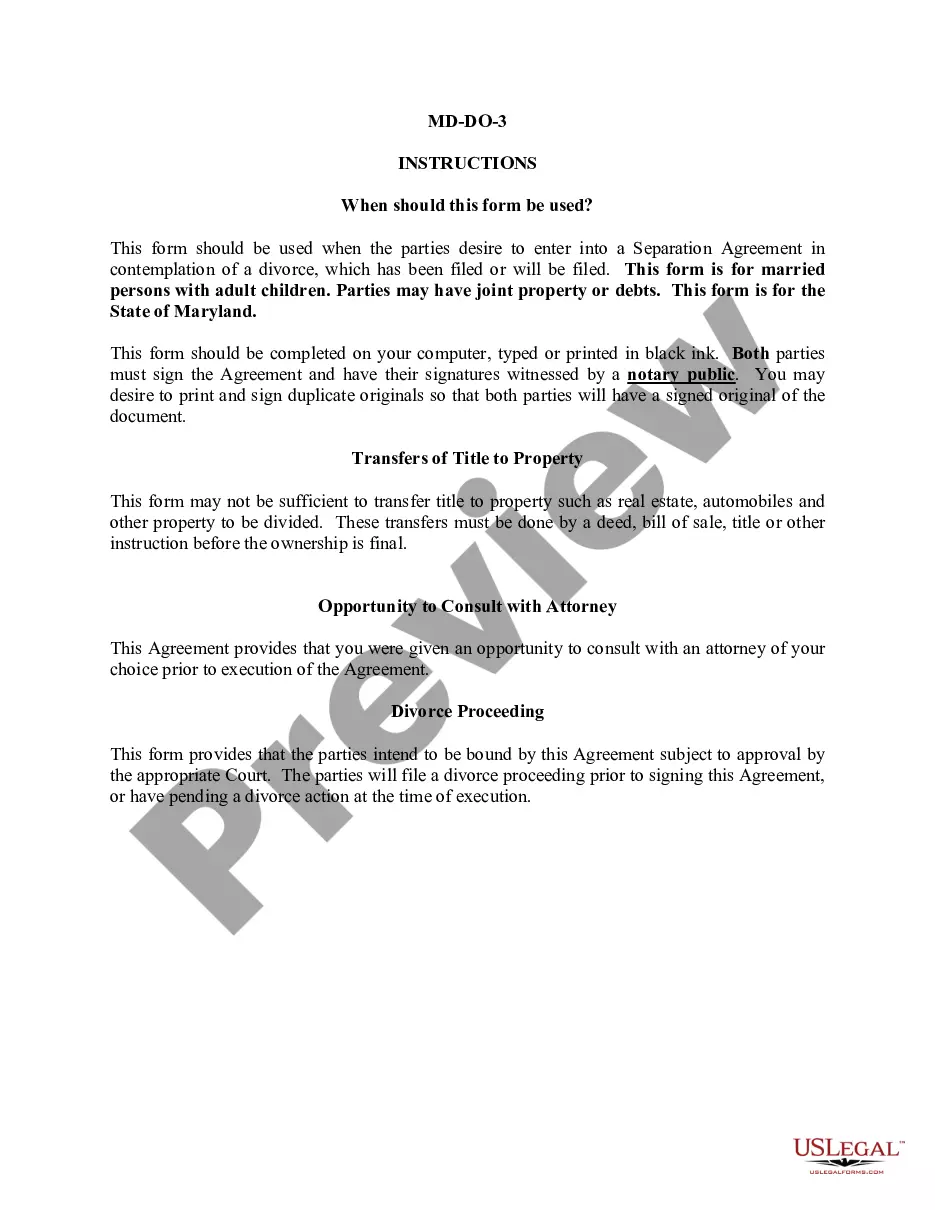

Should you use US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have selected the shape for your correct area/region.

- Step 2. Make use of the Preview method to check out the form`s articles. Do not forget about to read the explanation.

- Step 3. In case you are unhappy using the form, use the Look for discipline at the top of the display screen to discover other variations of the legal form template.

- Step 4. Once you have located the shape you want, select the Buy now option. Select the pricing strategy you favor and add your accreditations to sign up on an account.

- Step 5. Method the purchase. You can utilize your Мisa or Ьastercard or PayPal account to accomplish the purchase.

- Step 6. Find the format of the legal form and download it on your own product.

- Step 7. Comprehensive, edit and produce or indicator the North Dakota Term Loan Agreement.

Each legal document template you buy is the one you have forever. You possess acces to each and every form you downloaded inside your acccount. Go through the My Forms segment and select a form to produce or download once again.

Contend and download, and produce the North Dakota Term Loan Agreement with US Legal Forms. There are millions of specialist and state-distinct kinds you can use for the company or person requires.

Form popularity

FAQ

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

Eligibility Criteria for Applying for a Term Loan Minimum age of the applicant has to be 18, and maximum age has to be 65. The borrower needs to have a CIBIL score of 750 or above. The applicant needs to have a good repayment history and creditworthiness. Applicants shouldn't have any history of default with any lender.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

form, bilateral, secured or unsecured, sterling, term facility agreement (or loan agreement) between a single lender and a single borrower with interest charged at a margin over base rate.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

How to Write a Loan Agreement Step 1 ? Name the Parties. ... Step 2 ? Write Down the Loan Amount. ... Step 3 ? Specify Repayment Details. ... Step 4 ? Choose How the Loan Will Be Secured (Optional) ... Step 5 ? Provide a Guarantor (Optional) ... Step 6 ? Specify an Interest Rate. ... Step 7 ? Include Late Fees (Optional)

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.