North Dakota Letter to Shareholders regarding meeting of shareholders

Description

How to fill out Letter To Shareholders Regarding Meeting Of Shareholders?

Are you inside a place in which you need to have files for either enterprise or personal functions almost every time? There are tons of legal record web templates available online, but discovering versions you can trust is not effortless. US Legal Forms gives a huge number of develop web templates, such as the North Dakota Letter to Shareholders regarding meeting of shareholders, which are composed to satisfy state and federal demands.

When you are presently knowledgeable about US Legal Forms website and have an account, simply log in. Next, it is possible to download the North Dakota Letter to Shareholders regarding meeting of shareholders template.

Unless you provide an account and need to start using US Legal Forms, abide by these steps:

- Discover the develop you want and ensure it is for that appropriate metropolis/area.

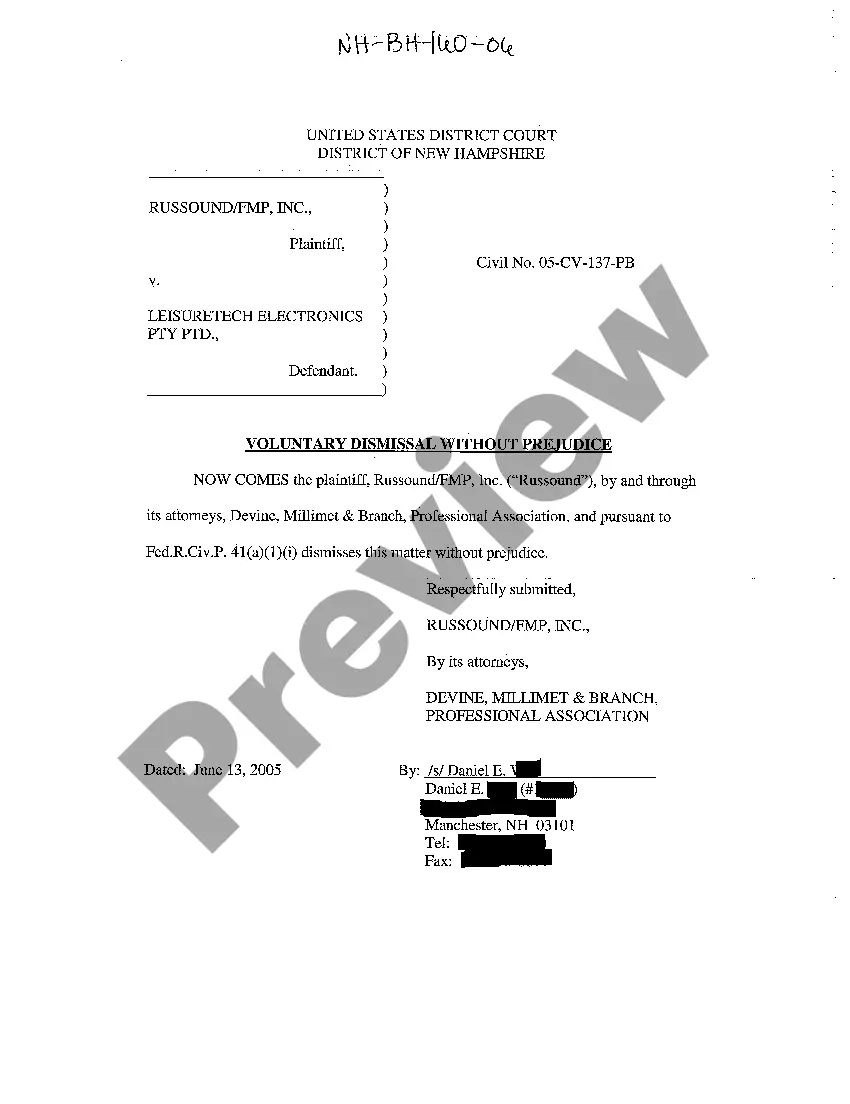

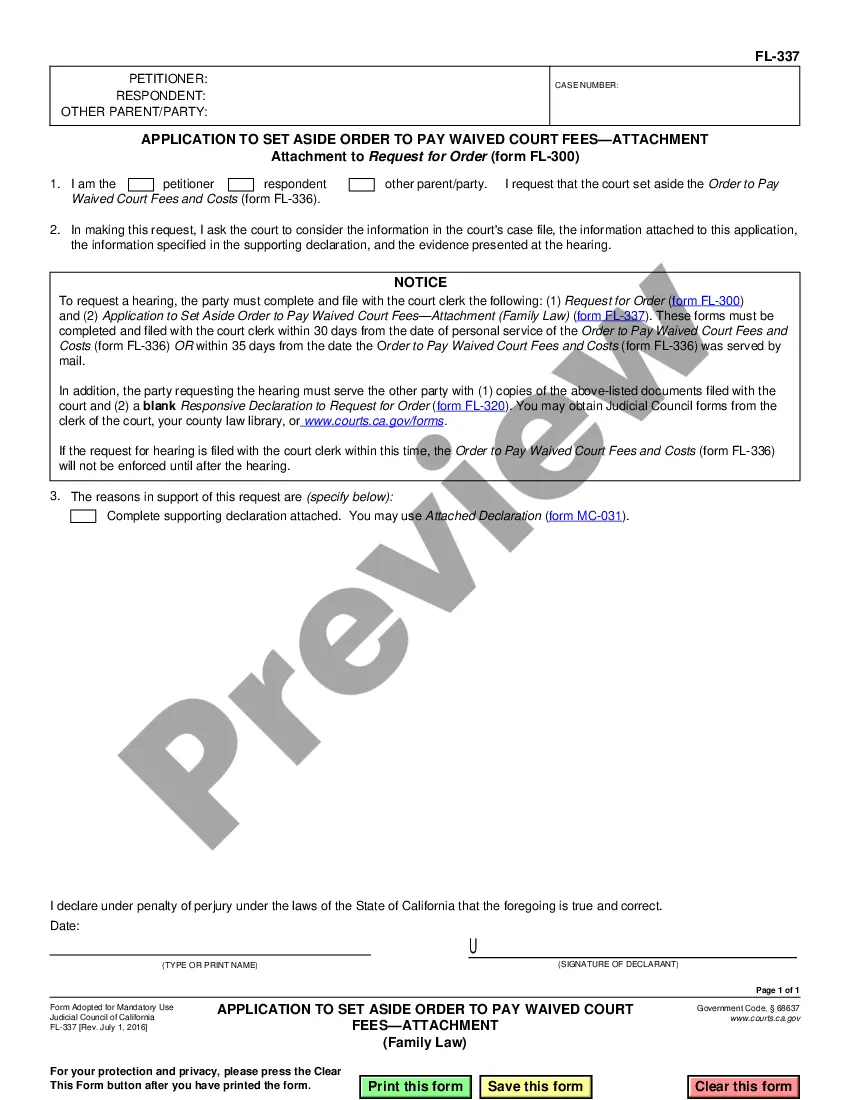

- Utilize the Preview switch to check the shape.

- Look at the information to actually have selected the appropriate develop.

- If the develop is not what you are seeking, use the Research field to discover the develop that fits your needs and demands.

- When you get the appropriate develop, just click Buy now.

- Opt for the pricing prepare you would like, fill out the desired info to produce your bank account, and purchase the transaction using your PayPal or bank card.

- Select a convenient document file format and download your version.

Get all the record web templates you might have purchased in the My Forms menu. You can get a further version of North Dakota Letter to Shareholders regarding meeting of shareholders at any time, if needed. Just click the needed develop to download or print the record template.

Use US Legal Forms, probably the most comprehensive collection of legal types, to save some time and avoid faults. The service gives expertly made legal record web templates which can be used for a selection of functions. Make an account on US Legal Forms and begin generating your life easier.

Form popularity

FAQ

It costs $100 to register a North Dakota corporation or $135 to form a North Dakota LLC. Nearly all businesses formed by filing with the state of North Dakota must file a federal Beneficial Ownership Information (BOI) Report with the Financial Crimes Enforcement Network (FinCEN) following business formation.

Foreign corporation registered in Texas: To withdraw or cancel your foreign Texas Corporation in Texas, you provide the completed Form 608, Certificate of Withdrawal of Registration in duplicate to the Secretary of State by mail, fax or in person.

How to Incorporate in North Dakota. To start a corporation in North Dakota, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Business Registration Unit. You can file this document online or by mail.

Submit the form, Certificate of Withdrawal Foreign Corporation Application to the SOS. North Dakota allows filing in person, by mail, or by fax. Both withdrawal forms include a credit card payment authorization section that must be completed if you are paying by credit card.

Tax Exemptions: If you register a new company in North Dakota then you will be able to benefit from the variety of tax exemptions available and these include: ? North Dakota exempts different types of items from sales tax normally taxed by other states, like electricity, groceries, and natural gas.

Less... Hold a Board of Directors meeting and record a resolution to Dissolve the North Dakota Corporation. ... Hold a Shareholder meeting to approve Dissolution of the North Dakota Corporation. ... File a Intent to Dissolve with the ND Secretary of State. ... File all required Annual Reports with the North Dakota Secretary of State.

A professional corporation may render: One specific type of professional service and services ancillary thereto; or. Two or more kinds of professional services that are specifically authorized to be practiced in combination under North Dakota's licensing laws of each of the professional services to be rendered.

To withdraw a foreign corporation or LLC registered in North Carolina, you just have to file the appropriate form with the North Carolina Secretary of State, Corporations Division (SOS). You can submit the form to the North Carolina SOS by mail, in person, or online.

Top 10 states: Common factors No individual or corporate taxes: Wyoming, Nevada, and South Dakota. No sales or individual income taxes: Alaska. No individual income tax: Tennessee and Florida. No sales tax: Montana and New Hampshire. Low tax rates: Utah and Indiana impose all the primary taxes, but their rates are very low.

An individual resident residing in North Dakota, Another domestic or foreign corporation that is registered with the Secretary of State and has a business office in North Dakota, or. A domestic or foreign limited liability company that is registered with the Secretary of State and has a business office in North Dakota.