North Dakota List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005

Description

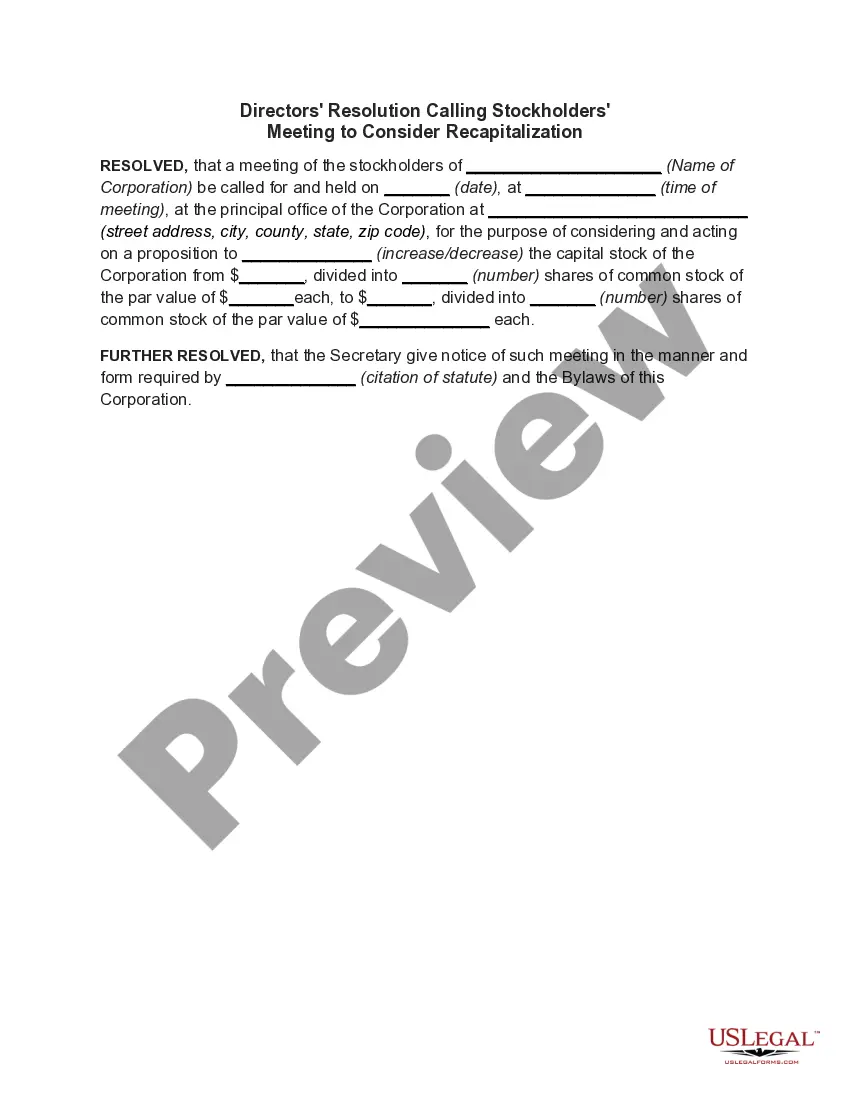

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

US Legal Forms - one of the most significant libraries of authorized types in the United States - gives a variety of authorized record web templates you may acquire or printing. Using the website, you can get 1000s of types for organization and specific reasons, sorted by types, states, or keywords and phrases.You can find the newest variations of types such as the North Dakota List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 in seconds.

If you have a subscription, log in and acquire North Dakota List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 from your US Legal Forms library. The Down load option will show up on each and every form you view. You have access to all formerly downloaded types in the My Forms tab of your respective account.

If you wish to use US Legal Forms the very first time, here are simple recommendations to help you get started off:

- Be sure you have selected the best form to your town/county. Click the Review option to examine the form`s information. Browse the form explanation to actually have selected the proper form.

- When the form does not fit your demands, make use of the Lookup industry near the top of the display to get the one who does.

- In case you are happy with the shape, affirm your choice by clicking the Get now option. Then, choose the rates plan you want and give your references to sign up for an account.

- Procedure the transaction. Utilize your charge card or PayPal account to finish the transaction.

- Select the format and acquire the shape on your own device.

- Make adjustments. Load, modify and printing and indicator the downloaded North Dakota List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005.

Each and every design you included with your account does not have an expiration day and it is your own forever. So, if you wish to acquire or printing another copy, just go to the My Forms area and click on on the form you will need.

Gain access to the North Dakota List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 with US Legal Forms, by far the most comprehensive library of authorized record web templates. Use 1000s of professional and condition-particular web templates that meet up with your small business or specific requires and demands.

Form popularity

FAQ

Incomplete or Inaccurate Documentation: Filing for Chapter 13 bankruptcy requires comprehensive documentation, including income records, tax returns, and a complete list of debts and assets. Failure to provide accurate or complete information may result in disqualification or case dismissal.

Absolute priority, also known as "liquidation preference," is a rule governing the order of payment among creditors and shareholders in the event of a corporate liquidation. The absolute priority rule is used in corporate bankruptcies to decide the portion of payment that will be made to each participant.

In summary, a Chapter 13 bankruptcy can fail for lots of reasons. These could be inadequate repayment plans, failure to make plan payments, changes in your financial circumstances, failure to do those required courses, filing too soon after previous bankruptcy, and filing without legal representation.

A creditor with an unsecured claim has a promise to pay from the borrower but doesn't have a lien. There are two types of unsecured claims: Priority unsecured claims. These debts aren't dischargeable in bankruptcy, and, if money is available, the claim will get paid before nonpriority unsecured claims.

The court may deny an individual debtor's discharge in a chapter 7 or 13 case if the debtor fails to complete "an instructional course concerning financial management." The Bankruptcy Code provides limited exceptions to the "financial management" requirement if the U.S. trustee or bankruptcy administrator determines ...

A total of 226,777 chapter 13 consumer cases were closed by dismissal or plan completion in 2020. Table 6 illustrates that 116,145 of these cases were dismissed. In 49 percent of the cases closed (110,632 cases), the debtors received a discharge after completing repayment plans, up from 43 percent in 2019.

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged).

A report from the American Bankruptcy Institute, shows that filing Chapter 13 bankruptcy with the help of an attorney has a more successful outcome than pursuing credit counseling. While results vary somewhat from state to state, between 40 percent to 70 percent of Chapter 13 cases complete repayment successfully.