North Dakota Salaried Employee Appraisal Guidelines - Employee Specific

Description

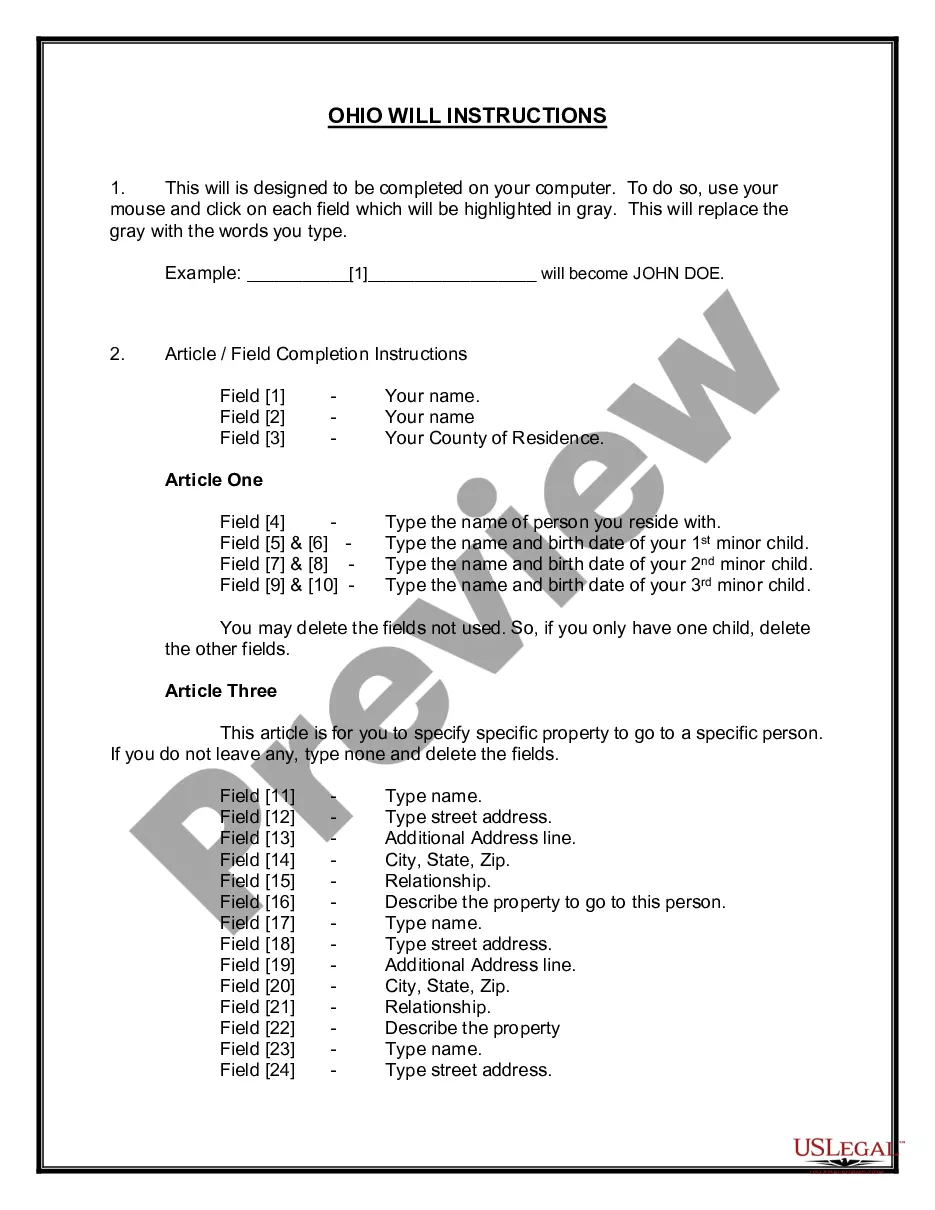

How to fill out Salaried Employee Appraisal Guidelines - Employee Specific?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse range of legal template documents that you can download or create.

By using the website, you can discover thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of forms like the North Dakota Salaried Employee Evaluation Guidelines - Employee Specific in just moments.

Read the form description to ensure you have selected the appropriate form.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you already have a monthly membership, Log In and download North Dakota Salaried Employee Evaluation Guidelines - Employee Specific from the US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple instructions to get started.

- Make sure you have selected the correct form for your city/state.

- Click the Review button to examine the content of the form.

Form popularity

FAQ

Currently, North Dakota labor laws do not mandate 15-minute breaks for salaried employees. However, many employers choose to offer short breaks to support employee wellbeing and productivity. To align with the North Dakota Salaried Employee Appraisal Guidelines - Employee Specific, businesses may consider implementing break policies that enhance work-life balance.

Determining Employment Status A general rule is if a worker is self-employed, he is in business on his own account and is responsible for the success of his business. Employed workers work for an employer and do not run their own business. They receive regular paychecks from an employer.

Employees whose jobs are governed by the FLSA are either "exempt" or "nonexempt." Nonexempt employees are entitled to overtime pay. Exempt employees are not. Most employees covered by the FLSA are nonexempt.

Regular Employee means an employee whose employment is reasonably expected to continue for longer than two years, although such employment may be terminated earlier by action on the part of the Company or the employee.

These are individuals who work for someone else but are not employees....Key TakeawaysAn employee is a regular, long-term worker who gets paid a set hourly wage or annual salary for their work.The IRS sets guidelines to determine which workers are employees and which aren't.More items...?

The FLSA, identifies two types of employees: non-exempt employees and exempt employees: Non-exempt employees are employees who, based on the duties performed and the manner of compensation, are required to account for time worked and sick leave, vacation, and other leave on an hourly and fractional hourly basis.

In fact, employees' right to discuss their salary is protected by law. While employers may restrict workers from discussing their salary in front of customers or during work, they cannot prohibit employees from talking about pay on their own time.

An employee is on a company's payroll and receives wages and benefits in exchange for following the organization's guidelines and remaining loyal. A contractor is an independent worker who has autonomy and flexibility but does not receive benefits such as health insurance and paid time off.

The law only requires employment for at least a year, whether continuous or not continuous, to be considered a regular employee. Further, the law deems repeated and continuing need for its performance as sufficient evidence of the necessity if not indispensability of that activity to the business.

Under Executive Order 11246, you have the right to inquire about, discuss, or disclose your own pay or that of other employees or applicants. You cannot be disciplined, harassed, demoted, terminated, denied employment, or otherwise discriminated against because you exercised this right.