North Dakota Employee Payroll Record

Description

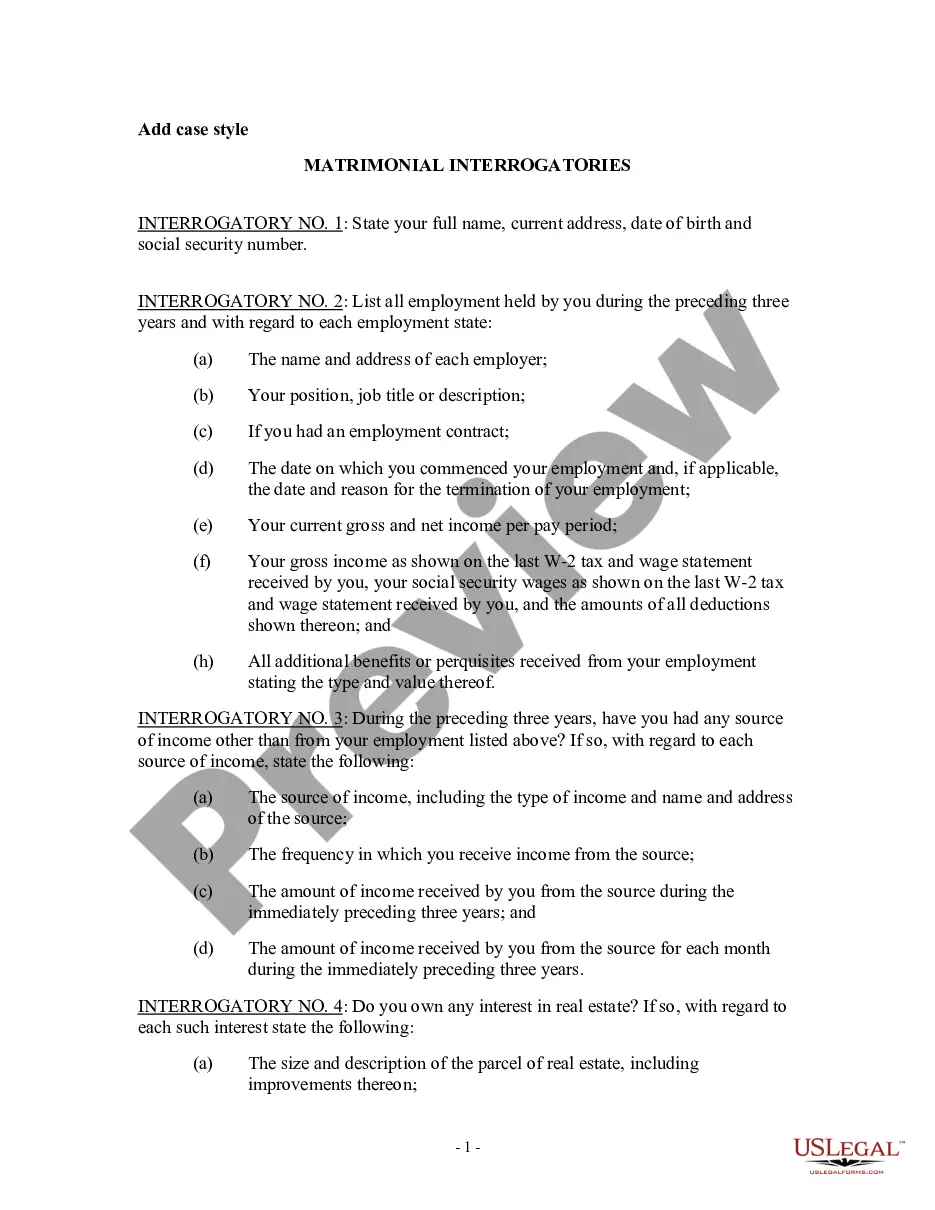

How to fill out Employee Payroll Record?

If you require to complete, obtain, or create authentic legal document templates, utilize US Legal Forms, the premier assortment of legal forms accessible online.

Utilize the site's straightforward and user-friendly search feature to find the documents you need.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After you have found the form you need, click on the Get now button. Choose your preferred payment plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Use US Legal Forms to locate the North Dakota Employee Payroll Record in just a few clicks.

- If you are currently a US Legal Forms customer, Log In to your account and click the Download button to access the North Dakota Employee Payroll Record.

- You can also retrieve forms you previously acquired from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct state/region.

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the description.

- Step 3. If you are not content with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

An employee personnel file must include key documents that establish the employment relationship, such as offer letters, contracts, and identification documents. Additionally, performance evaluations and records of any disciplinary actions are essential. Keeping these elements organized within the North Dakota Employee Payroll Record can significantly enhance overall HR management and streamline communication with employees.

An employee's payroll record must document the employee's name, Social Security number, the wages earned, hours worked, and deductions taken. These records not only comply with North Dakota labor laws but also support transparency and accountability in payroll management. Utilizing a platform like US Legal Forms can help ensure that all aspects of the North Dakota Employee Payroll Record are accurately recorded and maintained.

A comprehensive employee personnel file should include essential documents such as employment applications, tax forms, and performance reviews. It should also contain any disciplinary actions and benefits information. By organizing the North Dakota Employee Payroll Record efficiently, employers can streamline processes and ensure that all necessary data is readily accessible when needed.

In North Dakota, the law mandates that employers maintain accurate personnel files for each employee. These files should reflect employment records, performance evaluations, and signed documents. Additionally, the law emphasizes the importance of privacy, requiring careful handling of sensitive information to protect employees' rights. Being compliant with the North Dakota Employee Payroll Record standards ensures that employers meet legal obligations.

Not all records in North Dakota are accessible to the public, especially personal payroll records which are protected by privacy laws. While some documents may be open for public review, sensitive information like North Dakota Employee Payroll Records generally requires authorization. To understand what records are available, you can refer to state guidelines or consult a legal professional. If you need to access particular records, platforms like USLegalForms offer guidance on how to navigate these inquiries effectively.

In North Dakota, finding someone's salary online is not straightforward due to privacy laws. Most payroll records are confidential, and access is typically restricted to authorized individuals. While some sites may offer salary estimates for specific job titles or industries, these figures may not reflect actual earnings. If you are seeking detailed payroll information, consider requesting access to a North Dakota Employee Payroll Record through the proper channels.

Generally, access to payroll information is limited to authorized personnel, such as payroll administrators and human resources staff. Employees typically have access to their own North Dakota Employee Payroll Record for personal review and verification. It is essential for businesses to maintain confidentiality regarding salary and payroll details to protect employee privacy. If you have questions about who can see your information, check with your HR department for specific guidelines.

If you need a specific payroll record, you can reach out directly to your employer and request it. Be clear about which record you require, as employers may have various formats for their North Dakota Employee Payroll Record. Additionally, some companies may allow you to access your information through an employee portal. If your employer has policies in place, familiarize yourself with their procedures for requesting payroll records.

To obtain your payroll records in North Dakota, you should start by contacting your employer or the human resources department. They typically maintain these records and can provide access to your North Dakota Employee Payroll Record upon request. In some cases, employers may require you to submit a formal request or identification to ensure privacy and security. Utilizing platforms like USLegalForms can also simplify this process by providing templates for requests.

Employers in North Dakota are required to keep employee payroll records for a specific period. Generally, it is advisable to retain payroll records for at least three years from the date of payment. This timeframe helps ensure compliance with tax and labor laws. By maintaining these records, businesses can provide necessary information during audits or employee inquiries regarding their North Dakota Employee Payroll Record.