North Dakota Business Trust

Description

How to fill out Business Trust?

If you require extensive, acquire, or create authorized document templates, utilize US Legal Forms, the largest assortment of legal forms, which are accessible online.

Employ the site's straightforward and convenient search to locate the documents you need.

Numerous templates for business and personal purposes are categorized by type and state, or by keywords. Use US Legal Forms to find the North Dakota Business Trust with just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Choose the format of the legal document and download it onto your device. Step 7. Complete, modify, and print or sign the North Dakota Business Trust. Every legal document template you purchase is yours permanently. You have access to every form you saved in your account. Click the My documents section and select a form to print or download again. Compete and access, and print the North Dakota Business Trust with US Legal Forms. There are many professional and state-specific templates available for your personal or business needs.

- If you are currently a US Legal Forms user, Log In to your account and select the Obtain option to access the North Dakota Business Trust.

- You can also retrieve forms you have previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the correct form for your specific city/state.

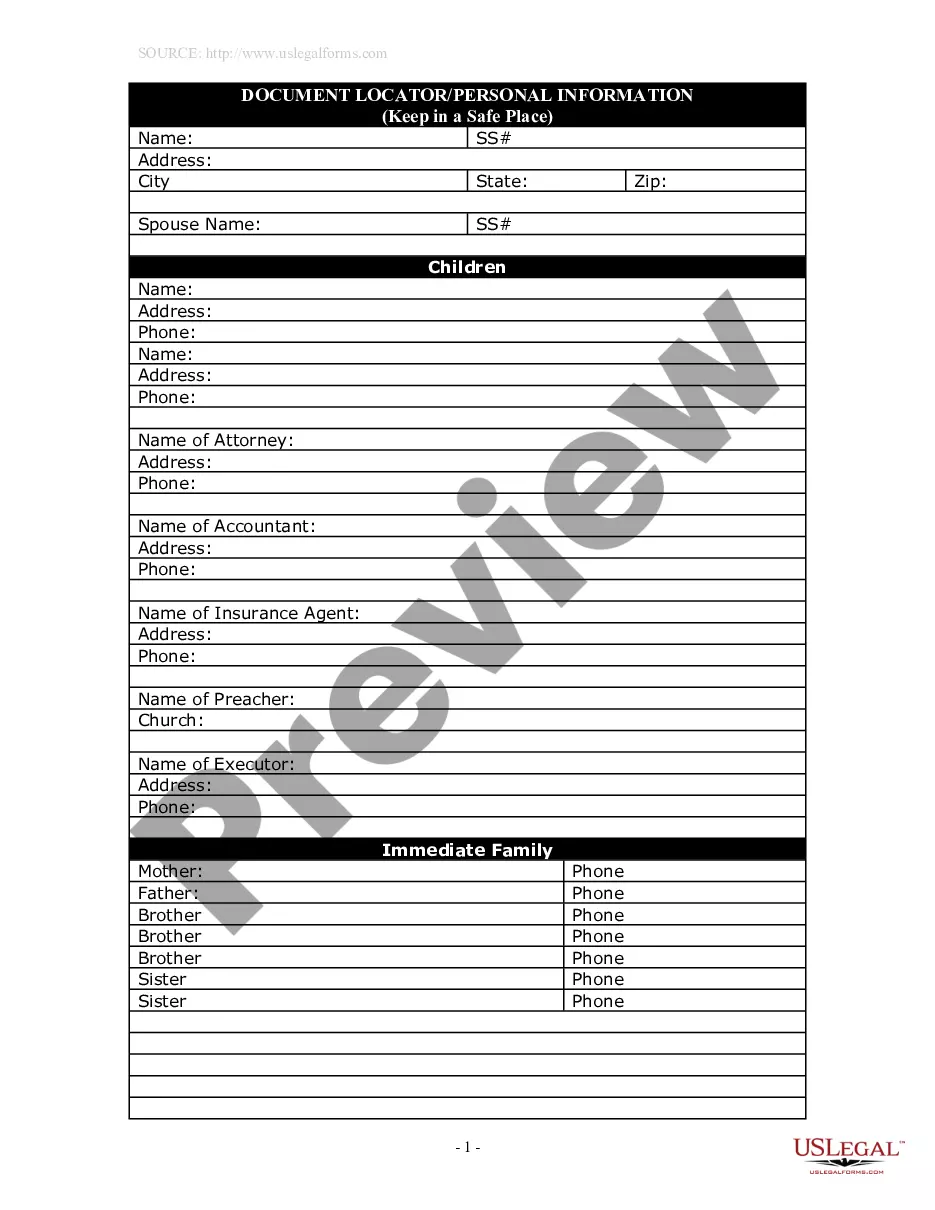

- Step 2. Use the Review feature to inspect the form's details. Be sure to read through the summary.

- Step 3. If you are not satisfied with the form, use the Research field at the top of the screen to search for alternative versions of the legal form.

- Step 4. Once you find the form you need, click on the Acquire now option. Select your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

Hunting regulations on state trust land in Minnesota differ from those in North Dakota. While hunting may be allowed, specific permits and regulations apply. If you are considering hunting in Minnesota while holding assets in a North Dakota business trust, ensure you stay informed about the local laws related to hunting and property usage. Always consult local authorities for the latest information.

Non-residents of North Dakota need to file Form ND-1, the North Dakota Individual Income Tax Return. This form records income earned from North Dakota sources and calculates the appropriate tax. Completing this form is essential for compliance, especially for those operating through a North Dakota business trust. For assistance with tax forms, USLegalForms can provide the necessary documentation.

Examples of business trusts include: Example #1: Delaware and Alaska have specific state laws related to trusts in that there are special tax and financial advantages for beneficiaries. Example #2: A grantor trust allows someone to manage their business finances while providing for heirs.

What are the Disadvantages of a Trust?Costs. When a decedent passes with only a will in place, the decedent's estate is subject to probate.Record Keeping. It is essential to maintain detailed records of property transferred into and out of a trust.No Protection from Creditors.

How Does a Business Trust Work? A trust is an agreement that allows one party, known as a trustee, to hold, manage, and direct assets or property on behalf of another party, called the beneficiary. In a business trust, a trustee manages a business and conducts transactions for the benefit of its beneficiaries.

Updated December 05, 2021. The North Dakota living trust is a legal instrument used to bypass the probate process when distributing a person's estate.

Creating a living trust in North Dakota involves the following these six steps:Choose what kind of living trust you prefer.Take inventory of the property and assets you want in your trust.Decide who you want to be your trustee.Put together your living trust.Sign the trust document in front of a notary public.More items...?

Business Trust= Real Estate Investment Trusts (REITs) + Infrastructure Investment Trusts (InvITs). These trusts are like mutual funds that raise resources from many investors to be directly invested in realty or infrastructure projects.

The Virginia business trust operates like a typical trust. Assets are given by a Grantor to a Trustee. The Trustee agrees to accept the assets and manage them as directed by a private contract known as the trust agreement.

A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. Trusts can be arranged in many ways and can specify exactly how and when the assets pass to the beneficiaries.