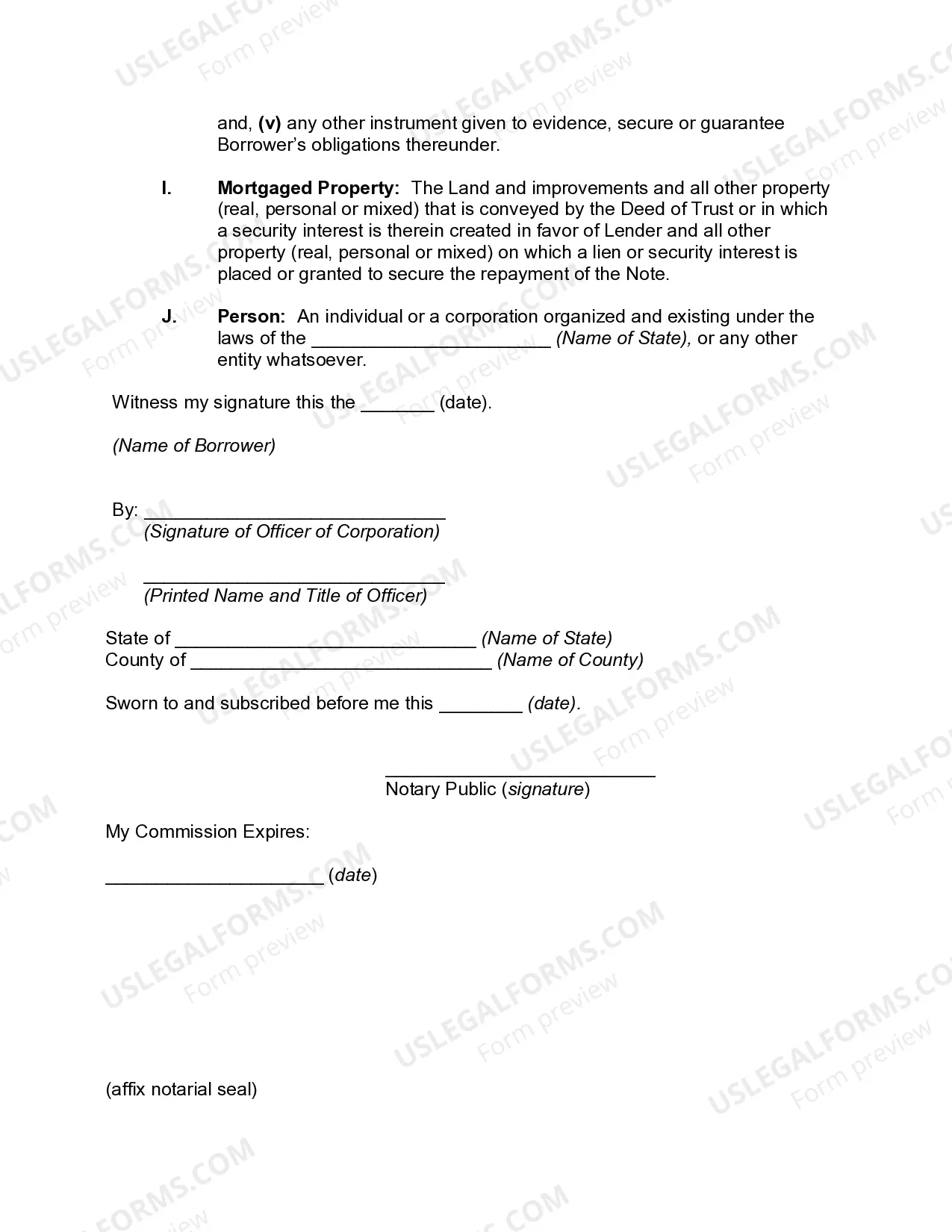

North Dakota Certificate of Borrower regarding Commercial Loan

Description

How to fill out Certificate Of Borrower Regarding Commercial Loan?

US Legal Forms - among the biggest libraries of legal varieties in the States - offers a variety of legal record themes you can download or produce. While using website, you can find thousands of varieties for business and individual reasons, categorized by groups, says, or search phrases.You can find the newest variations of varieties much like the North Dakota Certificate of Borrower regarding Commercial Loan within minutes.

If you have a membership, log in and download North Dakota Certificate of Borrower regarding Commercial Loan from your US Legal Forms collection. The Down load option will appear on every single kind you see. You have accessibility to all earlier saved varieties inside the My Forms tab of your own bank account.

If you would like use US Legal Forms the first time, listed here are basic guidelines to get you started out:

- Be sure to have picked out the correct kind for your metropolis/area. Go through the Preview option to check the form`s content. Read the kind explanation to actually have selected the correct kind.

- In the event the kind doesn`t satisfy your specifications, take advantage of the Lookup field on top of the screen to obtain the the one that does.

- Should you be content with the shape, validate your choice by visiting the Acquire now option. Then, opt for the rates prepare you prefer and supply your references to register for an bank account.

- Approach the financial transaction. Make use of your charge card or PayPal bank account to complete the financial transaction.

- Pick the formatting and download the shape in your gadget.

- Make adjustments. Fill out, modify and produce and indicator the saved North Dakota Certificate of Borrower regarding Commercial Loan.

Each and every template you included with your bank account lacks an expiry date which is the one you have eternally. So, if you want to download or produce yet another copy, just check out the My Forms section and click around the kind you require.

Gain access to the North Dakota Certificate of Borrower regarding Commercial Loan with US Legal Forms, by far the most comprehensive collection of legal record themes. Use thousands of specialist and status-specific themes that meet up with your small business or individual needs and specifications.

Form popularity

FAQ

Primary tabs. A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

"Money brokering" means the act of arranging or providing loans or leases as a form of financing, or advertising or soliciting either in print, by letter, in person, or otherwise, the right to find lenders or provide loans or leases for persons or businesses desirous of obtaining funds for any purposes.

How do you get a Satisfaction of Mortgage? A Satisfaction of Mortgage is issued by the lender after they have received the final mortgage payment from the borrower. It's signed by the mortgagee (in the presence of a witness in some states and counties) and then notarized by a registered notary public.

If the satisfaction isn't recorded within a minimum of 60 days, they may incur penalties and be held liable for damages and attorney's fees.

A satisfaction of mortgage, also known as release, cancellation or discharge of mortgage, is a type of legal document that proves you paid your mortgage in full. As a result, it also certifies that the property's title is clear of any liens.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property.