North Dakota Sample Letter for Re-Request of Execution of Petition For Authority to Sell Property of Estate etc.

Description

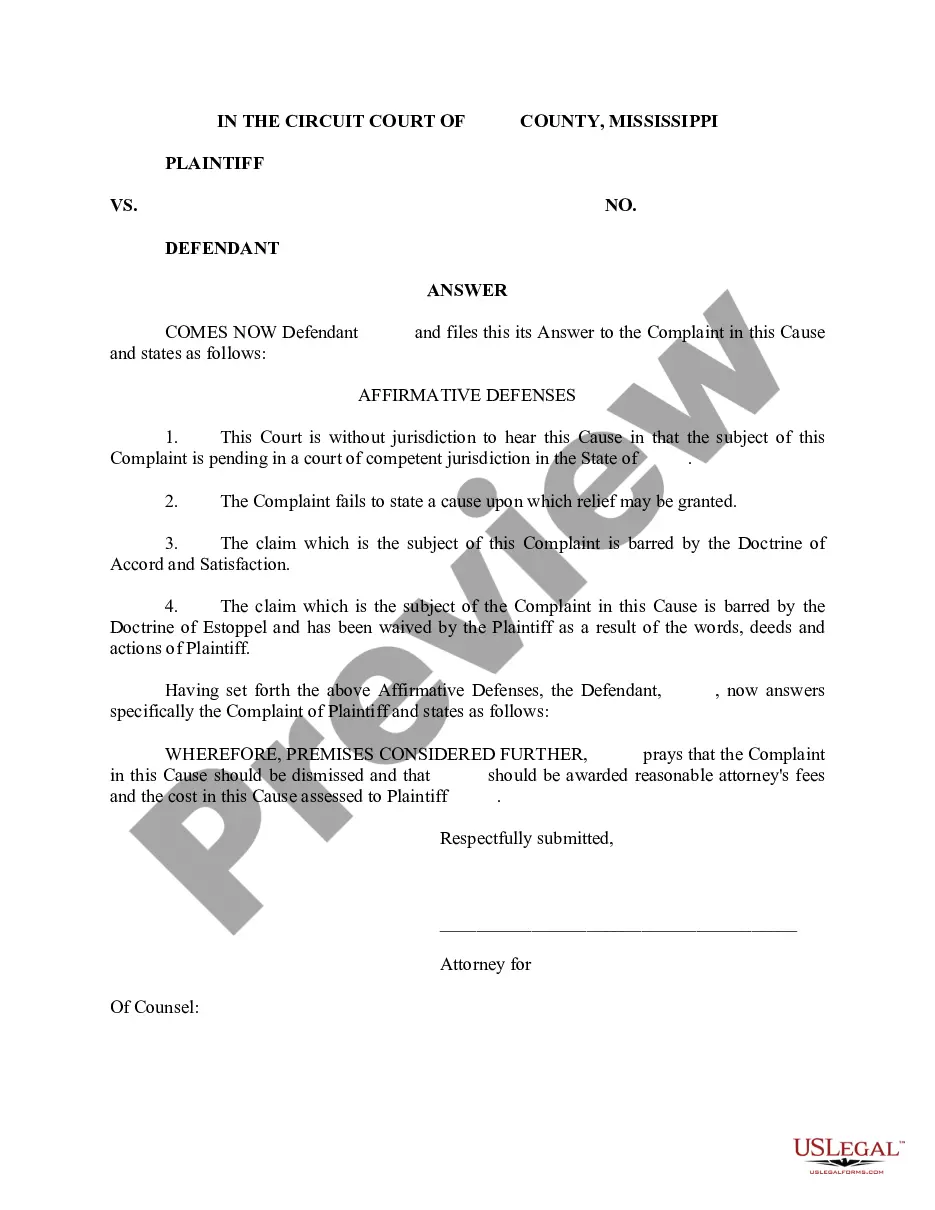

How to fill out Sample Letter For Re-Request Of Execution Of Petition For Authority To Sell Property Of Estate Etc.?

US Legal Forms - one of several biggest libraries of authorized kinds in the States - gives a wide array of authorized document templates you may acquire or printing. Making use of the website, you will get thousands of kinds for business and personal functions, categorized by types, says, or keywords and phrases.You can get the most recent variations of kinds just like the North Dakota Sample Letter for Re-Request of Execution of Petition For Authority to Sell Property of Estate etc. in seconds.

If you already have a membership, log in and acquire North Dakota Sample Letter for Re-Request of Execution of Petition For Authority to Sell Property of Estate etc. through the US Legal Forms collection. The Down load key will appear on every type you perspective. You get access to all earlier delivered electronically kinds inside the My Forms tab of your own accounts.

In order to use US Legal Forms the very first time, here are simple recommendations to help you started out:

- Be sure to have selected the right type for the metropolis/area. Go through the Review key to check the form`s articles. See the type description to ensure that you have selected the proper type.

- If the type doesn`t match your specifications, utilize the Lookup area near the top of the display screen to get the the one that does.

- When you are pleased with the shape, validate your choice by clicking the Purchase now key. Then, choose the rates strategy you want and supply your credentials to sign up to have an accounts.

- Procedure the financial transaction. Make use of your credit card or PayPal accounts to perform the financial transaction.

- Select the file format and acquire the shape on your system.

- Make modifications. Fill out, modify and printing and indicator the delivered electronically North Dakota Sample Letter for Re-Request of Execution of Petition For Authority to Sell Property of Estate etc..

Each and every format you put into your money lacks an expiry particular date and is yours permanently. So, in order to acquire or printing another backup, just proceed to the My Forms area and then click on the type you will need.

Obtain access to the North Dakota Sample Letter for Re-Request of Execution of Petition For Authority to Sell Property of Estate etc. with US Legal Forms, by far the most comprehensive collection of authorized document templates. Use thousands of expert and condition-specific templates that fulfill your organization or personal demands and specifications.

Form popularity

FAQ

Even without a statutory guideline on executor fees in North Dakota, the common understanding among legal professionals suggests that an executor can expect to receive about 2-5% of the estate's value. However, this percentage can vary based on the specifics of the estate and the executor's duties.

If you have a larger estate, you must go through probate, especially if real estate is involved. Other deciding factors for requiring probate include: A poorly written will. Debates over the proper heir.

The personal representative shall pay taxes on, and take all steps reasonably necessary for the management, protection, and preservation of, the estate in the personal representative's possession. The personal representative may maintain an action to recover possession of property or to determine the title thereto.

The surviving spouse who is a devisee of the decedent has the highest priority for consideration as the personal representative in informal probate proceedings.

Die intestate in North Dakota and your children will inherit part of your estate. However, how much they receive depends on whether you also leave behind a spouse, if those children are with your surviving spouse, and if you have children with someone other than your surviving spouse.

Die unmarried and intestate in North Dakota and your estate goes to your children in equal shares. If you don't have any children, then your parents are next in line. Finally, if you don't have a spouse, children, or surviving parents, then your estate will go to your grandparents, or descendants of your grandparents.