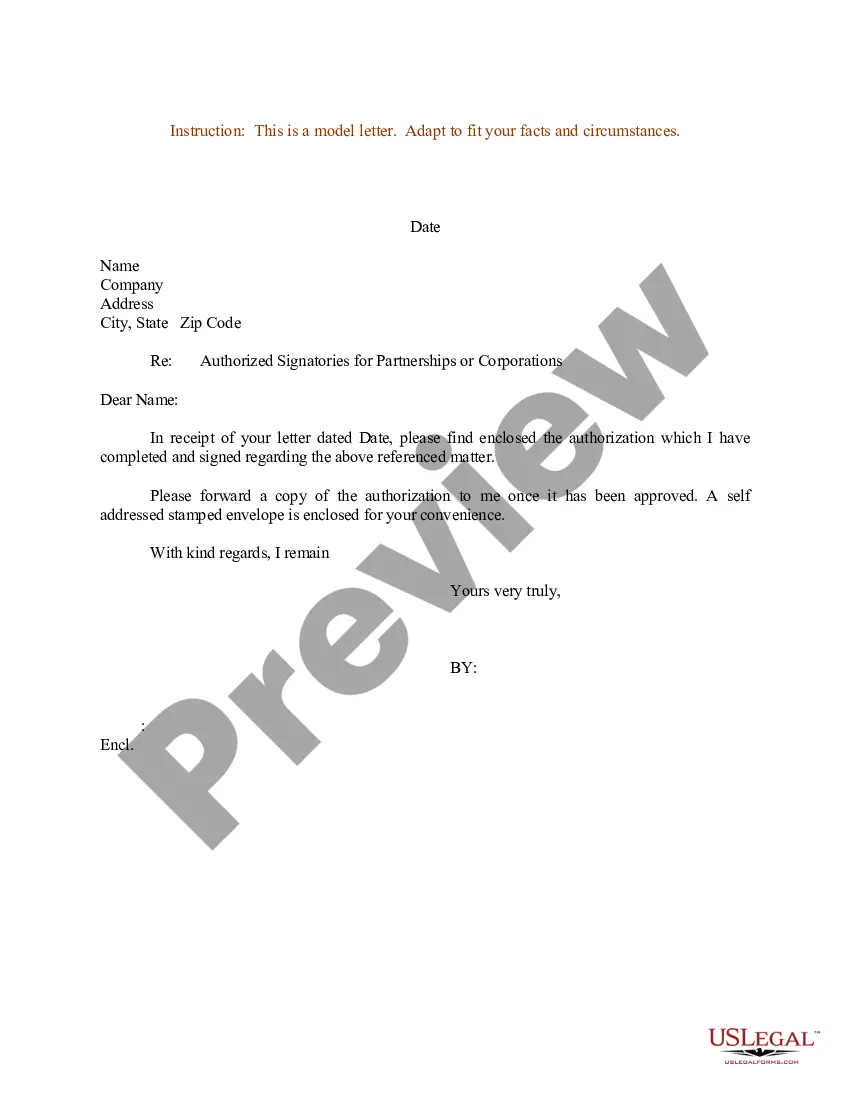

North Dakota Sample Letter for Authorized Signatories for Partnerships or Corporations

Description

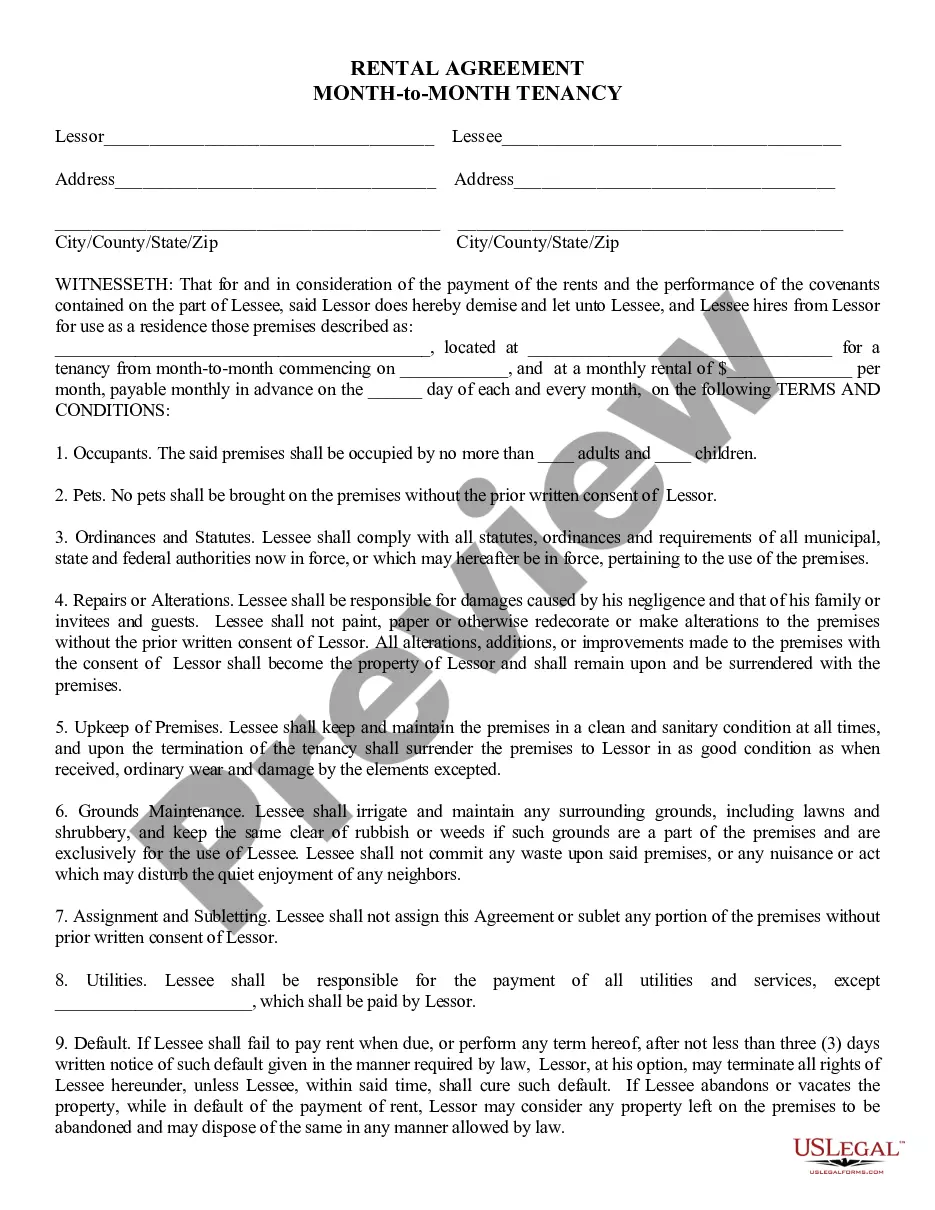

How to fill out Sample Letter For Authorized Signatories For Partnerships Or Corporations?

Choosing the right lawful record design could be a struggle. Obviously, there are plenty of themes accessible on the Internet, but how do you find the lawful type you will need? Make use of the US Legal Forms internet site. The support delivers 1000s of themes, including the North Dakota Sample Letter for Authorized Signatories for Partnerships or Corporations, which can be used for business and private needs. Each of the types are examined by experts and satisfy federal and state specifications.

If you are already authorized, log in to your bank account and click on the Download key to have the North Dakota Sample Letter for Authorized Signatories for Partnerships or Corporations. Use your bank account to search from the lawful types you might have ordered earlier. Visit the My Forms tab of the bank account and get yet another backup from the record you will need.

If you are a whole new end user of US Legal Forms, allow me to share basic guidelines that you can adhere to:

- Initially, make certain you have selected the appropriate type for your personal town/county. It is possible to examine the shape utilizing the Review key and study the shape outline to guarantee this is basically the right one for you.

- If the type will not satisfy your needs, use the Seach industry to discover the correct type.

- When you are sure that the shape is proper, click the Get now key to have the type.

- Opt for the prices strategy you need and enter in the required details. Design your bank account and buy the transaction making use of your PayPal bank account or credit card.

- Select the document file format and acquire the lawful record design to your product.

- Complete, change and print and indicator the received North Dakota Sample Letter for Authorized Signatories for Partnerships or Corporations.

US Legal Forms is the largest collection of lawful types for which you will find a variety of record themes. Make use of the company to acquire professionally-produced paperwork that adhere to state specifications.

Form popularity

FAQ

North Dakota relies on the federal Form W-4 (Employee's Withholding Allowance Certificate) to calculate the amount to withhold. For more information regarding income tax withholding, see: Guideline ? Income Tax Withholding & Information Returns. Income Tax Withholding Rates and Instructions.

A partnership may, but is not required to, make estimated income tax payments. For more information, including payment options, obtain the 2023 Form 58-ES. A partnership must withhold North Dakota income tax at the rate of 2.90% from the year-end distributive share of North Dakota income of a nonresident partner.

Under North Dakota Century Code (N.D.C.C.) § 57-38-31.1, a passthrough entity is required to withhold North Dakota income tax at the rate of 2.90% from a nonresident member's North Dakota distributive share of income if (1) it is $1,000 or more and (2) it is not included in a composite return.

A North Dakota tax power of attorney (Form 500), otherwise known as the ?Office of North Dakota State Tax Commissioner Authorization to Disclose Tax Information and Designation of Representative Form,? is used to designate a person as a representative of your interests in tax matters before the concerned tax authority.

North Dakota considers a seller to have physical nexus if you have any of the following in the state: A temporary or permanent office or place of business. An employee or agent. Leasing or renting tangible personal property.

Permit Requirements The small seller exception requires sales tax collection by remote sellers only if their taxable sales into the state within a calendar year 1) meet or exceed $100,000 or 2) meet or exceed 200 separate transactions. More information on remote sellers can be found at .tax.nd.gov/remoteseller.

Form 500 may be used by a taxpayer to do one of the following: Authorize the North Dakota Office of State Tax Commissioner to disclose the taxpayer's confidential tax information to another individual or firm not otherwise entitled to the information.

Some customers are exempt from paying sales tax under North Dakota law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.