North Dakota Assignment Creditor's Claim Against Estate

Description

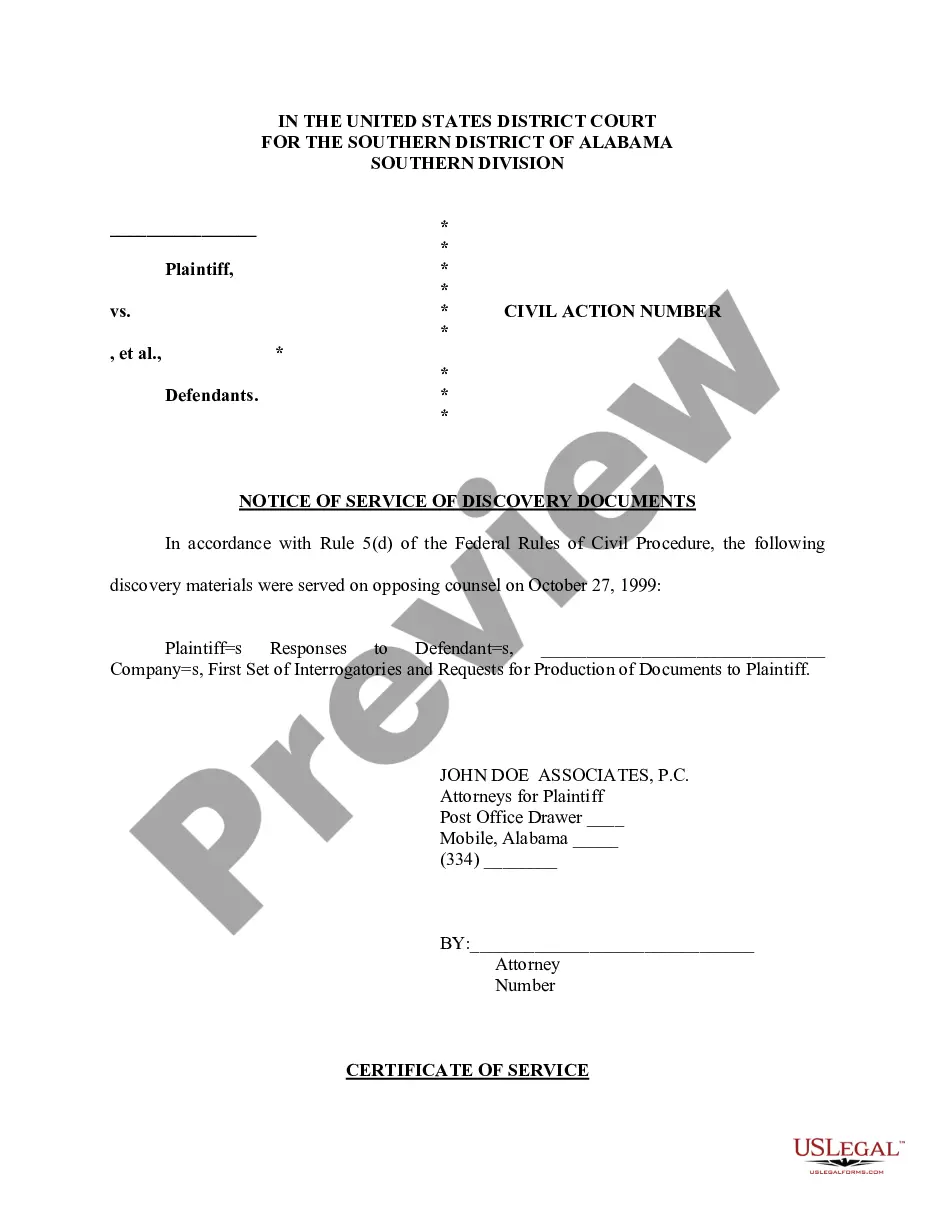

How to fill out Assignment Creditor's Claim Against Estate?

It is feasible to devote hours online attempting to locate the valid document template that meets the state and federal criteria you will require.

US Legal Forms offers a vast array of valid forms that can be assessed by professionals.

It is easy to download or print the North Dakota Assignment Creditor's Claim Against Estate from the service.

Review the form details to ensure you have chosen the appropriate form. If available, use the Review option to examine the document template as well.

- If you possess a US Legal Forms account, you can sign in and select the Download option.

- Subsequently, you can complete, modify, print, or sign the North Dakota Assignment Creditor's Claim Against Estate.

- Each valid document template you acquire is your property permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click on the corresponding option.

- If you are using the US Legal Forms website for the first time, please follow the simple instructions below.

- First, make sure you have selected the correct document template for your state/town of preference.

Form popularity

FAQ

There is normally a six-month period from the deceased's death for creditors to advise the executor of any sums due to them from the estate.

Remember, credit does not die and continues after the death of the debtor, meaning that creditors have a right to claim from the deceased's estate. Remember, the executor is obliged to pay all the estate's debts before distributing anything to their heirs or legatees of the deceased.

Making a claim against an estate. After the death of a person, their Will can be contested by relatives, dependents and others. A claim can be made for 'reasonable financial provision' in the Court.

What debt is forgiven when you die? Most debts have to be paid through your estate in the event of death. However, federal student loan debts and some private student loan debts may be forgiven if the primary borrower dies.

The executors may have to deal with claims against the estate from other people, for example under the Inheritance (Provision for Family & Dependents) Act 1975 or a challenge to the validity of a will itself. These are just a few examples of the problems which can arise which may result in claims against an executor.

If you received a cash inheritance, the court may order the bank account levied, which would allow the creditor to take the funds in the bank account to settle the debt. If the inheritance is real estate, the creditor may place a lien on the property.

Q: How do I claim against an estate?Step 1: Establish grounds to make a claim.Step 2: Check the time limits.Step 3: Consider entering a caveat.Step 4: Consider Alternative Dispute Resolution.Step 5: Follow the Pre Action Protocol.Step 6: Commence court proceedings.

The estate of a deceased person must be reported to the Master of the High Court within 14 days of the date of death. Any person that has control or possession of any property or a will of the deceased, can report the death by lodging a completed death notice with the Master.

Fully documented claims (including documents of ID and personal representative documents) must be received within 30 years of the date of death.