North Dakota Reorganization of Partnership by Modification of Partnership Agreement

Description

How to fill out Reorganization Of Partnership By Modification Of Partnership Agreement?

If you need to finalize, obtain, or create legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search feature to find the documents you require.

Different templates for professional and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to acquire the North Dakota Reorganization of Partnership by Modification of Partnership Agreement with just a few clicks.

Every legal document template you buy is yours indefinitely. You have access to every form you saved in your account. Click the My documents section and select a form to print or download again.

Stay proactive and download and print the North Dakota Reorganization of Partnership by Modification of Partnership Agreement with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal requirements.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to obtain the North Dakota Reorganization of Partnership by Modification of Partnership Agreement.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your relevant area/country.

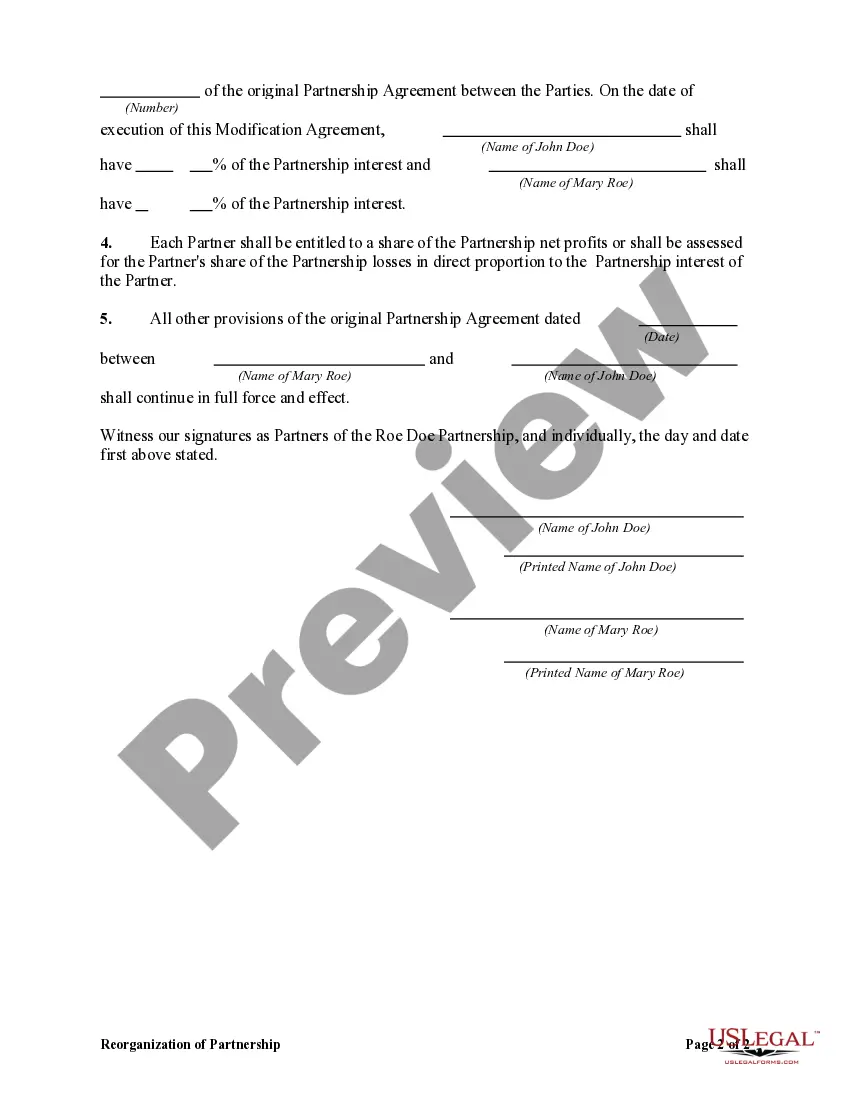

- Step 2. Use the Preview feature to review the contents of the form. Be sure to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Get now option. Choose the payment plan you prefer and enter your information to create your account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the North Dakota Reorganization of Partnership by Modification of Partnership Agreement.

Form popularity

FAQ

When one partner leaves a partnership, the remaining partners must assess how to continue the business. This could involve re-evaluating roles, responsibilities, and profit-sharing. It's also important to document the exit in line with your partnership agreement to maintain legal clarity. The North Dakota Reorganization of Partnership by Modification of Partnership Agreement can assist during this transitional period.

Removing a partner from a partnership involves following the terms laid out in your partnership agreement. Typically, this requires agreement from the remaining partners and legal documentation to finalize the change. It is crucial to address the partner's exit amicably and professionally. Utilizing platforms like uslegalforms can help you formalize the process efficiently.

Yes, a partnership agreement can be modified to reflect new terms and conditions as agreed upon by the partners. This usually requires written consent from all parties involved. Making changes ensures the partnership operates effectively under new circumstances. The North Dakota Reorganization of Partnership by Modification of Partnership Agreement can guide you on how to implement these changes correctly.

To change partners in a partnership firm, it's important to review your existing partnership agreement for any specific procedures. Generally, this involves obtaining consent from all partners and documenting the change legally. A modification of the partnership agreement can reflect new responsibilities and contributions. Engaging with uslegalforms can simplify this transition.

Yes, you can remove a partner from a partnership under certain conditions as specified in the partnership agreement. The process usually requires a formal vote or notice among partners. Additionally, it is essential to handle the removal respectfully to maintain relationships. For guidance on this process, exploring the North Dakota Reorganization of Partnership by Modification of Partnership Agreement can be beneficial.

To dissolve a partnership in North Dakota, partners need to follow specific steps outlined in their partnership agreement. Typically, this involves notifying all partners, settling debts, and distributing remaining assets. After determining the partnership has reached its end, a formal dissolution can be filed. For comprehensive assistance, consider using uslegalforms to ensure all legalities are properly handled.

The structure of a partnership agreement typically begins with an introduction that names the partners and the business. It should then include sections on capital contributions, profit sharing, and management responsibilities. Each part plays a vital role in the overall framework, facilitating a well-organized North Dakota Reorganization of Partnership by Modification of Partnership Agreement.

Completing a partnership agreement requires a thorough review of the terms that all partners have agreed upon. Ensure that all necessary details are filled in, such as profit-sharing ratios and partner duties. After everyone signs, consider storing it safely in accordance with the North Dakota Reorganization of Partnership by Modification of Partnership Agreement for future reference and clarity.

Filling out a partnership form involves providing accurate information about each partner, including their contributions and ownership percentages. Be sure to include the partnership name and purpose, along with any terms agreed upon by the partners. Utilizing USLegalForms can simplify this process, ensuring your North Dakota Reorganization of Partnership by Modification of Partnership Agreement is compliant and efficient.

An example of a partnership agreement includes the identification of partners, the purpose of the business, and how profits will be shared. Other critical sections can cover responsibilities and dispute resolution procedures. Such clear documentation helps facilitate the North Dakota Reorganization of Partnership by Modification of Partnership Agreement, promoting smoother business operations.