North Dakota Invoice Template for Teacher

Description

How to fill out Invoice Template For Teacher?

You can spend countless hours online trying to locate the authentic document template that complies with the state and federal requirements you need.

US Legal Forms offers a vast array of authentic forms that have been vetted by professionals.

You can easily download or print the North Dakota Invoice Template for Educators from my service.

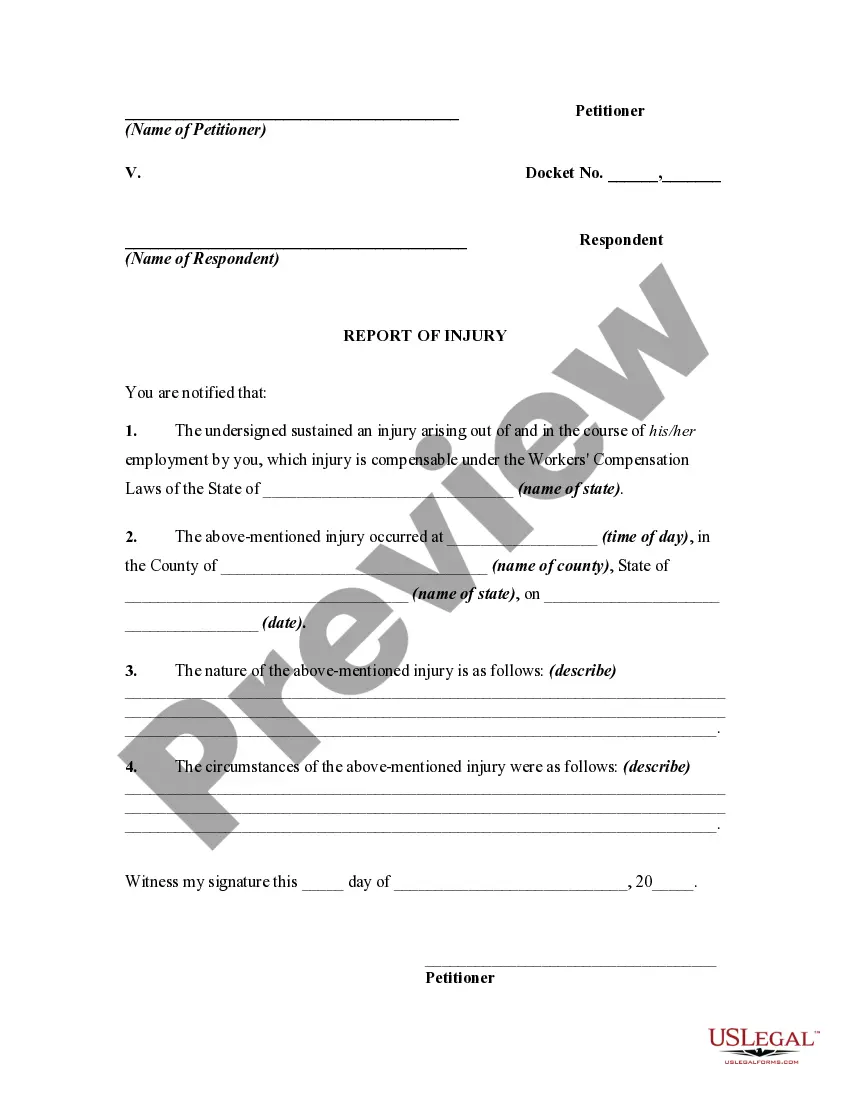

If available, use the Review button to look over the document template as well. If you need to find another version of your form, use the Search field to locate the template that meets your needs and specifications.

- If you possess a US Legal Forms account, you may sign in and click the Download button.

- Subsequently, you can complete, modify, print, or sign the North Dakota Invoice Template for Educators.

- Every legitimate document template you acquire is yours permanently.

- To obtain an extra copy of any purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your chosen state/city.

- Review the form description to confirm that you have picked the correct form.

Form popularity

FAQ

Yes, Microsoft Word offers various invoice templates, but not all are tailored for specific needs. A North Dakota Invoice Template for Teacher provides a more customized solution, giving you an invoice that caters to the educational sector. You can easily download and modify this template to fit your requirements.

Yes, it is perfectly legal to create your own invoice. Many professionals and freelancers use a North Dakota Invoice Template for Teacher to ensure compliance with state guidelines. This tool helps you produce a well-structured invoice that meets all legal requirements.

Yes, individuals can create their own invoices without any issues. By utilizing a North Dakota Invoice Template for Teacher, you can easily customize your invoice to suit your needs. This template is user-friendly and helps you include all vital information needed for clarity and record-keeping.

Absolutely, you can generate an invoice from yourself. With a North Dakota Invoice Template for Teacher, you can fill out the necessary details, such as the date, services rendered, and payment terms. This process is simple, yet it establishes a clear record for your customers.

Yes, you can create an invoice for yourself easily. Using a North Dakota Invoice Template for Teacher allows you to structure your invoice clearly, detailing the services you provide. This template ensures that all essential information is included, helping you maintain professionalism in your billing.

You are considered a North Dakota resident if you maintain a permanent home in the state and have established your primary domicile there. Factors such as physical presence, intent to remain, and personal connections to the community are also considered. For teachers who work in a non-residential capacity, employing a North Dakota Invoice Template for Teacher can help clarify your financial activities in the state.

Certain items, such as clothing, certain food items, and educational materials, are exempt from sales tax in North Dakota. This exemption is important for educators and institutions, as it can reduce expenses associated with teaching resources. To keep track of exempt purchases, consider using a North Dakota Invoice Template for Teacher when documenting transactions.

The general sales tax rate in North Dakota is currently set at 5%. However, local municipalities may impose additional taxes, which can vary. Understanding the tax obligations is essential for teachers generating invoices; using a North Dakota Invoice Template for Teacher can simplify calculating the correct amount for sales tax.

Filing taxes as a resident when you qualify as a non-resident can lead to potential penalties and interest charges. It could also result in overpaying taxes, as residents and non-residents have different tax rates and obligations in North Dakota. To avoid this confusion, consider using a North Dakota Invoice Template for Teacher, which helps clarify your status and income.

Any individual who receives income for services performed in North Dakota while living in another state must file a North Dakota nonresident tax return. This includes teachers who might not reside in the state but provide educational services there. Utilizing a North Dakota Invoice Template for Teacher can aid in documenting income accurately for filing purposes.