North Dakota Sworn Statement of Identity Theft

Description

1. Obtains, records, or accesses identifying information that would assist in accessing financial resources, obtaining identification documents, or obtaining benefits of the victim.

2. Obtains goods or services through the use of identifying information of the victim.

3. Obtains identification documents in the victim's name.

Identity theft statutes vary by state and usually do not include use of false identification by a minor to obtain liquor, tobacco, or entrance to adult business establishments. The types of information protected from misuse by identity theft statutes includes, among others:

-Name

-Date of birth

-Social Security number

-Driver's license number

-Financial services account numbers, including checking and savings accounts

-Credit or debit card numbers

-Personal identification numbers (PIN)

-Electronic identification codes

-Automated or electronic signatures

-Biometric data

-Fingerprints

-Passwords

-Parent's legal surname prior to marriage

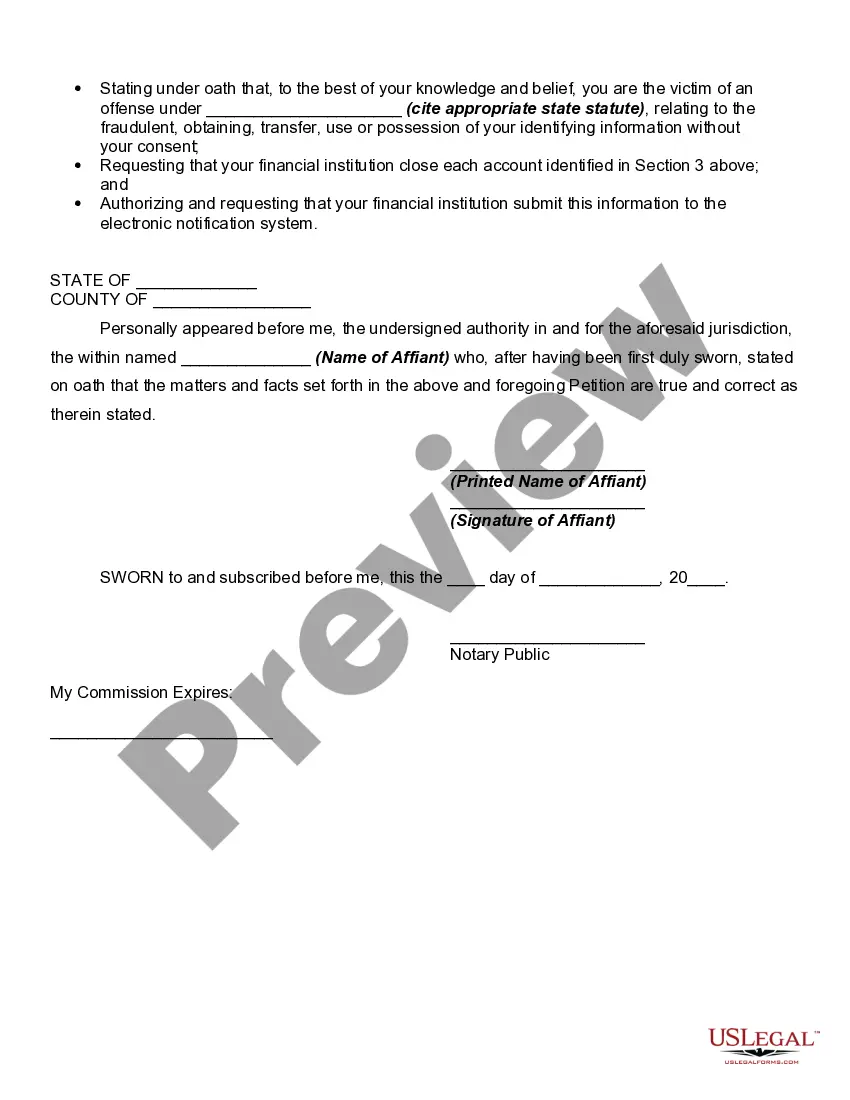

How to fill out Sworn Statement Of Identity Theft?

US Legal Forms - among the largest libraries of legal forms in America - delivers an array of legal papers themes you can obtain or produce. Making use of the internet site, you may get thousands of forms for organization and individual functions, sorted by groups, suggests, or search phrases.You will discover the latest versions of forms just like the North Dakota Sworn Statement of Identity Theft in seconds.

If you have a subscription, log in and obtain North Dakota Sworn Statement of Identity Theft in the US Legal Forms local library. The Down load switch will show up on every kind you view. You have access to all formerly saved forms inside the My Forms tab of the profile.

If you wish to use US Legal Forms the very first time, listed below are basic recommendations to obtain began:

- Be sure you have picked the proper kind to your area/county. Click on the Preview switch to analyze the form`s content. Look at the kind explanation to ensure that you have chosen the correct kind.

- When the kind does not suit your requirements, take advantage of the Research area towards the top of the monitor to discover the the one that does.

- In case you are content with the form, validate your option by clicking on the Acquire now switch. Then, opt for the rates strategy you want and supply your qualifications to register on an profile.

- Method the deal. Make use of your charge card or PayPal profile to accomplish the deal.

- Choose the formatting and obtain the form on your gadget.

- Make adjustments. Complete, edit and produce and indicator the saved North Dakota Sworn Statement of Identity Theft.

Each and every format you put into your money does not have an expiry time and it is yours eternally. So, if you want to obtain or produce yet another version, just proceed to the My Forms area and click on the kind you want.

Obtain access to the North Dakota Sworn Statement of Identity Theft with US Legal Forms, probably the most comprehensive local library of legal papers themes. Use thousands of specialist and status-distinct themes that satisfy your company or individual demands and requirements.

Form popularity

FAQ

Warning signs of identity theft Debt collection calls for accounts you did not open. Information on your credit report for accounts you did not open. Denials of loan applications. Mail stops coming to, or is missing from, your mailbox.

I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

Check your mail for unfamiliar bank or credit card statements. If you receive unfamiliar bank or credit card statements, it may mean someone has opened a bank account or applied for credit under your name. Immediately contact the financial institution referenced on the statement to report the unauthorized account.

Check your bank, investment, and credit card accounts for unfamiliar transactions. Flag anything and follow up with either the vendor or your bank or credit card company. Don't ignore small transactions. Identity thieves may make small purchases to test if a card or account number works before moving on to larger ones.

You may be a victim of identity theft if: bills do not arrive. statements show transactions you did not make. creditors ask you about an account or card you have not applied for.

Consumers can report identity theft at IdentityTheft.gov, the federal government's one-stop resource to help people report and recover from identity theft. The site provides step-by-step advice and helpful resources like easy-to-print checklists and sample letters.

Use the ID Theft Affidavit The Federal Trade Commission's ID Theft Affidavit is accepted by the credit bureaus and by most major creditors. Send copies of the completed form to creditors where the thief opened accounts in your name.