North Dakota Business Management Consulting or Consultant Services Agreement - Self-Employed

Description

How to fill out Business Management Consulting Or Consultant Services Agreement - Self-Employed?

Are you in a circumstance where you require documents for either business or personal purposes on a daily basis? There are numerous legal document templates available online, but finding ones you can trust is not simple.

US Legal Forms offers thousands of form templates, including the North Dakota Business Management Consulting or Consultant Services Agreement - Self-Employed, designed to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the North Dakota Business Management Consulting or Consultant Services Agreement - Self-Employed template.

Access all the form templates you have purchased in the My documents section. You can obtain an additional copy of the North Dakota Business Management Consulting or Consultant Services Agreement - Self-Employed whenever needed. Simply click on the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- Obtain the form you need and ensure it is for the correct city/state.

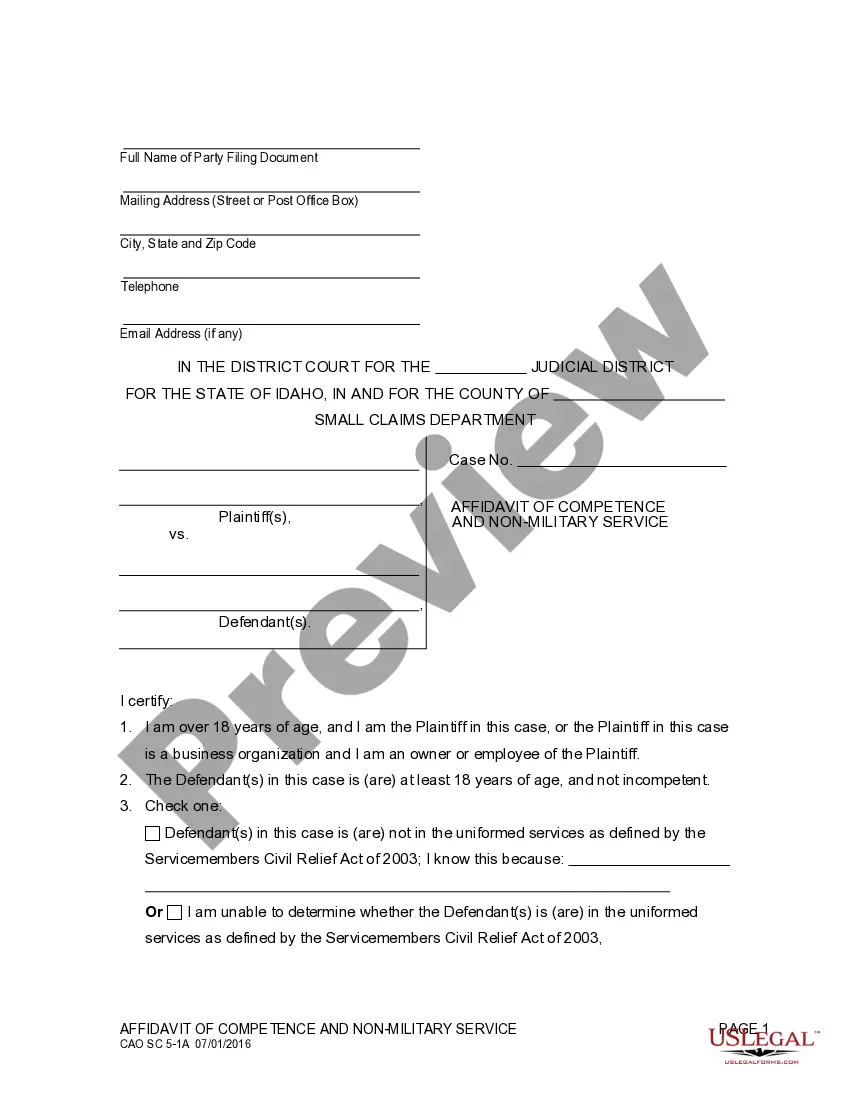

- Use the Review button to verify the form.

- Read the description to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that suits your needs and requirements.

- If you locate the right form, click on Get now.

- Choose the pricing plan you want, fill in the necessary information to create your account, and process the payment using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

The purpose of a consulting agreement is to establish clear expectations and responsibilities between the consultant and the client. This agreement defines the services provided, payment terms, confidentiality, and other essential details that protect both parties. In the context of North Dakota Business Management Consulting or Consultant Services Agreement - Self-Employed, a well-drafted consulting agreement can help prevent misunderstandings and create a successful working relationship.

Contracting often involves a broader scope of work related to specific projects or services, while consulting typically focuses on providing expert advice and guidance. For instance, in the field of North Dakota Business Management Consulting or Consultant Services Agreement - Self-Employed, consulting involves analyzing business challenges and offering solutions, whereas contracting may involve executing tasks based on agreed outcomes. This distinction is key in determining which service fits your needs best.

While a consulting agreement falls under the broader category of contracts, it is specifically designed for consulting arrangements. A consulting agreement details the nature of the consulting relationship and outlines deliverables, timelines, and payment structures. When engaging in North Dakota Business Management Consulting or Consultant Services Agreement - Self-Employed, it is essential to utilize a consulting agreement to protect your interests and clarify responsibilities.

A consulting agreement is a specific type of contract tailored for consulting services, while a general contract can cover various types of obligations. The purpose of a consulting agreement in the realm of North Dakota Business Management Consulting or Consultant Services Agreement - Self-Employed is to outline the scope of services, payment terms, and confidentiality. Understanding this difference can help you ensure that you have the appropriate documentation for your business arrangements.

Yes, there is a fundamental difference between a contract and an agreement. An agreement is a mutual understanding between two or more parties, while a contract is a specific type of agreement that is legally enforceable. In the context of North Dakota Business Management Consulting or Consultant Services Agreement - Self-Employed, having a formal contract clarifies the expectations and obligations of all parties involved.

Yes, having a contract is crucial when you work as a consultant. A well-drafted contract protects both you and your client by clarifying services, payment terms, and intellectual property rights. It ensures that both parties have clear expectations and reduces the risk of misunderstandings. Use a North Dakota Business Management Consulting or Consultant Services Agreement - Self-Employed to formalize your relationship and protect your interests.

A consultant operates a service-based business that provides expert advice and solutions to clients in various fields. This type of business can range from management consulting, marketing, to technology services. Consultants often help organizations improve efficiency and profitability. Establishing a North Dakota Business Management Consulting or Consultant Services Agreement - Self-Employed is essential for outlining your role and the services you provide.

A service agreement typically outlines the general terms of service delivery, while a consultancy agreement focuses specifically on advisory services. The consultancy agreement often includes details regarding the consultant's expertise, deliverables, and compensation. Understanding these distinctions helps you choose the right contract for your business, particularly in North Dakota Business Management Consulting or consulting roles.

Yes, a consultant is typically considered self-employed. When you provide services to clients without being an employee of those clients, you operate as a self-employed individual. This arrangement allows flexibility in your work schedule and the potential for higher earnings. Utilizing a North Dakota Business Management Consulting or Consultant Services Agreement - Self-Employed solidifies your status and outlines the terms of your engagement.

While most consultants operate as independent contractors, some may also work as W-2 employees for specific projects. This dual role can complicate tax situations and contractual obligations. If you're considering both paths, it's wise to consult with a tax professional familiar with North Dakota Business Management Consulting and employment classifications.