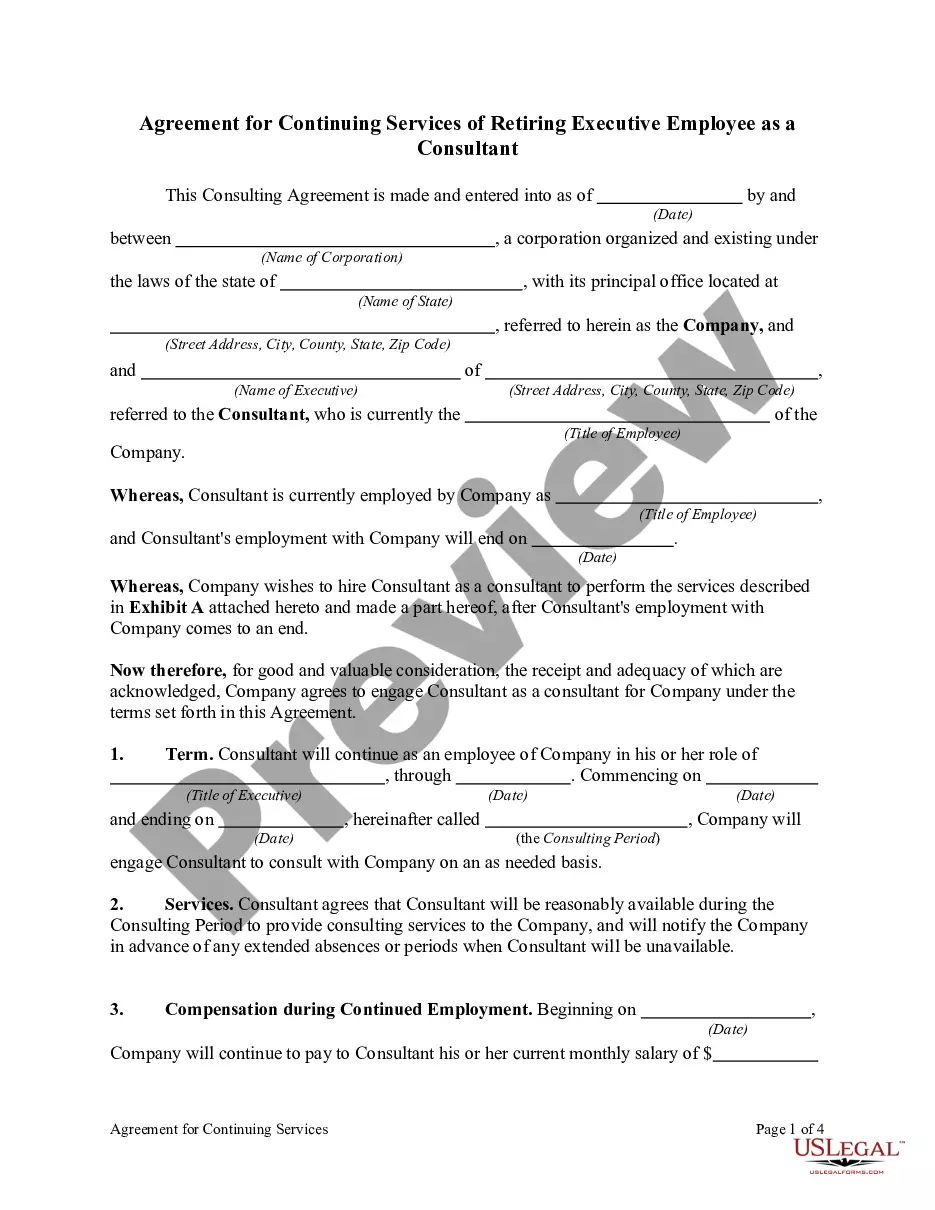

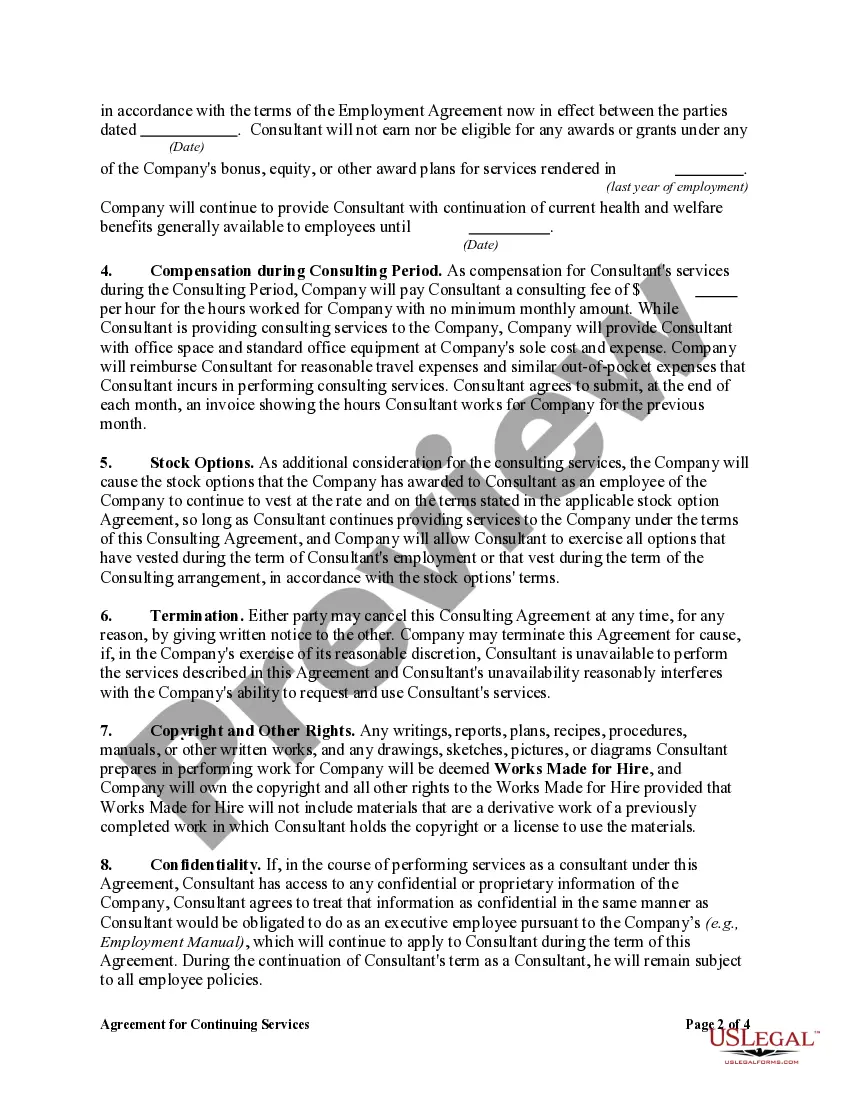

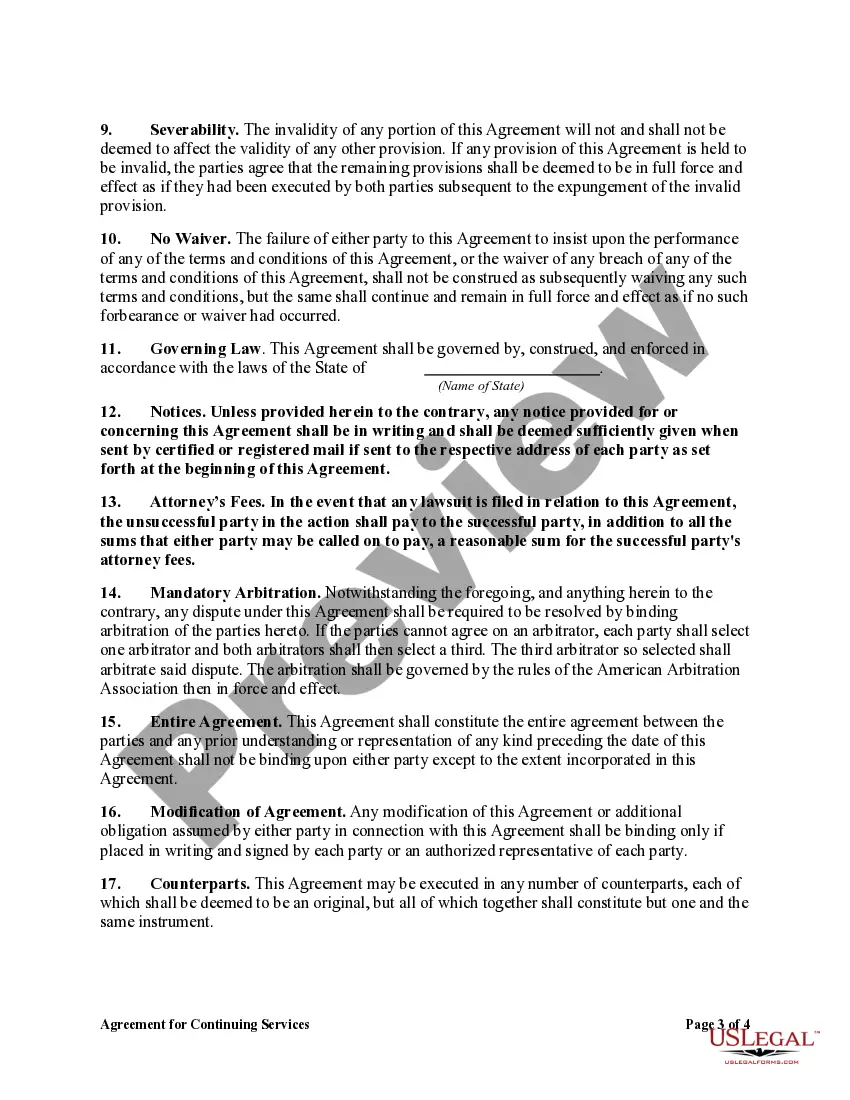

North Dakota Agreement for Continuing Services of Retiring Executive Employee as a Consultant

Description

How to fill out Agreement For Continuing Services Of Retiring Executive Employee As A Consultant?

If you require to access, download, or print authentic document templates, utilize US Legal Forms, the most extensive collection of authentic forms, available online.

Take advantage of the website's simple and user-friendly search to locate the documents you need.

A range of templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. After locating the form you need, click on the Purchase now button. Choose the pricing plan you prefer and enter your credentials to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to find the North Dakota Agreement for Continuing Services of Retiring Executive Employee as a Consultant in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the North Dakota Agreement for Continuing Services of Retiring Executive Employee as a Consultant.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form's content. Always remember to read the details.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternative versions of the authentic form template.

Form popularity

FAQ

For CalPERS, the required years of service to retire can differ based on your job classification and plan. Generally, you need at least five years of service to qualify for a pension. Engaging in the North Dakota Agreement for Continuing Services of Retiring Executive Employee as a Consultant can also complement your retirement by allowing you to continue working in a consultancy capacity, maximizing your career potential.

The standard retirement age in North Dakota aligns with the federal guidelines, typically around 65 years old for full benefits. However, early retirement options may be available, depending on your specific pension plan. The North Dakota Agreement for Continuing Services of Retiring Executive Employee as a Consultant allows for flexibility in transitioning into consultancy roles, which can provide additional opportunities past the traditional retirement age.

To calculate your PERSI retirement, you will need to consider your length of service, salary history, and the specific formula used by PERSI. Also, utilizing the North Dakota Agreement for Continuing Services of Retiring Executive Employee as a Consultant can provide clarity on additional income options post-retirement. Consulting with a financial advisor can help you maximize your retirement benefits.

Retirement payouts generally comprise pension distributions, social security benefits, and any other retirement savings you have accumulated. The specifics can vary significantly based on your agreement and the North Dakota Agreement for Continuing Services of Retiring Executive Employee as a Consultant may allow retirees to receive compensation for their consultancy. Thus, understanding these payouts can help you plan your finances effectively.

Yes, you can work for the same company after retirement, depending on the terms outlined in your retirement plan. The North Dakota Agreement for Continuing Services of Retiring Executive Employee as a Consultant facilitates this transition, allowing retirees to continue providing valuable services. It's important to review your specific agreement to ensure compliance with any stipulations.

In North Dakota, retirement income is subject to state income tax. This includes pensions and social security benefits. However, the North Dakota Agreement for Continuing Services of Retiring Executive Employee as a Consultant may provide specific tax advantages for retirees looking to transition into consultancy roles. Consulting can help you manage your taxable income effectively while leveraging your experience.

Yes, an agreement for benefits payments post-retirement is common, particularly for executives. Such agreements provide financial security, allowing former employees to enjoy their retirement without stress. The North Dakota Agreement for Continuing Services of Retiring Executive Employee as a Consultant is a structured approach that helps define these benefits, ensuring clarity and support for all parties involved.

An employer's contribution refers to the portion of an employee's benefits that the employer pays, which can include retirement plans, health insurance, and other benefits. These contributions are crucial for enhancing employee satisfaction and loyalty. When considering the North Dakota Agreement for Continuing Services of Retiring Executive Employee as a Consultant, employers can streamline these contributions to ensure retiring executives continue to receive valued benefits.

The average employer pension contribution in the USA typically ranges from 3% to 10% of an employee's salary. Employers are increasingly recognizing the importance of these contributions to attract and retain talent. As such, agreements like the North Dakota Agreement for Continuing Services of Retiring Executive Employee as a Consultant help ensure that retiring employees have a structured avenue to continue contributing, benefiting both the employer and the individual.

The retirement age for the North Dakota Public Employees Retirement System (NDPERS) varies based on the plan. Generally, employees can retire at age 65 with full benefits. However, options for early retirement may exist, providing flexibility in alignment with the North Dakota Agreement for Continuing Services of Retiring Executive Employee as a Consultant, creating a smooth transition into consultancy roles.