An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

North Dakota Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage

Description

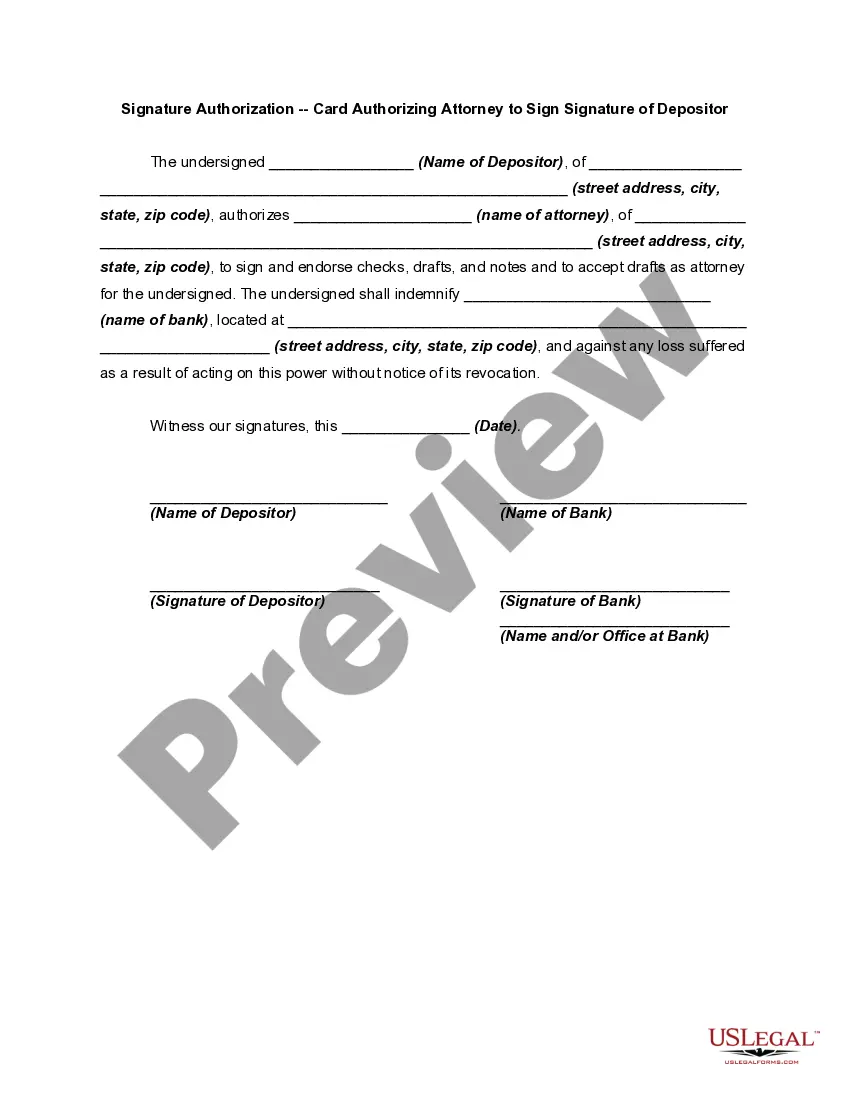

How to fill out Agreement To Modify Interest Rate On Promissory Note Secured By A Mortgage?

Have you been in the placement that you will need papers for either organization or individual reasons nearly every day? There are a variety of lawful record layouts available on the net, but getting kinds you can rely isn`t easy. US Legal Forms provides a large number of develop layouts, just like the North Dakota Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage, which are created in order to meet federal and state specifications.

When you are previously informed about US Legal Forms website and get a merchant account, merely log in. Afterward, you may obtain the North Dakota Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage design.

If you do not come with an account and want to begin to use US Legal Forms, abide by these steps:

- Discover the develop you will need and make sure it is for that appropriate town/county.

- Utilize the Preview option to review the shape.

- See the information to actually have chosen the correct develop.

- If the develop isn`t what you`re looking for, use the Research discipline to obtain the develop that suits you and specifications.

- When you discover the appropriate develop, click Acquire now.

- Opt for the rates program you desire, submit the specified information to make your bank account, and pay for the transaction using your PayPal or charge card.

- Decide on a practical paper structure and obtain your duplicate.

Discover each of the record layouts you possess purchased in the My Forms menus. You may get a extra duplicate of North Dakota Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage whenever, if required. Just click on the essential develop to obtain or print out the record design.

Use US Legal Forms, one of the most considerable selection of lawful forms, to save time and avoid faults. The support provides appropriately created lawful record layouts which you can use for an array of reasons. Create a merchant account on US Legal Forms and commence producing your way of life easier.

Form popularity

FAQ

Secured promissory notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Borrower's promise to pay is secured by a mortgage, deed of trust or similar security instrument that is dated the same date as this Note and called the ?Security Instrument.? The Security Instrument protects the Lender from losses, which might result if Borrower defaults under this Note.

Mortgage Note: --is a type of promissory note that is secured by a mortgage loan. --provides security for the loan held by the promissory note. --agreements between the borrower and lender that allow the lender to demand full repayment of a loan should the borrower default on the loan.

Types of Mortgage Notes Mortgage notes can vary based on the kind of lender and the kind of loan used to buy a home: Secured loan note. This note uses the real estate property to secure the loan. If the borrower fails to repay the loan ing the note's terms, the lender may take possession of the property.

A secured promissory note is an agreement where the borrower puts something of value up as collateral to safeguard the value of the loan. In the event the borrower is unable to make payments and defaults on the loan, a secured promissory note empowers the lender to take possession of the collateral in lieu of payment.

A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.

A mortgage note represents a home loan for a given borrower. The note is a security instrument that allows the loan to be grouped with other mortgages after closing and sold to investors. A mortgage note comes with a promissory note, which is the borrower's promise to repay the loan.

With a promissory note, you promise to make periodic payments, usually monthly, to repay the borrowed amount. With a mortgage, you give the lender a way to get its money back if you don't keep your promise to make those payments?through a foreclosure.