North Dakota Agreement to Manage Farm

Description

How to fill out Agreement To Manage Farm?

You can spend hours online trying to find the official document template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of legal forms that are reviewed by experts.

You can easily download or print the North Dakota Agreement to Manage Farm from our platform.

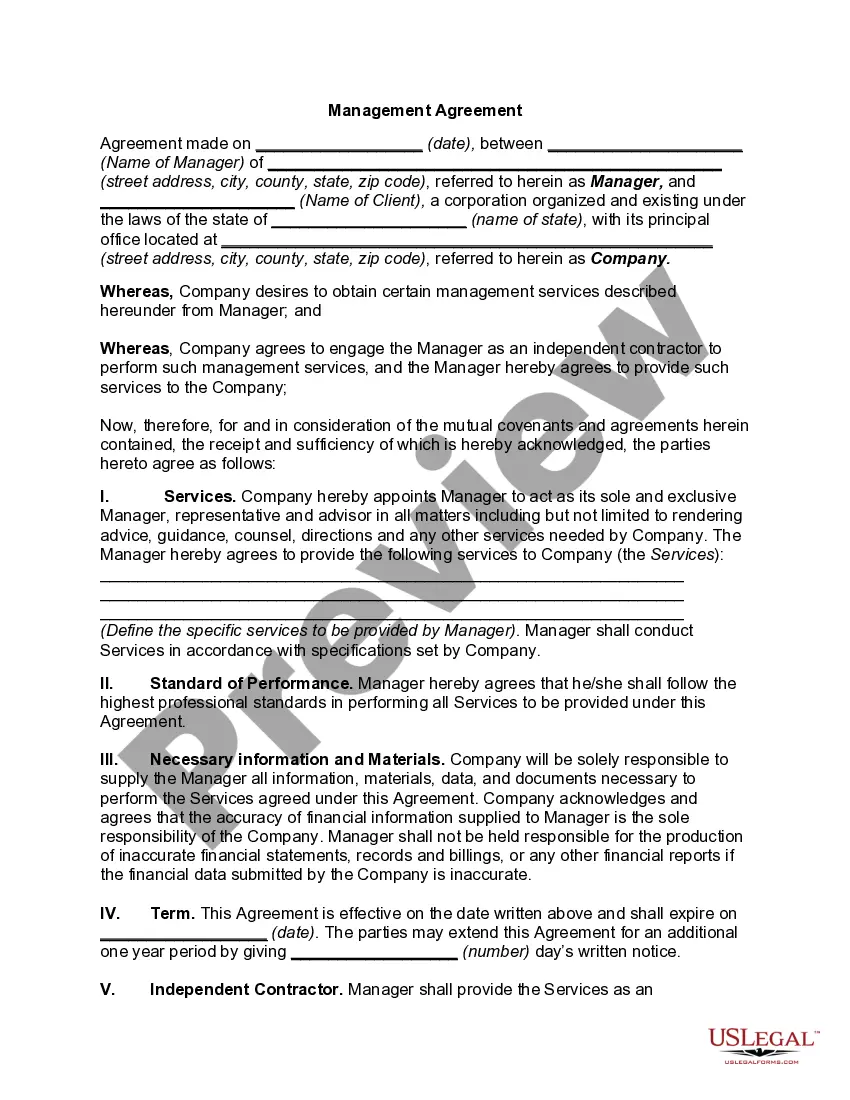

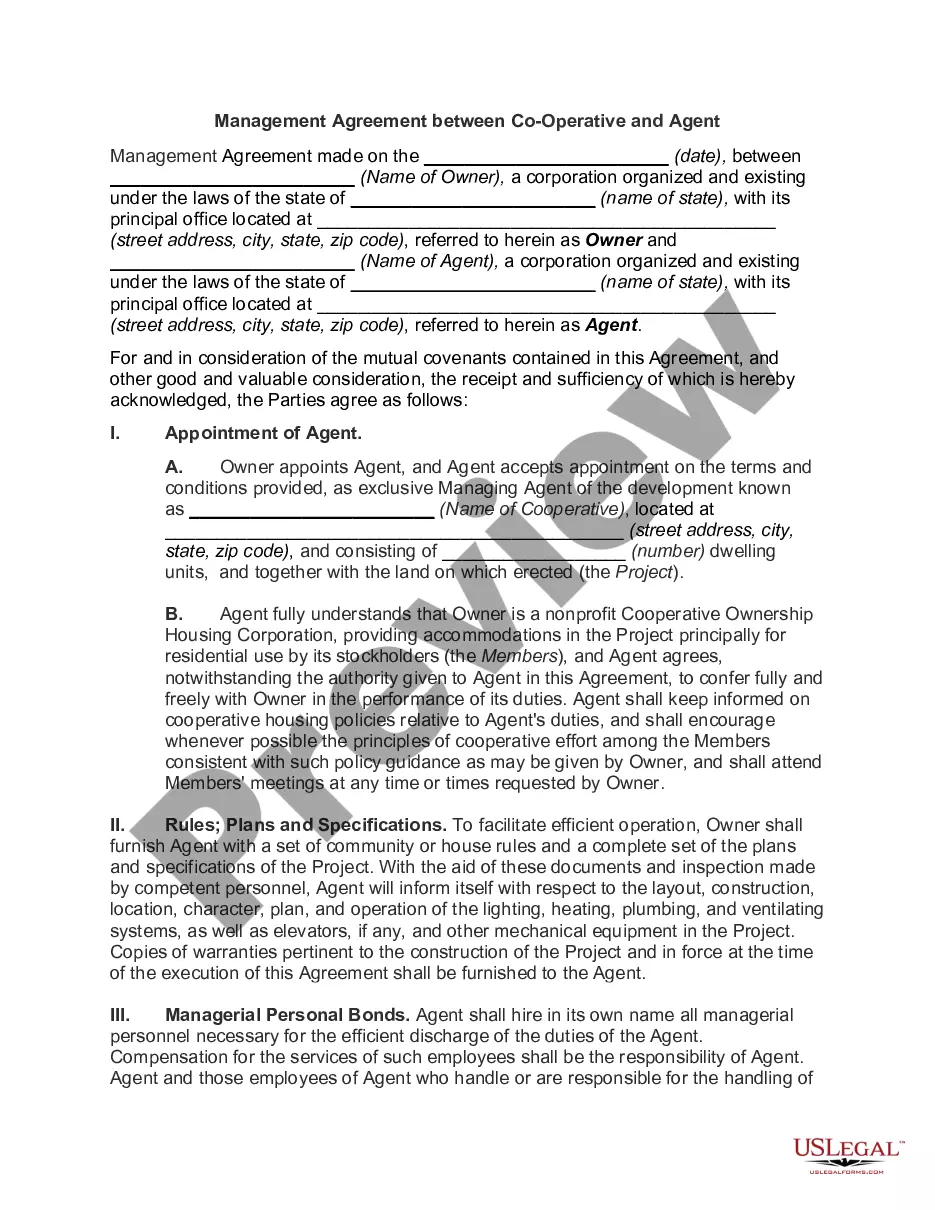

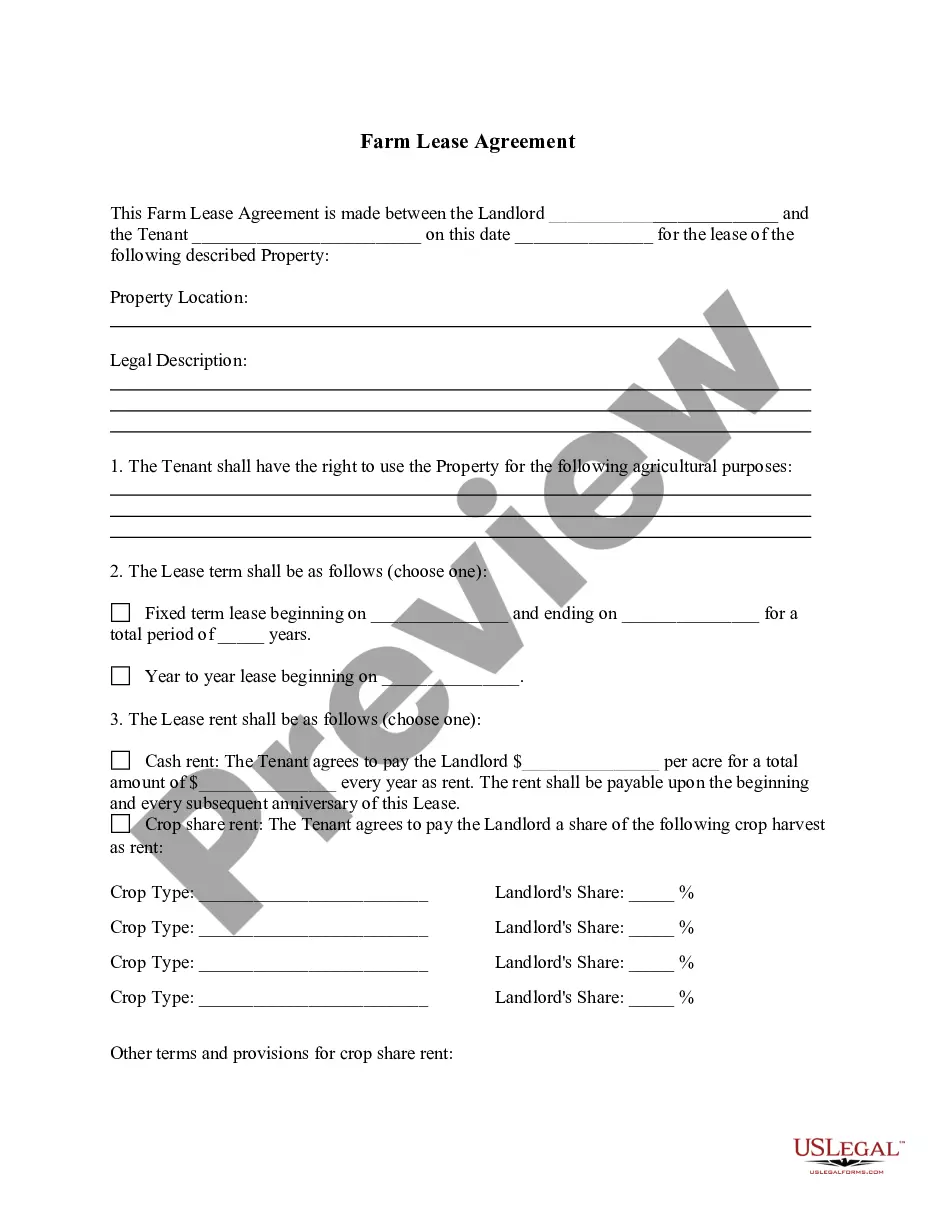

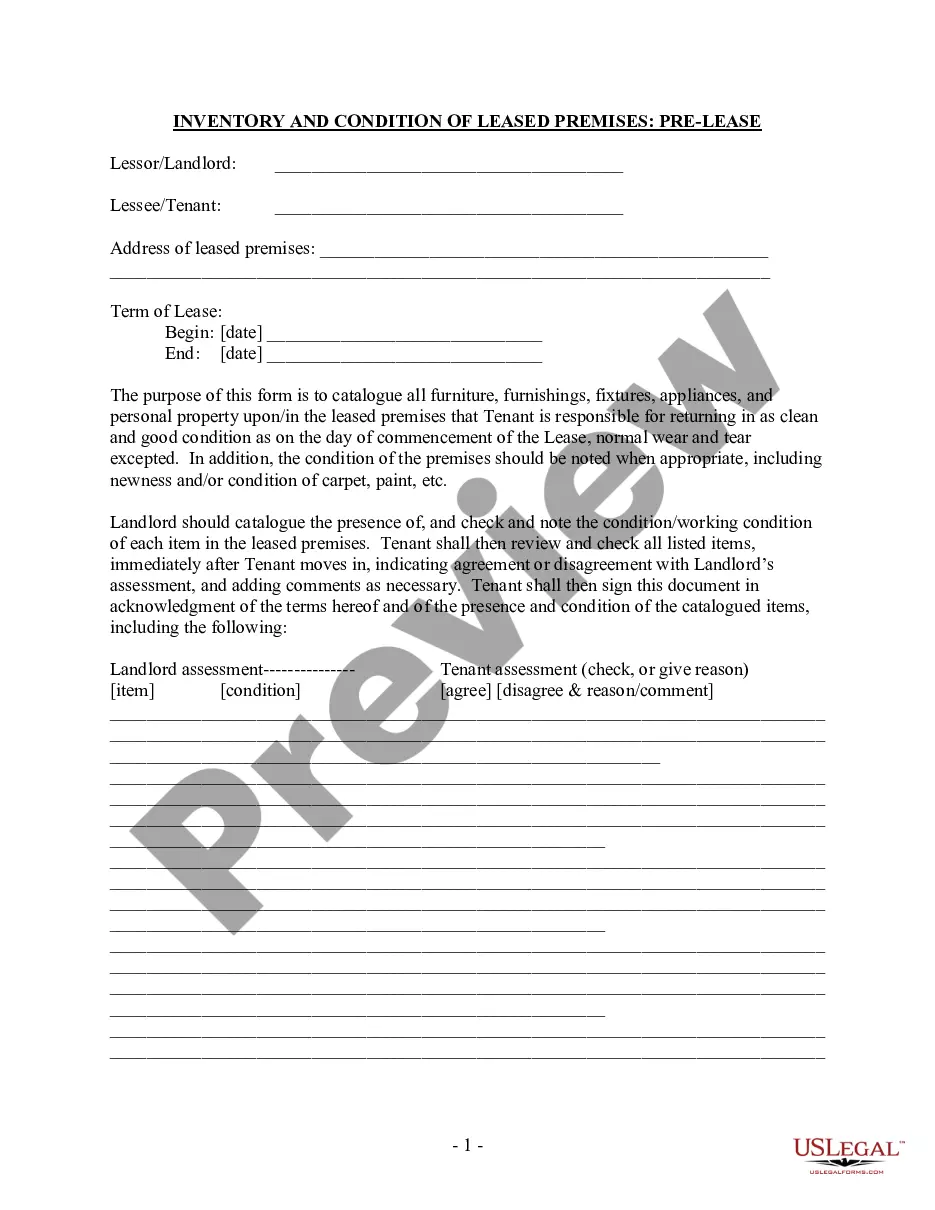

If available, utilize the Review button to preview the document template as well.

- If you have a US Legal Forms account, you can Log In and click on the Obtain button.

- After that, you can complete, edit, print, or sign the North Dakota Agreement to Manage Farm.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of the purchased form, go to the My documents section and click on the corresponding button.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county/town.

- Review the form details to confirm you have chosen the appropriate template.

Form popularity

FAQ

As of now, there is no state in the United States that completely excludes property tax. However, some states, like Wyoming and Alaska, have very low property taxes or offer various exemptions. When you draft a North Dakota Agreement to Manage Farm, it's essential to understand local taxation policies, helping you make informed decisions about your farming operations.

In North Dakota, property owners aged 65 and older may qualify for property tax reductions or exemptions based on their income and financial circumstances. There is no specific age at which all property taxes cease. However, if you are managing a farm, a North Dakota Agreement to Manage Farm can provide insights into managing property effectively, ensuring you take full advantage of any applicable senior tax benefits.

Property tax in North Dakota is based on the assessed value of your property and varies by county. The average effective property tax rate typically hovers around 1.0% to 1.5%. Utilizing a North Dakota Agreement to Manage Farm can help you strategize how to manage your assets effectively, potentially leading to tax-saving opportunities as you navigate property ownership.

In North Dakota, certain items are exempt from agricultural sales tax, including machinery, equipment, and supplies directly used in farming operations. Additionally, services related to agricultural production can also qualify for exemptions. If you manage your farm through a North Dakota Agreement to Manage Farm, understanding these exemptions can help reduce your tax burden and encourage growth in your agricultural business.

Filing an annual report in North Dakota involves submitting key information about your business to the Secretary of State. This process typically requires details about your business structure, address, and any changes over the year. If you are managing your farm under a North Dakota Agreement to Manage Farm, timely filing of your annual report will help you maintain good standing and meet compliance requirements.

Yes, North Dakota recognizes domestic partnerships, providing legal advantages similar to those of marriage. This recognition can be beneficial when entering into agreements, such as the North Dakota Agreement to Manage Farm. Understanding your rights and responsibilities in a domestic partnership ensures better management of your farm assets.

A fictitious partnership name in North Dakota allows a partnership to operate under a name different from its registered name. This can enhance marketability and brand recognition for your farming business. When establishing your North Dakota Agreement to Manage Farm, consider using a fictitious partnership name to represent your operational goals clearly.

The average farm in North Dakota spans approximately 1,300 acres, reflecting the state's focus on agricultural production. This scale provides ample opportunity for efficient farming practices and effective management strategies. Utilizing a North Dakota Agreement to Manage Farm can help you optimize the use of your land and resources.

Yes, obtaining a business license in North Dakota is typically necessary, depending on your business type and location. This ensures that you comply with state regulations, including those relevant to agricultural operations. If you're using the North Dakota Agreement to Manage Farm, your license will support your legitimacy and help you operate within legal boundaries.

Partnership nonresident withholding in North Dakota refers to the requirement for partnerships to withhold taxes on income earned by nonresident partners. This applies to various types of income, including that generated from managing your farm through a North Dakota Agreement to Manage Farm. Understanding these tax obligations can help you avoid penalties and ensure proper financial management.