North Dakota Restricted Endowment to Educational, Religious, or Charitable Institution

Description

How to fill out Restricted Endowment To Educational, Religious, Or Charitable Institution?

US Legal Forms - one of the most important repositories of legal forms in the United States - offers a broad selection of legal document templates that you can download or print.

By utilizing the site, you can access numerous forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest forms such as the North Dakota Restricted Endowment to Educational, Religious, or Charitable Institution within moments.

If you already have an account, Log In and obtain the North Dakota Restricted Endowment to Educational, Religious, or Charitable Institution from the US Legal Forms library. The Download option will appear on each form you view. You can access all previously saved forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Choose the file format and download the form to your device. Edit it. Fill out, modify and print or sign the downloaded North Dakota Restricted Endowment to Educational, Religious, or Charitable Institution. Each template you add to your account has no expiration date and is yours indefinitely. So, to download or print an additional copy, simply visit the My documents section and click on the form you need. Access the North Dakota Restricted Endowment to Educational, Religious, or Charitable Institution with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you've selected the correct form for your locality/region.

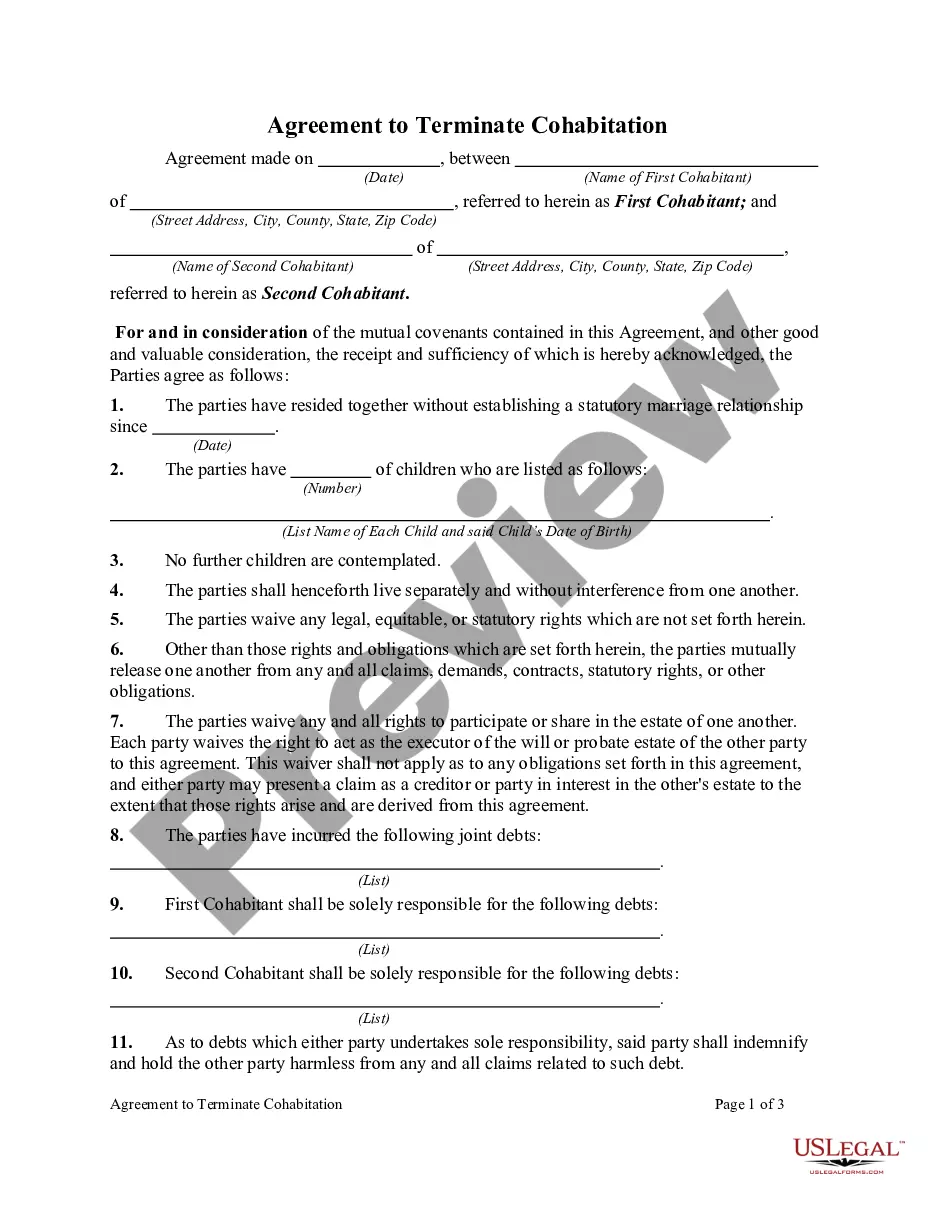

- Click the Review option to examine the form's content.

- Check the form description to confirm that you've chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- When satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

The three types of endowments include permanently restricted, temporarily restricted, and unrestricted endowments. Permanently restricted endowments, like the North Dakota Restricted Endowment to Educational, Religious, or Charitable Institution, maintain principal amounts in perpetuity while only the earnings can be spent. Temporarily restricted endowments allow for withdrawals within a specified timeframe, and unrestricted endowments provide the most flexibility, allowing funds to be used at the institution's discretion.

A restricted endowment is a specific type of funding mechanism where the donor imposes restrictions on how the principal amount can be used. Generally, this means that the endowment's earnings support designated programs or causes without depleting the original gift. For North Dakota educational, religious, or charitable institutions, this structure provides a reliable resource for ongoing support, ensuring alignment with donor wishes and institutional goals.

A restricted endowment fund is a financial asset provided to an educational, religious, or charitable institution, with limitations on its use. Specifically, it may mandate that the principal amount remains intact while only the generated earnings can be spent according to specified purposes. In a North Dakota context, such funds help institutions sustain programs and services vital to their mission, maintaining long-term financial health.

The restricted fund method refers to a financial strategy used to maintain separate accounts for resources allocated to specific purposes. In the context of a North Dakota Restricted Endowment to Educational, Religious, or Charitable Institution, this method ensures that donations are utilized exclusively for the intended goals. This approach promotes accountability and transparency, making it clear how funds are used to support the designated institution.

Currently, Harvard University is recognized as the richest school by endowment. Its financial assets not only promote academic excellence but also underline the importance of endowments as seen in the North Dakota Restricted Endowment to Educational, Religious, or Charitable Institution. By fostering financial support for educational goals, such endowments can drive impactful change within communities.

Harvard University holds the title for the largest endowment in the United States. Its endowment exceeds $40 billion, which significantly contributes to its academic programs and financial aid initiatives. This grand scale of funding showcases the power of endowment funds, similar to how the North Dakota Restricted Endowment to Educational, Religious, or Charitable Institution supports local educational and charitable activities.

The North Dakota endowment tax credit encourages donations to charitable organizations and educational institutions. Eligible contributions can earn tax credits, making it a favorable option for donors. This initiative aligns closely with the North Dakota Restricted Endowment to Educational, Religious, or Charitable Institution, supporting local causes and enhancing community funding.

The Notre Dame endowment is a financial fund established to support the University of Notre Dame's mission. It serves to provide scholarships, faculty support, and facility improvements. This endowment reflects the larger framework of endowments, including the North Dakota Restricted Endowment to Educational, Religious, or Charitable Institution, which aims to bolster educational entities across the state.

The tax relief credit in North Dakota offers financial support to taxpayers, enabling them to reduce the income tax burden. This credit extends to individuals who contribute to eligible educational, religious, or charitable institutions. Supporting a North Dakota Restricted Endowment to Educational, Religious, or Charitable Institution may make you eligible for this credit, reinforcing the state's commitment to philanthropy.

The endowment tax is levied on certain large endowment funds that do not distribute enough income to support their missions. It applies to institutions in North Dakota with significant endowment portfolios. Understanding the implications of this tax is crucial for organizations managing a North Dakota Restricted Endowment to Educational, Religious, or Charitable Institution, as it can impact funding availability.