North Dakota Reimbursement for Expenditures - Resolution Form - Corporate Resolutions

Description

How to fill out Reimbursement For Expenditures - Resolution Form - Corporate Resolutions?

Locating the appropriate official document template can be a challenge.

Certainly, there are numerous templates accessible online, but how do you acquire the authentic form you require.

Utilize the US Legal Forms website.

If you are a first-time user of US Legal Forms, here are simple steps you should follow: First, confirm you have selected the correct form for your region.

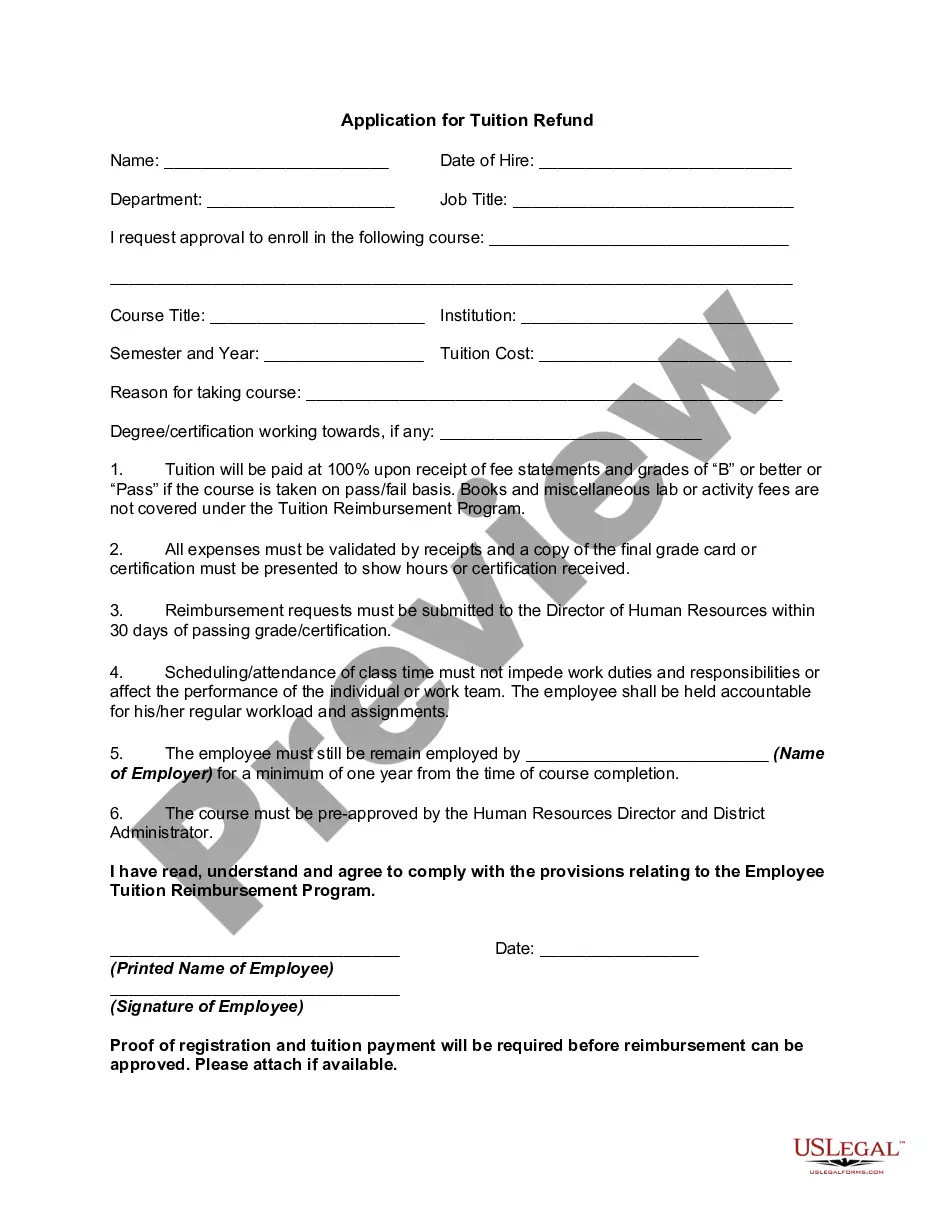

You can review the form using the Preview button and read the form description to ensure this is indeed the one you need.

If the form does not suit your needs, use the Search field to locate the correct form.

Once you are certain the form meets your requirements, click the Purchase now button to obtain the form.

Select the payment plan you desire and enter the required information.

Create your account and pay for the order using your PayPal account or credit card.

Choose the file format and download the official document template to your device.

Complete, modify, print, and sign the downloaded North Dakota Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.

US Legal Forms is the largest repository of official forms where you can find a range of document templates.

Take advantage of the service to download professionally crafted documents that comply with state requirements.

- The service offers thousands of templates, including the North Dakota Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, suitable for business and personal needs.

- All forms are verified by experts and satisfy both state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the North Dakota Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.

- Use your account to browse through the official forms you have previously purchased.

- Visit the My documents tab in your account and obtain another copy of the document you require.

Form popularity

FAQ

Net operating losses can typically be transferred under certain conditions, such as during mergers or acquisitions. This ability allows businesses to leverage losses for the benefit of their new structure. To navigate this process efficiently, the North Dakota Reimbursement for Expenditures - Resolution Form - Corporate Resolutions serves as a valuable tool, guiding you through the necessary documentation and requirements.

Yes, net losses can be carried forward to offset future taxable income. This process can help your business recover from financial loss over time. Using the North Dakota Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can simplify carrying forward net losses, thus providing clear guidance on how to apply these benefits.

You can carry forward a net capital loss up to $3,000 per year against ordinary income. For any remaining losses, you have the option to carry them into subsequent years. Properly documenting and claiming these losses using the North Dakota Reimbursement for Expenditures - Resolution Form - Corporate Resolutions is crucial for maximizing your tax benefits.

In North Dakota, you can carry a net operating loss forward up to 20 years. This means that if your business faces financial setbacks, you can apply those losses to future tax returns. Utilizing the North Dakota Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can help streamline this process, ensuring you take full advantage of your losses within the allotted time frame.

The sales factor weighting election in North Dakota allows businesses to choose how much weight to give their sales in determining their corporate income tax liability. This can influence your overall tax responsibilities significantly. Making an informed choice can help your business optimize its tax position. To understand how to implement this alongside the North Dakota Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, consider leveraging the resources available through uslegalforms.

The corporate tax rate in North Dakota is structured on a sliding scale based on income levels. Generally, businesses face rates ranging from 1.41% to 4.31%. Understanding these rates is important for effective tax planning. If your business needs to navigate these figures while filling out the North Dakota Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, uslegalforms can offer essential templates and guidance for compliance.

Yes, you can carry forward a net operating loss in North Dakota. This means that if your business experiences a loss, you can use that loss to offset future taxable income. This process can help alleviate tax burdens as you recover and grow. For assistance with the North Dakota Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, consider using uslegalforms, which provides straightforward resources to guide you through this process.