North Dakota Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate

Description

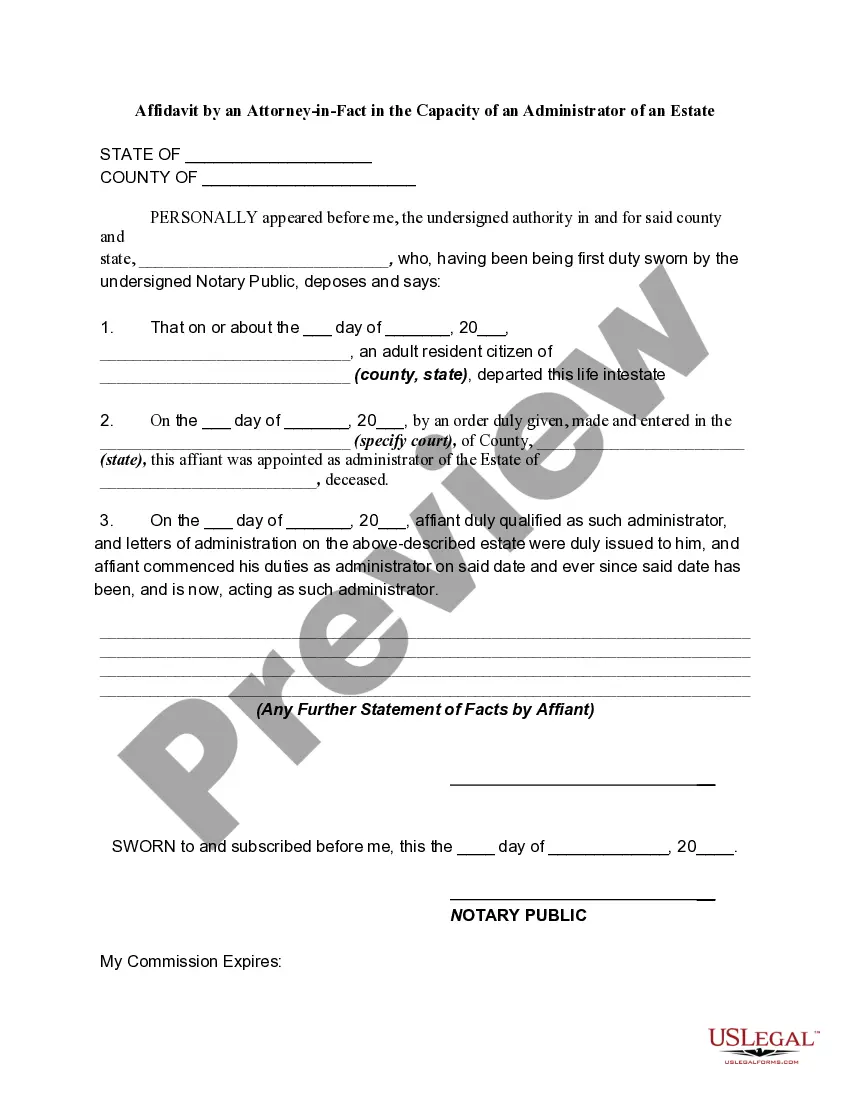

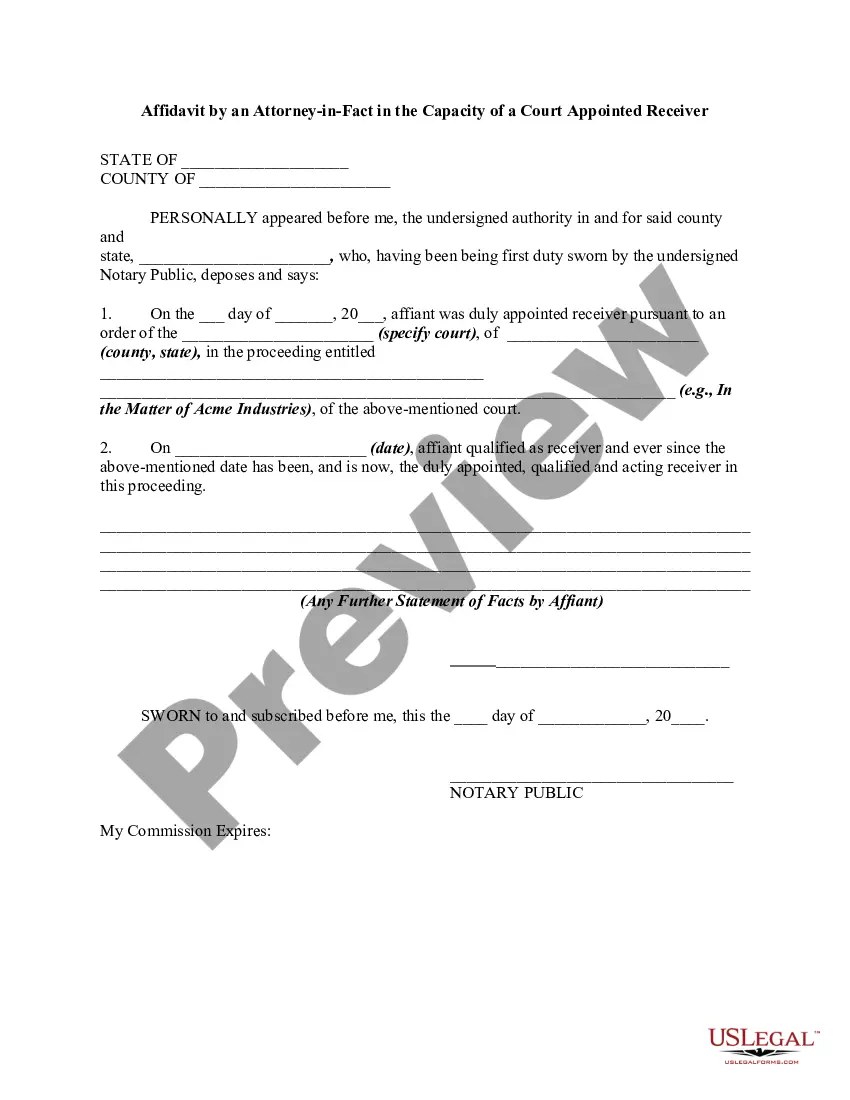

How to fill out Affidavit By An Attorney-in-Fact In The Capacity Of An Executor Of An Estate?

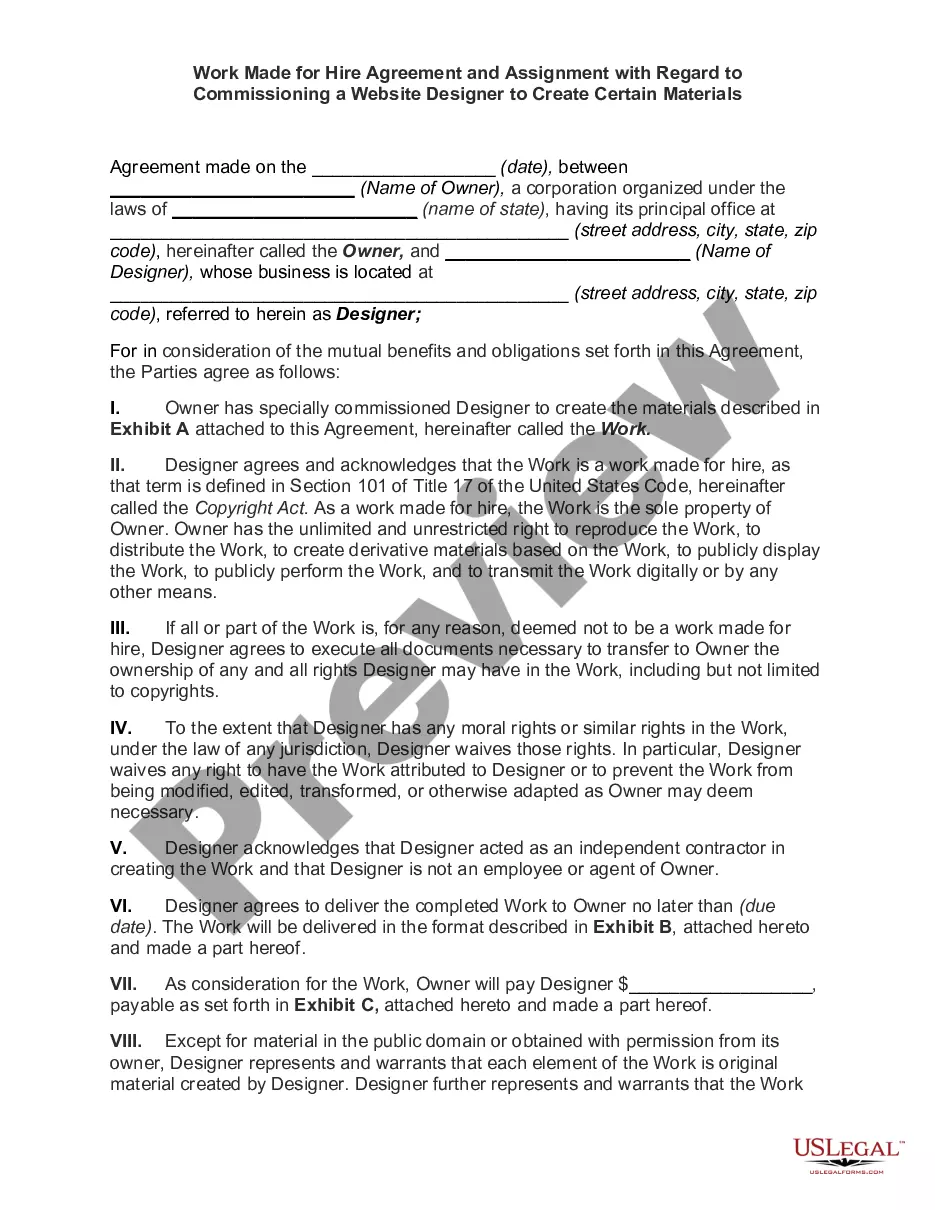

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print. By using the website, you can find thousands of forms for business and personal use, categorized by types, states, or keywords. You can access the latest versions of forms such as the North Dakota Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate in just moments.

If you already have a subscription, Log In and download the North Dakota Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to help you get started: Ensure you have selected the correct form for your city/county. Click the Preview button to review the form's details. Check the form summary to confirm you have chosen the correct form. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. Once you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, select the pricing plan you prefer and provide your information to register for an account. Process the transaction. Use your credit card or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

- Make edits. Fill out, modify, and print and sign the downloaded North Dakota Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate.

- Every document you added to your account has no expiration date and belongs to you permanently.

- So, if you want to download or print another copy, simply go to the My documents section and click on the form you wish.

- Access the North Dakota Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate with US Legal Forms, the most extensive collection of legal document templates.

- Utilize a wide range of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

Even without a statutory guideline on executor fees in North Dakota, the common understanding among legal professionals suggests that an executor can expect to receive about 2-5% of the estate's value. However, this percentage can vary based on the specifics of the estate and the executor's duties.

The surviving spouse who is a devisee of the decedent has the highest priority for consideration as the personal representative in informal probate proceedings.

In North Dakota, there is no set minimum estate value for probate.

The total value of the probated property (minus any debts or other encumbrances on the property) is less than $50,000.00; No real property (real estate) is part of the probated estate; No probate case is started or completed in a North Dakota state district court, a court of any other state, or a tribal court; and.

A personal representative is under a duty to settle and distribute the estate of the decedent in ance with the terms of any probated and effective will and this title, and as expeditiously and efficiently as is consistent with the best interests of the estate.

Die intestate in North Dakota and your children will inherit part of your estate. However, how much they receive depends on whether you also leave behind a spouse, if those children are with your surviving spouse, and if you have children with someone other than your surviving spouse.

In North Dakota, you must file probate within three years of the individual's passing. Filing within three years allows you to qualify for informal probate or affidavit. If you wait longer than three years to file, the estate has to go through normal probate.