North Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor

Description

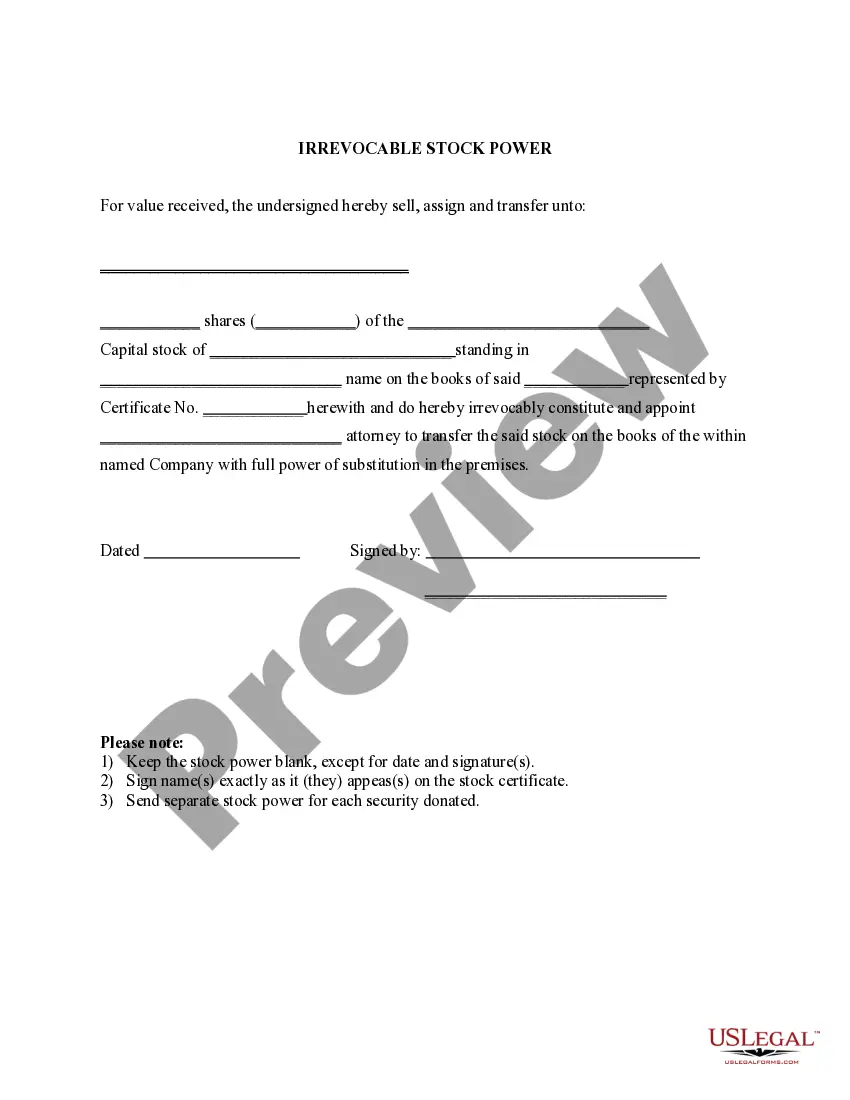

How to fill out Irrevocable Power Of Attorney For Transfer Of Stock By Executor?

Are you in a situation where you need to have documents for either business or personal purposes almost every day.

There are many legal document templates available online, but finding versions you can rely on is not easy.

US Legal Forms provides thousands of form templates, such as the North Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor, that are designed to meet state and federal requirements.

Once you find the correct form, click Get now.

Select the pricing plan you prefer, fill in the required information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

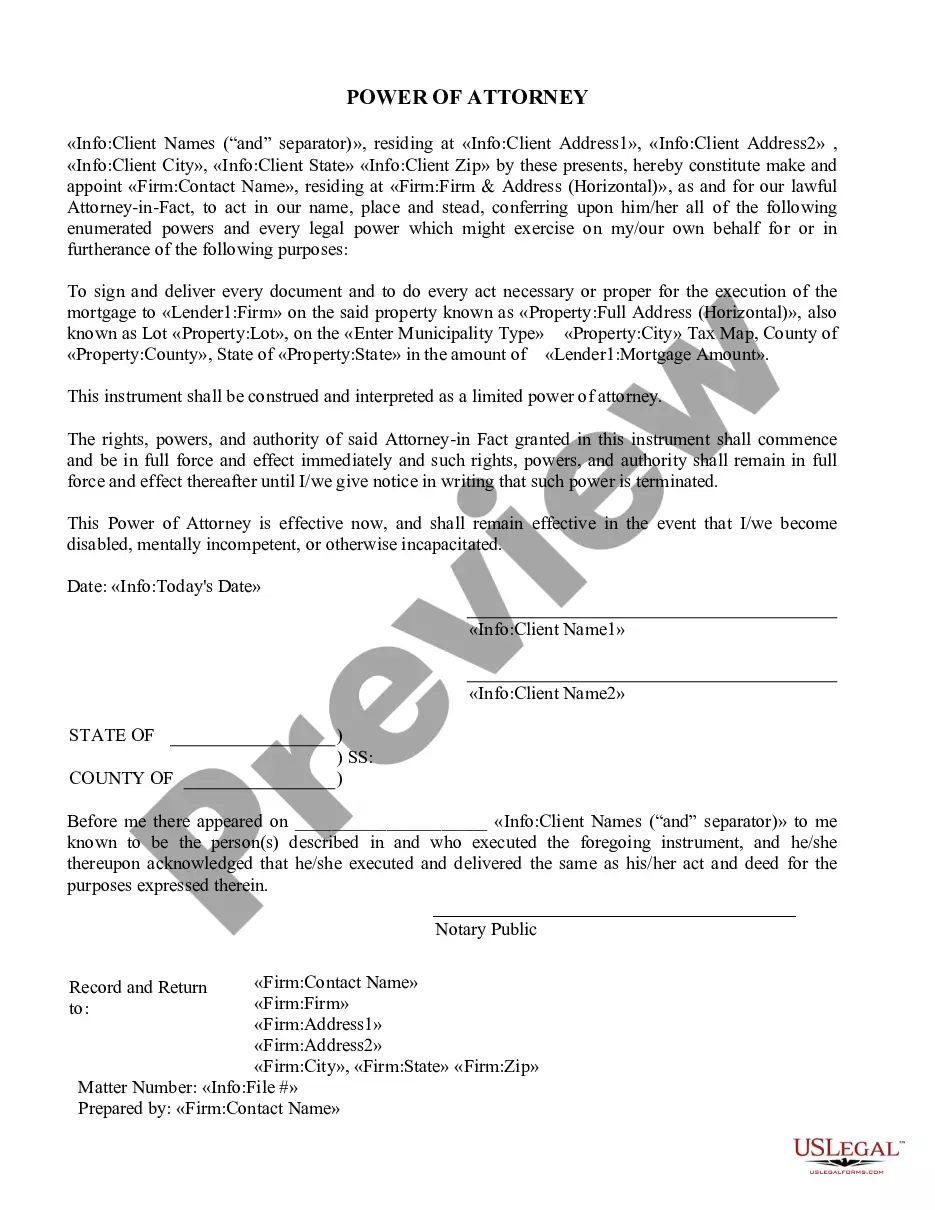

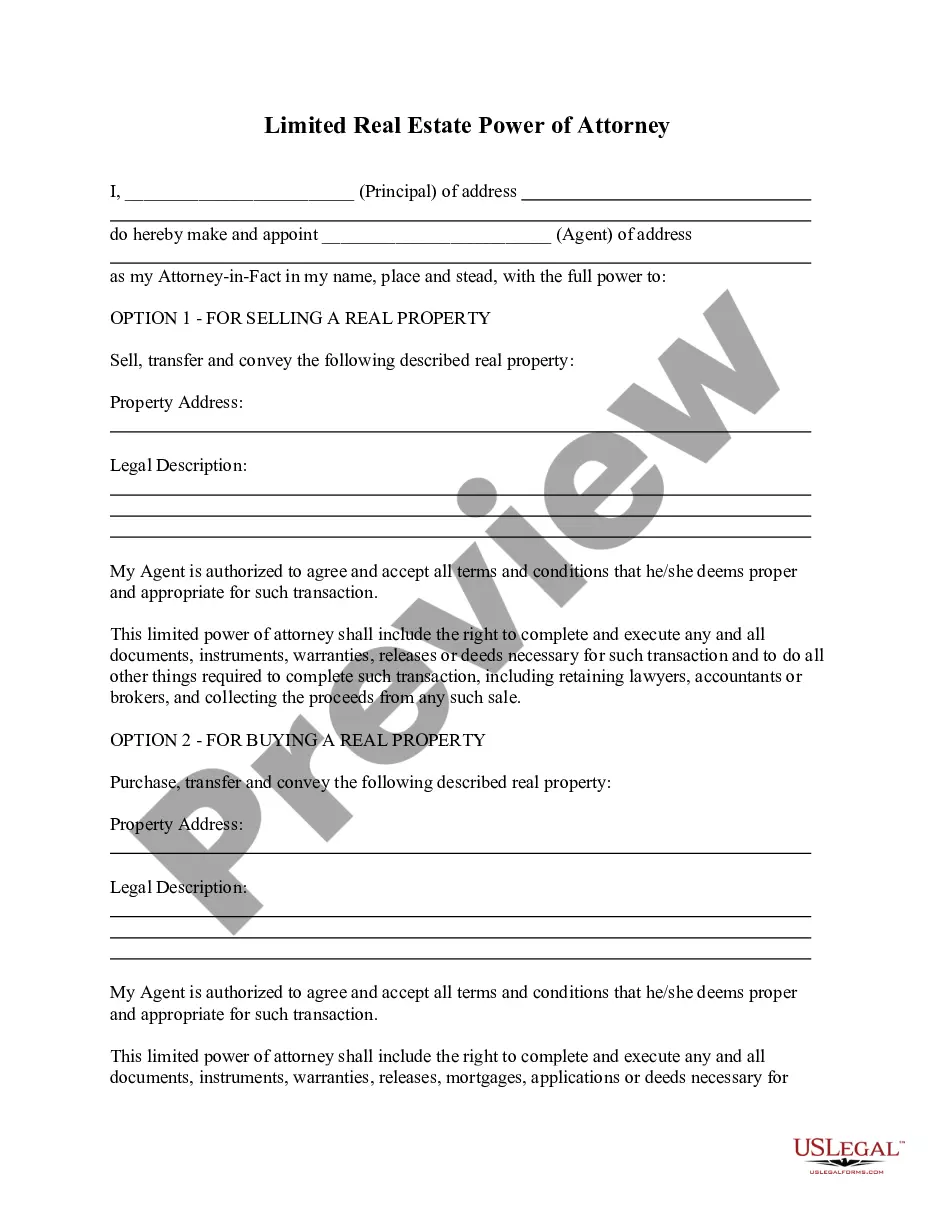

- Use the Preview option to review the form.

- Check the description to ensure you have chosen the right form.

- If the form is not what you are looking for, use the Search field to locate the form that fits your needs.

Form popularity

FAQ

In North Carolina, a power of attorney form should be kept in a secure location, such as with the principal or their attorney. If you are using a North Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor, you may also want to file it with financial institutions or other entities involved in stock management. This ensures that all parties recognize the authority granted. UsLegalForms can provide you with the necessary forms and guidance to ensure proper filing.

In North Carolina, an executor generally has up to one year to settle an estate. This timeline may vary based on the complexity of the estate and any potential disputes. If you are utilizing a North Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor, it can help streamline the process of managing and transferring assets. Staying organized and working closely with legal experts can facilitate timely settlements.

In North Carolina, a power of attorney does not need to be filed with the court to be valid. However, if you are using a North Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor, it is often advisable to keep a copy on file with relevant financial institutions. This ensures that the executor can effectively manage stock transfers as intended. Always check with legal counsel for specific requirements related to your situation.

In North Carolina, certain assets are exempt from probate, including life insurance policies with named beneficiaries, retirement accounts, and joint tenancy properties. These exemptions can help streamline the transfer process for families. Utilizing a North Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor can further assist in managing these assets effectively.

probate transfer refers to the transfer of assets that does not go through the probate process. Examples include assets held in joint tenancy or accounts with designated beneficiaries. Using a North Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor can facilitate these transfers efficiently, ensuring that your assets are managed according to your wishes without unnecessary delays.

A Power of Attorney (POA) cannot make decisions that are outside the authority granted in the document. For instance, a POA cannot change a will or make healthcare decisions if such powers are not specified. In the context of a North Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor, the limitations will be clearly defined, ensuring the agent acts within their designated scope.

Transferring property after a parent's death without a will in North Carolina typically involves identifying the legal heirs. The North Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor can be a valuable tool for heirs to manage the transfer of assets. It's advisable to consult with a legal expert to ensure compliance with state laws and to facilitate a smooth transfer.

Yes, property can often be transferred without probate in North Carolina, especially if the property is jointly owned or has a designated beneficiary. Utilizing a North Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor can streamline this process. This method is efficient and can help families avoid delays and costs associated with probate.

Yes, an estate can be settled without probate in North Carolina if the estate's value falls below a certain threshold. In such cases, heirs can use a North Carolina Irrevocable Power of Attorney for Transfer of Stock by Executor to manage the transfer of assets directly. This process simplifies matters for families and can help avoid lengthy court proceedings.