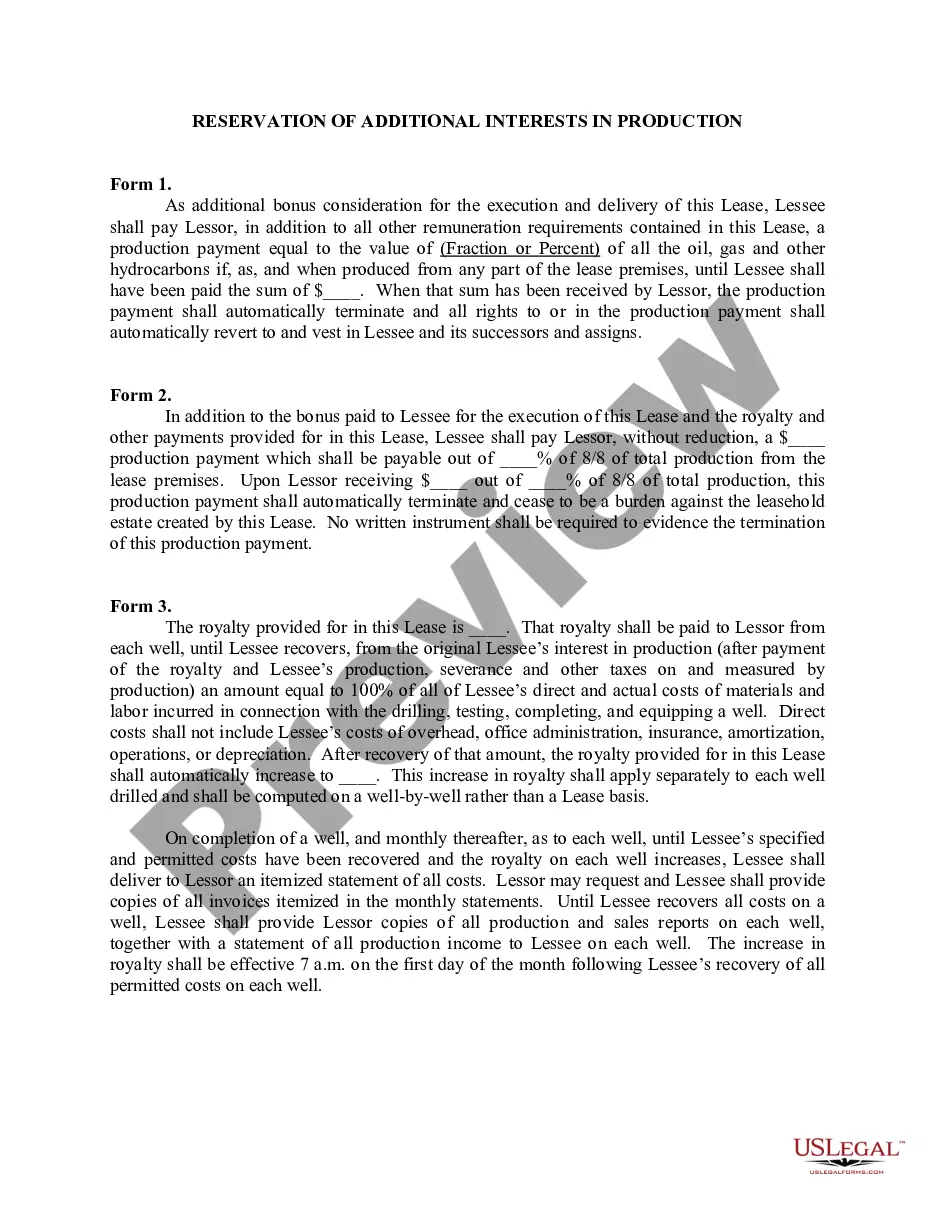

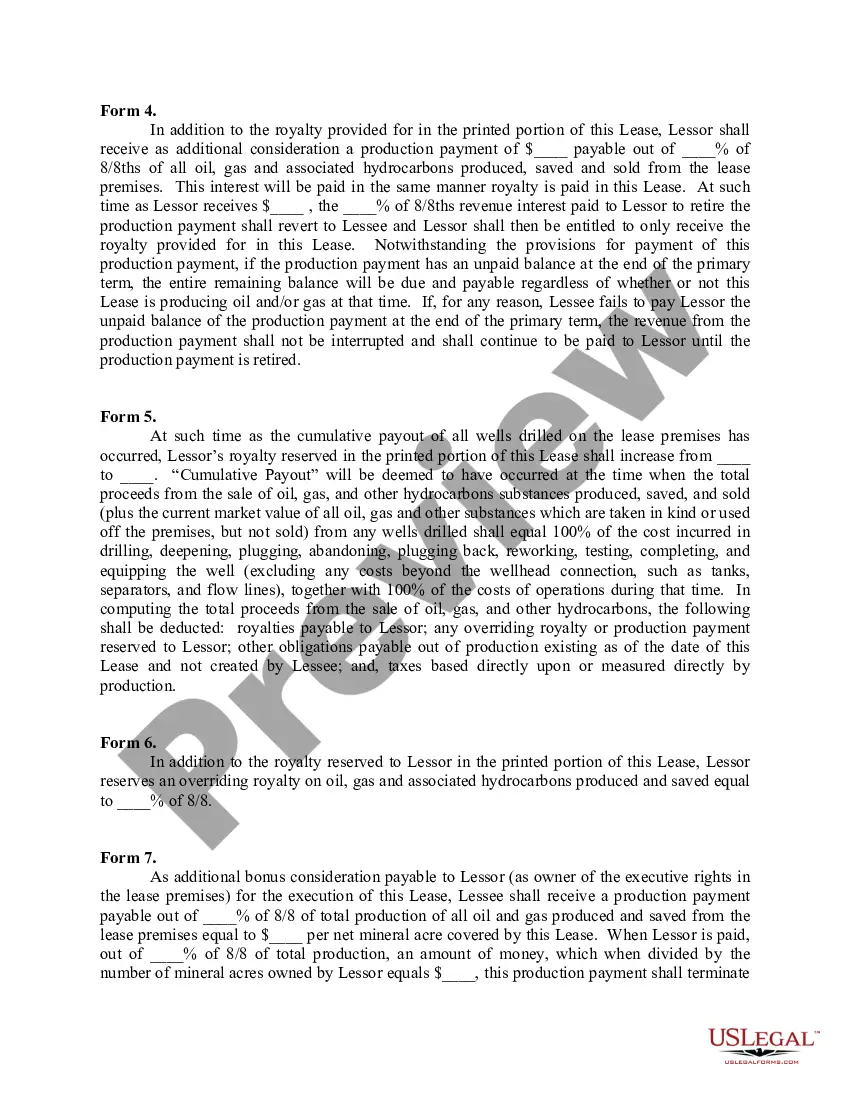

This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

North Carolina Reservation of Additional Interests in Production

Description

How to fill out Reservation Of Additional Interests In Production?

If you need to total, acquire, or produce authorized papers themes, use US Legal Forms, the greatest collection of authorized forms, which can be found on-line. Utilize the site`s simple and hassle-free search to get the documents you require. Numerous themes for company and person uses are categorized by categories and states, or keywords. Use US Legal Forms to get the North Carolina Reservation of Additional Interests in Production within a handful of clicks.

When you are currently a US Legal Forms client, log in to your accounts and click on the Obtain switch to find the North Carolina Reservation of Additional Interests in Production. You can even gain access to forms you in the past acquired inside the My Forms tab of the accounts.

If you are using US Legal Forms initially, refer to the instructions below:

- Step 1. Ensure you have selected the shape for your appropriate metropolis/land.

- Step 2. Make use of the Preview choice to look through the form`s content. Don`t forget to read through the explanation.

- Step 3. When you are not happy with the form, take advantage of the Lookup area near the top of the display screen to discover other variations of the authorized form design.

- Step 4. When you have found the shape you require, go through the Get now switch. Choose the rates program you prefer and add your qualifications to sign up for an accounts.

- Step 5. Process the financial transaction. You can use your Мisa or Ьastercard or PayPal accounts to accomplish the financial transaction.

- Step 6. Select the file format of the authorized form and acquire it on your device.

- Step 7. Complete, modify and produce or indication the North Carolina Reservation of Additional Interests in Production.

Each authorized papers design you purchase is your own for a long time. You possess acces to each form you acquired within your acccount. Click on the My Forms segment and pick a form to produce or acquire again.

Contend and acquire, and produce the North Carolina Reservation of Additional Interests in Production with US Legal Forms. There are millions of skilled and condition-particular forms you can utilize for your personal company or person requirements.

Form popularity

FAQ

North Carolina defers a portion of the property taxes on the appraised value of a permanent residence owned and occupied by a North Carolina resident who has owned and occupied the property at least five years, is at least 65 years of age or is totally and permanently disabled, and whose income does not exceed $50,700.

Services in North Carolina are generally not taxable, with important exceptions. If the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products. Some counties also consider a limited number of services (such as laundry and dry cleaning) taxable.

From and after July 1, 1957, it shall be unlawful for any person, partnership, corporation, limited liability company, association, or other business entity in this State to act as a real estate broker, or directly or indirectly to engage or assume to engage in the business of real estate broker or to advertise or hold ...

G.S. 105-164.13(32) provides an exemption from sales and use tax for the sale at retail and the use, storage, or consumption in this State of sales of motor vehicles, the sale of a motor vehicle body to be mounted on a motor vehicle chassis when a certificate of title has not been issued for the chassis, and the sale ...

Action without meeting. (a) Unless the articles of incorporation or bylaws provide otherwise, action required or permitted by this Chapter to be taken at a board of directors' meeting may be taken without a meeting if the action is taken by all members of the board.

The NC Department of Revenue says that if you are selling anything at retail, thus collecting sales tax thereon, and you provide repair, maintenance, or installation services with respect to that item sold at retail, you are a retailer and will collect sales tax on labor.

Machinery and Equipment, Sales and Use Tax Exemption Mill machinery, a term that generally includes manufacturing machinery, is exempt from sales and use tax.

Some goods are exempt from sales tax under North Carolina law. Examples include most non-prepared food items, food stamps, and medical supplies. We recommend businesses review the laws and rules put forth by the NCDOR to stay up to date on which goods are taxable and which are exempt, and under what conditions.