North Carolina Memorandum of Trust Agreement

Description

How to fill out Memorandum Of Trust Agreement?

Discovering the right authorized file web template can be quite a have difficulties. Obviously, there are plenty of templates accessible on the Internet, but how can you obtain the authorized form you will need? Use the US Legal Forms website. The service offers 1000s of templates, such as the North Carolina Memorandum of Trust Agreement, that can be used for business and private needs. All the forms are examined by experts and fulfill state and federal specifications.

If you are already listed, log in to your bank account and click on the Download button to get the North Carolina Memorandum of Trust Agreement. Make use of your bank account to look with the authorized forms you have acquired in the past. Proceed to the My Forms tab of the bank account and have another copy of your file you will need.

If you are a brand new user of US Legal Forms, here are basic instructions for you to adhere to:

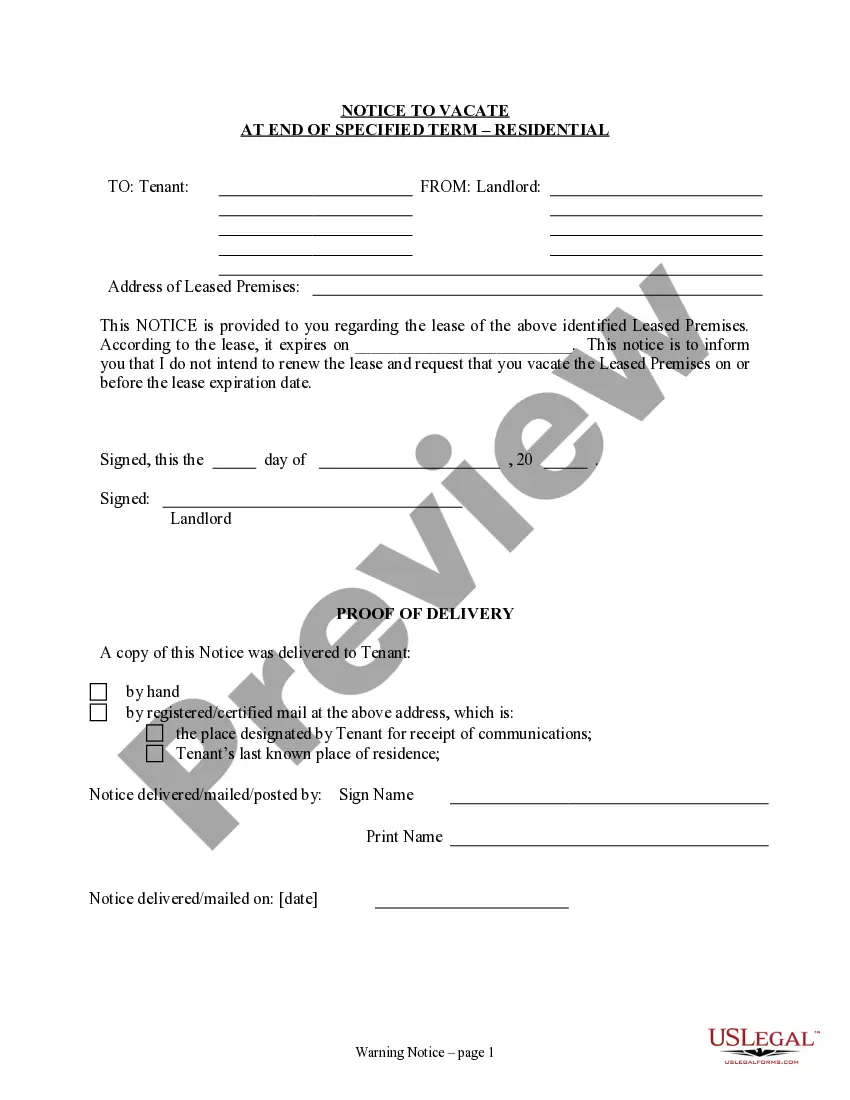

- Initially, make certain you have chosen the proper form for the metropolis/area. You may check out the shape using the Review button and browse the shape description to make certain this is the right one for you.

- When the form will not fulfill your expectations, make use of the Seach field to find the right form.

- When you are certain that the shape is suitable, click the Buy now button to get the form.

- Choose the prices program you want and enter the required details. Make your bank account and buy your order with your PayPal bank account or charge card.

- Pick the document formatting and acquire the authorized file web template to your gadget.

- Comprehensive, change and printing and indication the received North Carolina Memorandum of Trust Agreement.

US Legal Forms will be the biggest local library of authorized forms for which you can see a variety of file templates. Use the service to acquire expertly-made documents that adhere to status specifications.

Form popularity

FAQ

Living Trusts differ from Wills in that Living Trusts do not require verification by the court after you pass away. Rather than relying on the court or an executor to distribute your assets, a Living Trust allows your Trustee to pass on money and property directly to your heirs ? without court intervention.

(j) In transactions involving real property, a person who acts in reliance upon a certification of trust may require that the certification of trust be executed and acknowledged in a manner that will permit its registration in the office of the register of deeds in the county where the real property is located.

The cost of creating a trust in North Carolina varies, but a basic Revocable Living Trust generally ranges from $1,000 to $3,000. The cost may be higher for more complex trusts or if you require the assistance of an attorney. Online legal services can offer more affordable alternatives for creating trusts.

Unlike a will, you don't need to sign a trust in front of witnesses to make it legally enforceable in North Carolina. Instead, you simply need to draft a trust document (doing this with the help of an attorney is advisable), assign enough property to the trust to fund it, and sign the trust in front of a notary public.

To make a living trust in North Carolina, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

What are the Requirements for Creating a Valid Trust in North Carolina? A settlor with capacity to convey; A clear intention to create a trust; A definite and ascertainable beneficiary, unless a charitable trust or a trust for animals; A competent trustee with duties to perform; and.

In North Carolina, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on.