North Carolina Storage Services Contract - Self-Employed

Description

How to fill out Storage Services Contract - Self-Employed?

Are you in a situation where you will require documentation for possibly business or specific intents almost every day.

There are numerous legal form templates accessible online, but finding reliable types is not simple.

US Legal Forms offers thousands of document templates, including the North Carolina Storage Services Agreement - Self-Employed, which can be downloaded to meet state and federal requirements.

Utilize US Legal Forms, the most comprehensive collection of legal documents, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the North Carolina Storage Services Agreement - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

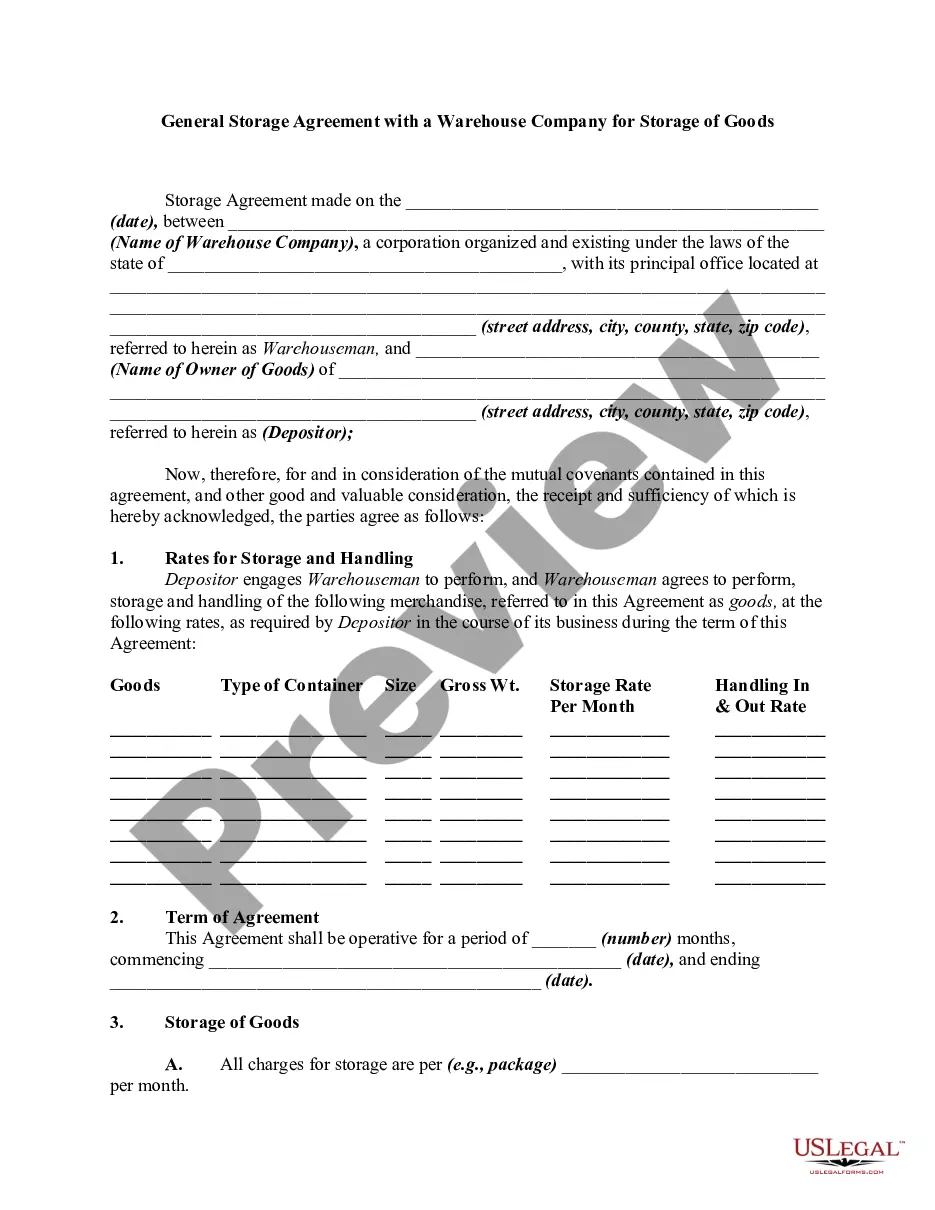

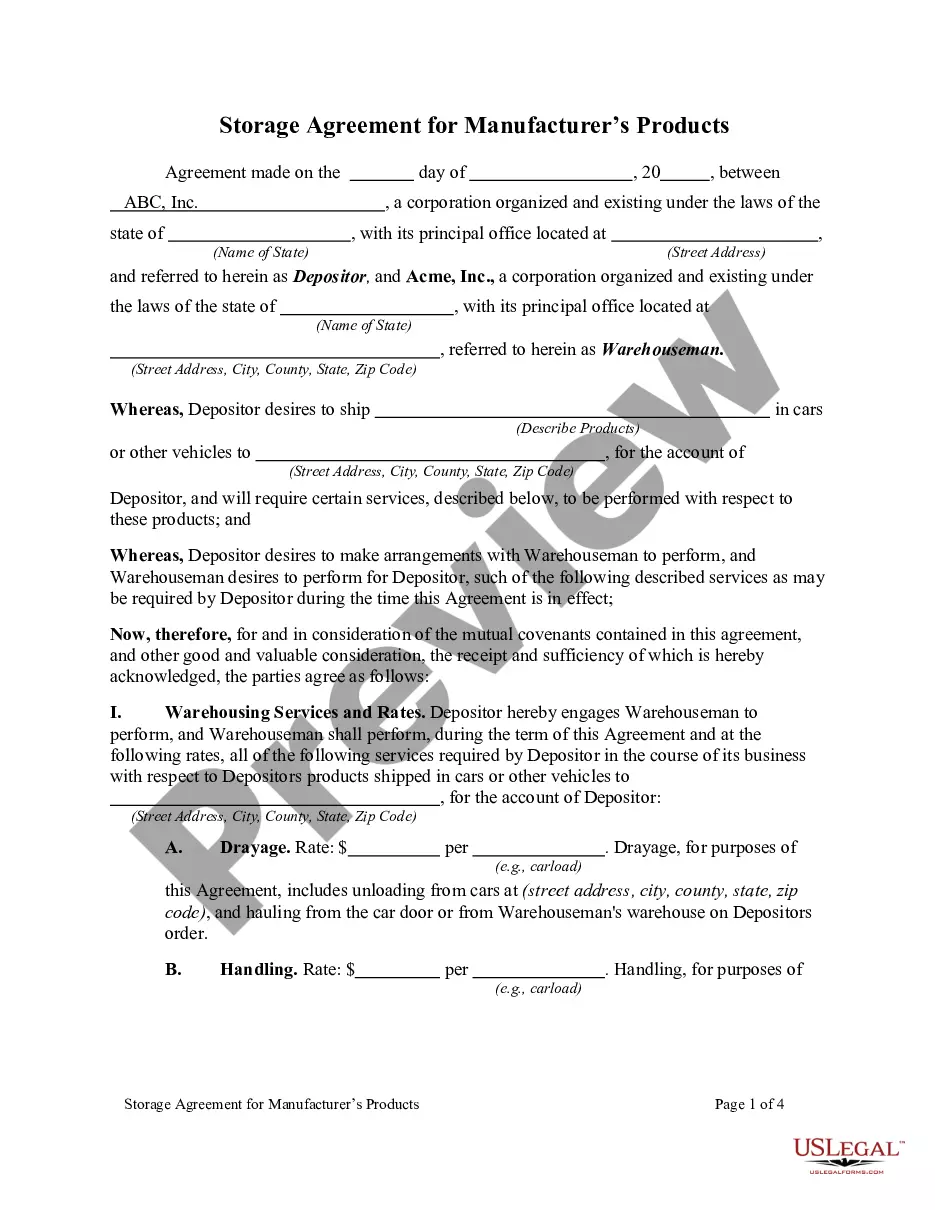

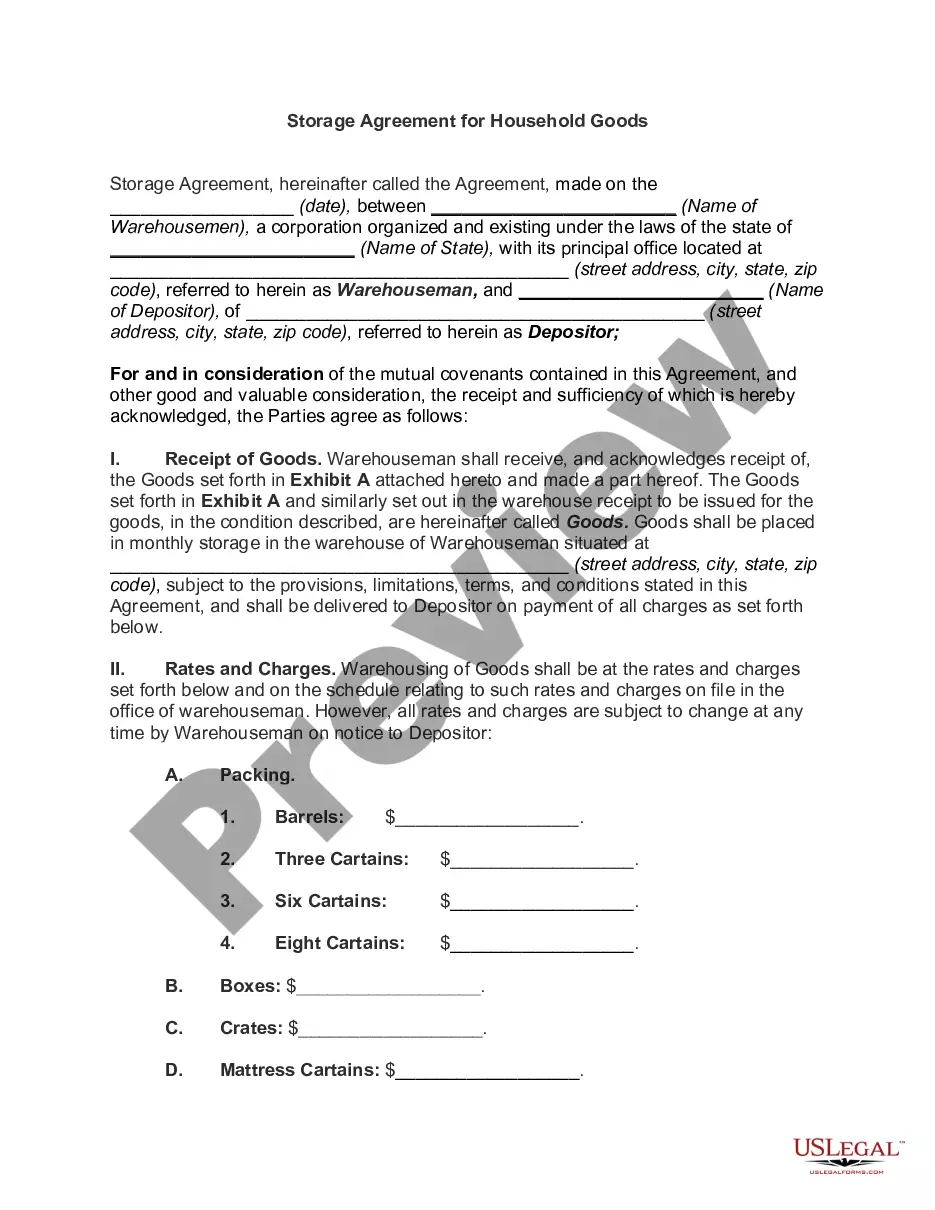

- Select the document you need and ensure it is for the correct state/region.

- Use the Preview button to review the form.

- Read the description to ensure you have chosen the appropriate document.

- If the document is not what you are looking for, utilize the Search field to find the form that meets your needs.

- Once you find the correct document, click Purchase now.

- Choose the payment plan you prefer, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Find all the document templates you have purchased in the My documents list. You can download an additional copy of the North Carolina Storage Services Agreement - Self-Employed at any time, if needed. Click the desired document to download or print the template.

Form popularity

FAQ

To be an independent contractor, you need to have a clear business plan and appropriate registrations. Establishing a separate business identity and keeping detailed financial records is crucial. Additionally, you may need specific licenses depending on your service area. A well-defined North Carolina Storage Services Contract - Self-Employed can help facilitate your agreements, ensuring you meet all professional expectations.

The time it takes to become a contractor in North Carolina varies based on your preparation and chosen business model. If you are ready with your paperwork and plans, the registration process may only take a few weeks. It also helps to connect with professionals in your industry to understand best practices and timelines. A comprehensive North Carolina Storage Services Contract - Self-Employed can expedite your client engagements once you are ready.

In North Carolina, whether you need a license to be a contractor depends on the type of work you do. General contractors are required to obtain a license, while some specialty contractors may not have this requirement. It’s important to check with the North Carolina Licensing Board for Contractors to see what applies to you. Additionally, having a North Carolina Storage Services Contract - Self-Employed can guide you through legal requirements.

Becoming an independent contractor in North Carolina involves several key steps. First, determine the type of services you will offer and create a business plan. Then, you can register your business and obtain any licenses needed. Utilizing a North Carolina Storage Services Contract - Self-Employed ensures that you define the scope of your work and establish professional relationships with clients.

To establish yourself as an independent contractor in North Carolina, you need to register your business appropriately. Begin by choosing a business structure, such as a sole proprietorship or LLC, and file the necessary paperwork. Your next step is to obtain any required permits or licenses based on your field. Remember, having a solid North Carolina Storage Services Contract - Self-Employed can help outline your services clearly and protect your interests.

Maintenance contracts in North Carolina may be taxable depending on the nature of the services provided. If the maintenance involves tangible personal property, then sales tax may apply. It's essential to evaluate your North Carolina Storage Services Contract - Self-Employed to determine if any maintenance agreements might incur tax obligations.

Running a business from a storage unit in North Carolina can be illegal depending on local zoning laws and storage unit policies. You may face restrictions on using a residential storage unit for commercial purposes. To ensure compliance and avoid potential issues, review your storage unit agreement and consider consulting local regulations regarding your North Carolina Storage Services Contract - Self-Employed.

While an operating agreement is not legally required for LLCs in North Carolina, it is highly recommended. This agreement defines the management structure and operating procedures of the LLC, providing clarity and protections for all members. For your North Carolina Storage Services Contract - Self-Employed, having a clear operating agreement can help delineate responsibilities and expectations.

A service contract in North Carolina outlines the terms and conditions between a service provider and a client. This document specifies the services to be provided, payment terms, and liability outlines. If you are preparing a North Carolina Storage Services Contract - Self-Employed, ensure that you clearly detail all aspects necessary for a smooth transaction.

Personal service contracts, such as those that involve labor without the transfer of tangible goods, are generally exempt from North Carolina sales tax. For your North Carolina Storage Services Contract - Self-Employed, this means that if you offer storage space without any accompanying services that involve goods, you may not be subject to taxation. It's wise to confirm details with a tax expert.