North Carolina Party Verification Letter

Description

How to fill out Party Verification Letter?

You can commit hrs online looking for the legitimate record web template that fits the federal and state needs you need. US Legal Forms supplies a huge number of legitimate varieties which are reviewed by specialists. It is possible to acquire or print the North Carolina Party Verification Letter from my services.

If you already have a US Legal Forms bank account, you may log in and click the Down load button. Next, you may comprehensive, edit, print, or indicator the North Carolina Party Verification Letter. Every legitimate record web template you acquire is the one you have forever. To get another duplicate associated with a bought form, proceed to the My Forms tab and click the related button.

If you are using the US Legal Forms site the first time, follow the easy recommendations listed below:

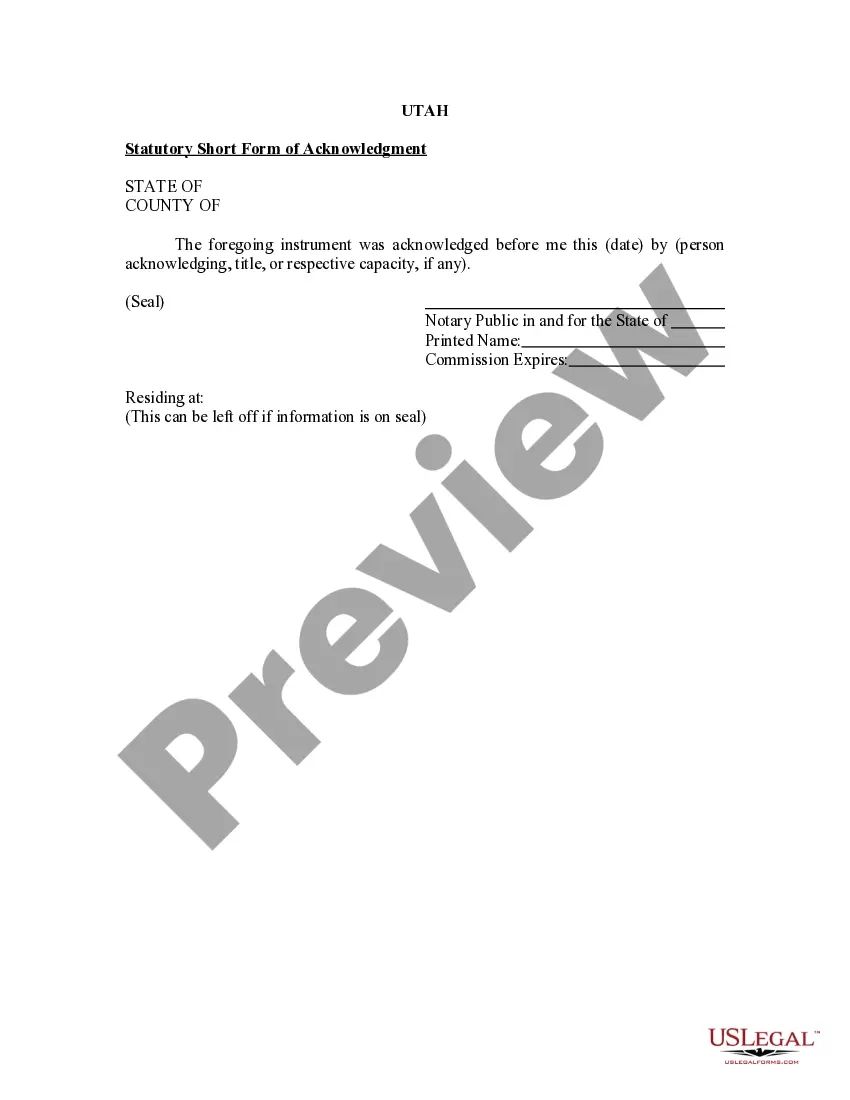

- Initially, make sure that you have selected the proper record web template for that county/metropolis that you pick. Browse the form explanation to make sure you have chosen the correct form. If readily available, use the Preview button to appear with the record web template also.

- If you would like discover another model of your form, use the Lookup discipline to find the web template that meets your needs and needs.

- Once you have identified the web template you need, simply click Get now to continue.

- Choose the costs strategy you need, type your accreditations, and register for your account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal bank account to pay for the legitimate form.

- Choose the file format of your record and acquire it to the system.

- Make changes to the record if required. You can comprehensive, edit and indicator and print North Carolina Party Verification Letter.

Down load and print a huge number of record web templates while using US Legal Forms web site, that offers the most important collection of legitimate varieties. Use specialist and condition-specific web templates to deal with your business or person requires.

Form popularity

FAQ

If you have received a Notice of Individual Income Tax Assessment, you have been assessed for income taxes due. You may have also previously received a "Notice to File a Return" and failed to respond to that notice within 30 days.

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

The North Carolina Department of Revenue is a cabinet-level executive agency charged with administering tax laws and collecting taxes on behalf of the people of the State. The Secretary of Revenue is appointed by the Governor.

Adjusted refund amount means the IRS either owes you more money on your return, or you owe more money in taxes. For example, the IRS may use your refund to pay an existing tax debt and issue you a CP49 notice.

If you have received a Notice of Individual Income Tax Assessment, you have been assessed for income taxes due. You may have also previously received a "Notice to File a Return" and failed to respond to that notice within 30 days.

You cannot request a copy by telephone. The Revenue Department must have a written request signed by you. There is no charge for copies of your return.