North Carolina Personal Property - Schedule B - Form 6B - Post 2005

Description

How to fill out Personal Property - Schedule B - Form 6B - Post 2005?

Are you in the position in which you will need files for either company or individual reasons virtually every time? There are a lot of lawful document layouts accessible on the Internet, but finding types you can rely is not simple. US Legal Forms offers a large number of develop layouts, just like the North Carolina Personal Property - Schedule B - Form 6B - Post 2005, that happen to be published to satisfy state and federal needs.

In case you are presently acquainted with US Legal Forms website and also have a free account, merely log in. Next, you may down load the North Carolina Personal Property - Schedule B - Form 6B - Post 2005 format.

If you do not come with an bank account and wish to begin using US Legal Forms, abide by these steps:

- Obtain the develop you want and ensure it is for that correct city/region.

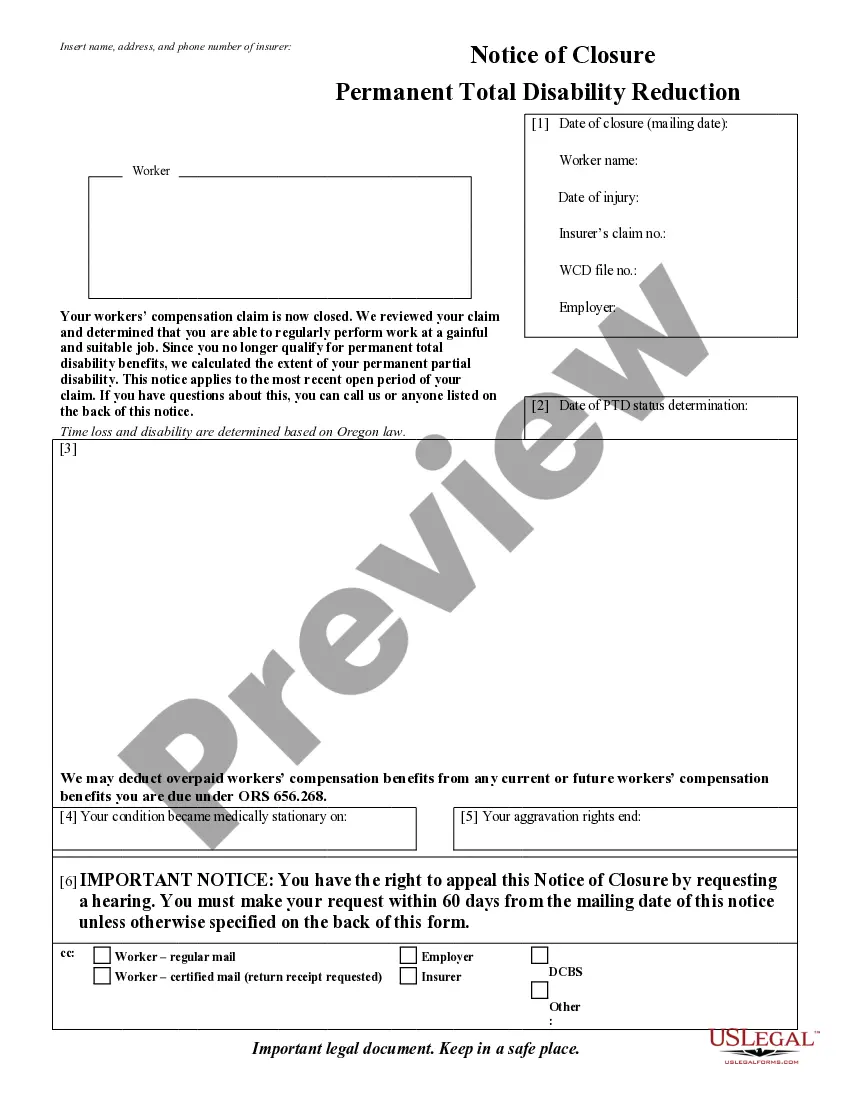

- Make use of the Review switch to review the shape.

- Read the explanation to ensure that you have selected the appropriate develop.

- If the develop is not what you are looking for, use the Look for industry to find the develop that suits you and needs.

- If you obtain the correct develop, click Get now.

- Choose the rates program you need, complete the necessary details to generate your bank account, and pay for your order utilizing your PayPal or bank card.

- Choose a hassle-free document formatting and down load your duplicate.

Find all the document layouts you might have purchased in the My Forms menu. You can get a extra duplicate of North Carolina Personal Property - Schedule B - Form 6B - Post 2005 at any time, if necessary. Just go through the essential develop to down load or printing the document format.

Use US Legal Forms, one of the most considerable selection of lawful types, to save time as well as stay away from mistakes. The support offers professionally created lawful document layouts that you can use for a variety of reasons. Generate a free account on US Legal Forms and begin creating your way of life a little easier.

Form popularity

FAQ

Individual Personal Property includes: Unlicensed vehicles, which are those not having an active North Carolina registration on January 1 of a year, including automobiles, trucks, trailers, permanent multi-year trailers, campers and motorcycles. Boats, Boat Motors, Jet Skis, etc. Mobile Homes.

The school tax is included in the property tax bill and is also included in the Orange County tax rates as noted above. Sales tax rates vary from county to county in North Carolina and range from 6.75% to 7.5%. Sales tax is applied to essentially all tangible merchandise.

Ing to the North Carolina General Statutes, all property that is not defined or taxed as "real estate" or "real property" is considered to be "personal property." Business personal property is taxable whether it is owned, leased, rented, loaned, or otherwise made available to the business.

In comparison to intangible personal property, tangible property can be touched. Consider property such as furniture, machinery, cell phones, computers, and collectibles which can be felt compared to intangibles such as patents, copyrights, and non-compete agreements that cannot be seen or touched.

How Much Is North Carolina's Vehicle Property Tax? North Carolina policy states that all vehicles will be taxed at 100 percent of their appraised value. How much this tax will cost you depends on where you live since vehicle property tax rates vary by county.

Any income producing property is considered by North Carolina General Statutes as business personal property. Business personal property includes: Airplanes. Computers.

Personal property tax is a tax imposed by state or local governments on certain assets that can be touched and moved, such as cars, livestock, or equipment. Generally, personal property means assets other than land or permanent structures, such as houses, which are considered real property.

Examples include clothes, jewelry, furniture, and automobiles. Personal property can also include assets owned by a business.