North Carolina Agreement to Reimburse for Insurance Premium

Description

How to fill out Agreement To Reimburse For Insurance Premium?

US Legal Forms - one of the largest collections of sanctioned forms in the United States - offers a range of sanctioned record templates that you can download or generate.

By using the website, you can discover countless forms for business and personal use, categorized by types, states, or keywords. You can find the most recent versions of forms such as the North Carolina Agreement to Reimburse for Insurance Premium in moments.

If you possess a subscription, Log In and download the North Carolina Agreement to Reimburse for Insurance Premium from the US Legal Forms library. The Download button will appear on each template you view. You can access all previously acquired forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form to your device. Edit it. Fill, modify, print, and sign the downloaded North Carolina Agreement to Reimburse for Insurance Premium. Each template you add to your account has no expiration date and is yours permanently. Therefore, to obtain or print another copy, simply go to the My documents section and select the form you need. Access the North Carolina Agreement to Reimburse for Insurance Premium with US Legal Forms, the most comprehensive library of sanctioned record templates. Utilize a wealth of professional and state-specific templates that align with your business or personal needs and requirements.

- To start using US Legal Forms for the first time, here are simple instructions to begin.

- Ensure you have chosen the correct form for your locality/county.

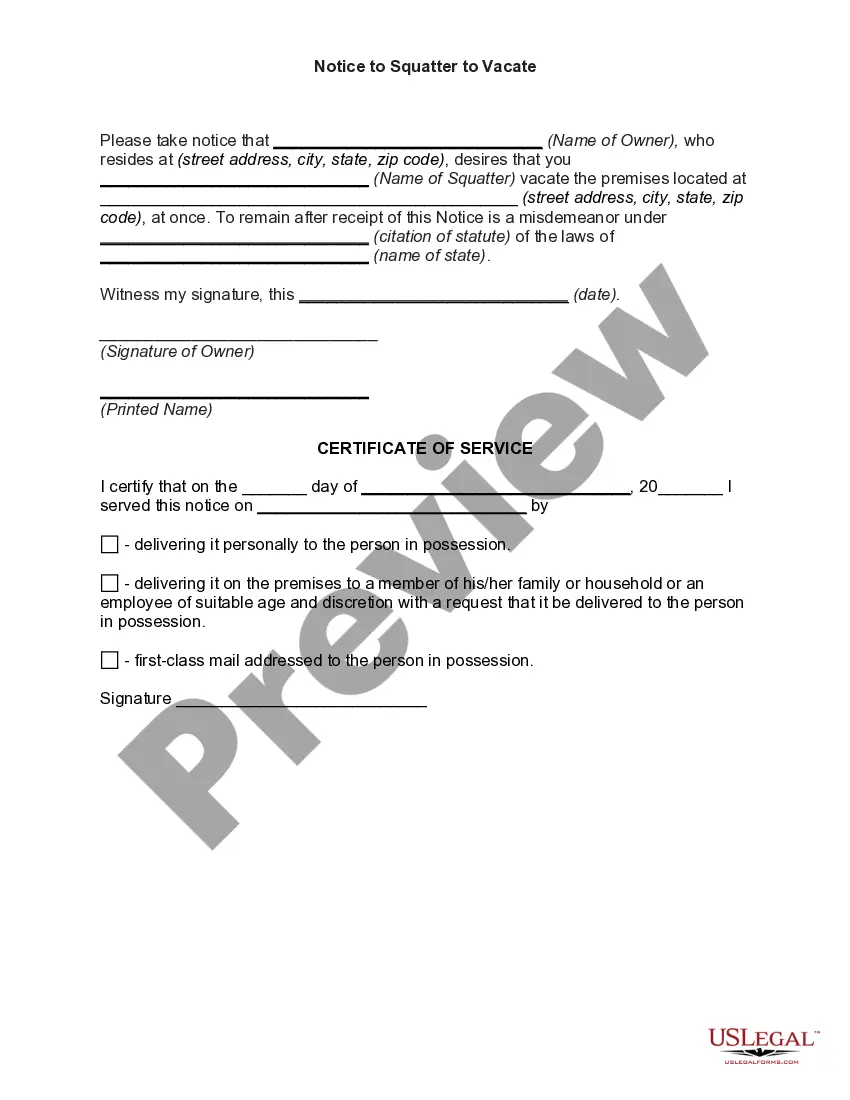

- Click the Preview button to review the form's details.

- Examine the form information to ensure you have selected the correct form.

- If the form does not meet your needs, use the Search area at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your details to register for the account.

Form popularity

FAQ

In life policies premiums are payable in advance. The Long-term Insurance Act prescribes that if premiums are not paid on due date there should be a grace period of at least 15 days before a policy lapses. Insurers may grant a longer period, often 30 days.

Insurance contracts are Unilateral contracts, where only the insurer makes legally enforceable promises to pay for covered losses. The Company cannot sue the Insured for breach of contract.

Unilateral Contract a contract in which only one party makes an enforceable promise. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. By contrast, the insured makes few, if any, enforceable promises to the insurer.

The insuring clause contains the insurer's promise to pay benefits in the event of a covered loss.

A promise to pay agreement is a promissory note. It details the amount of debt outstanding, the conditions under which the money will be repaid, the interest rate, and what will happen if the money is not repaid in a timely manner.

Return of premium is a term plan with death benefits, in which, if the policyholder survives the policy term, it returns the premium that's paid.

The money is then paid as a term life insurance claim at the time of settlement. Through premiums, the insurance company earns interest and return on investment. Sometimes, the amount of investment income can surpass the cost of insurance claims.

Return-of-premium life insurance pros and consIf you outlive your policy's term, you get your premium payments back. The returned money isn't taxed since it's not income, but simply a return of the payments you made.

1. When insurer elect to set aside the contract on the ground of innocent misrepresentation, non-disclosure, concealment or mistake, the assured is entitled to the return of the premium, in absence of fraud on his part and of any express conditions to the contrary; 2.

The basic concept of insurance being a promise is that you pay an insurance company, and they in turn promise to settle your claim should you have one. That is why it is essential to choose your agent and insurer with care.