North Carolina Employee Time Report (Nonexempt)

Description

How to fill out Employee Time Report (Nonexempt)?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a range of legal document formats that you can download or print. By using the website, you can access thousands of templates for business and personal purposes, organized by categories, states, or keywords.

You can find the latest templates such as the North Carolina Employee Time Report (Nonexempt) in just minutes.

If you already have a membership, Log In and obtain the North Carolina Employee Time Report (Nonexempt) from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved templates in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the saved North Carolina Employee Time Report (Nonexempt). Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the North Carolina Employee Time Report (Nonexempt) with US Legal Forms, one of the most extensive collections of legal document formats. Utilize numerous professional and state-specific templates that meet your business or personal needs and requirements.

- If it's your first time using US Legal Forms, here are simple instructions to get you started.

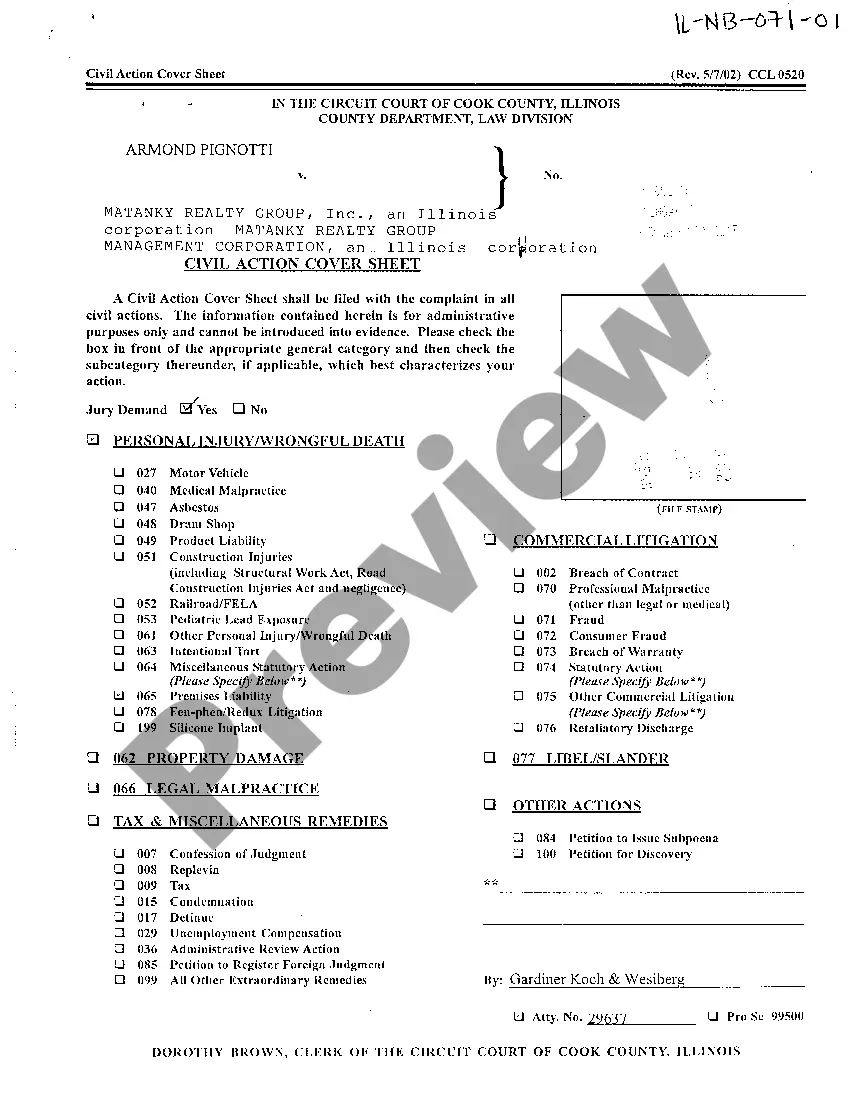

- Ensure that you have selected the correct form for your area/state. Click the Preview button to review the content of the form.

- Check the form description to make sure you have chosen the right one.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the pricing plan you want and provide your details to create an account.

Form popularity

FAQ

In North Carolina, part-time employment typically refers to work hours less than 40 hours per week. Many employers define part-time status differently, often requiring employees to work fewer than 30 or 32 hours weekly. Determining full-time or part-time classification affects benefits eligibility and payment structures, which should be reflected in your North Carolina Employee Time Report (Nonexempt).

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and in Federal, State, and local governments.

Currently the minimum wage in North Carolina is $7.25 an hour. But this is all an employer must pay its employees by statute pursuant to the North Carolina Wage and Hour Act (WHA). An employer is not required to pay its employees more in wages than is required by the minimum wage and overtime pay provisions.

The law categorizes all employees as exempt or non-exempt. Non-exempt employees are entitled to overtime pay, whereas exempt employees are not. There are certain types of employees that are more likely to be non-exempt.

North Carolina does not require employers to pay employees for accrued time off. Employers must pay employees for accrued vacation at the time of termination if their policy doesn't address what happens to it.

A. "Reporting time pay is a form of wages that compensate employees who are scheduled to report to work but who are not put to work or furnished with less than half of their usual or scheduled day's work because of inadequate scheduling or lack of proper notice by the employer.

FeffThe Fair Labor Standards Act (FLSA), governs the process that Compensation Analysts use to determine whether a position is either eligible for over-time pay for hours worked in excess of 40 per week (non-exempt) or is paid a flat sum for hours worked, even if they exceed 40 hours within a workweek (exempt).

A. Yes, you are entitled to one hour of reporting time pay. Under the law, if an employee is required to report to work a second time in any one workday and is furnished less than two hours of work on the second reporting, he or she must be paid for two hours at his or her regular rate of pay.

There are no rules for reporting time and show-up pay in North Carolina, which means your employer does not have to pay you for this time. However, there may be some situations where these employees do actually engage in work-related activities without receiving compensation.

An employer must pay an employee at least the minimum wage (currently $7.25 an hour under both North Carolina and federal labor laws) or pay the employee the promised rate of pay, whichever is greater, and pay time and one-half overtime pay based on the employee's regular rate of pay for all hours worked in excess of