North Carolina Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions

Description

How to fill out Confirmation Of Orally Accepted Employment Offer From Applicant To Company - Exempt Or Nonexempt Positions?

If you wish to finalize, obtain, or print sanctioned document templates, utilize US Legal Forms, the most extensive variety of legal documents available online. Take advantage of the site’s simple and convenient search feature to locate the files you require. Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to access the North Carolina Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions with just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click on the Acquire button to obtain the North Carolina Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions. You may also access forms you previously saved from the My documents section of your account.

Every legal document template you acquire is yours permanently. You have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the North Carolina Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

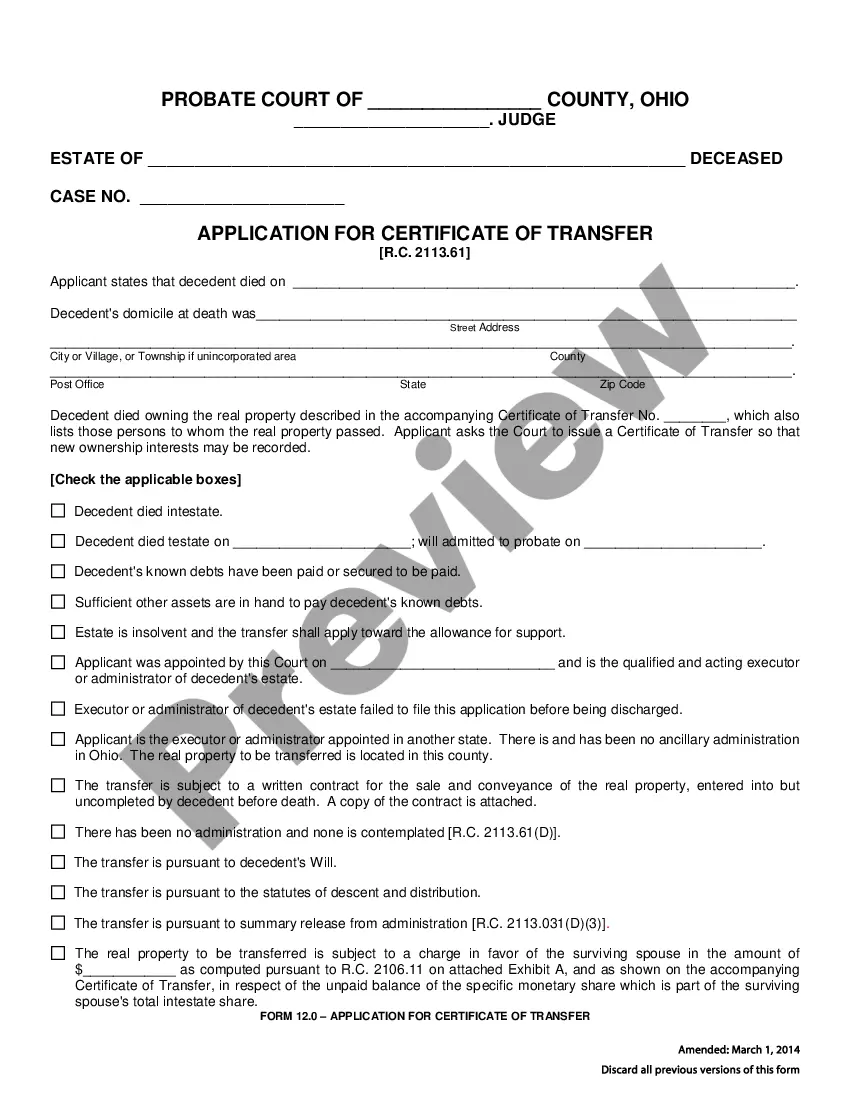

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s content. Make sure to read the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other forms in the legal document format.

- Step 4. Once you have found the form you need, click the Purchase now button. Select your preferred pricing plan and enter your credentials to register for an account.

- Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Retrieve the format of the legal document and download it to your device.

- Step 7. Complete, modify and print or sign the North Carolina Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions.

Form popularity

FAQ

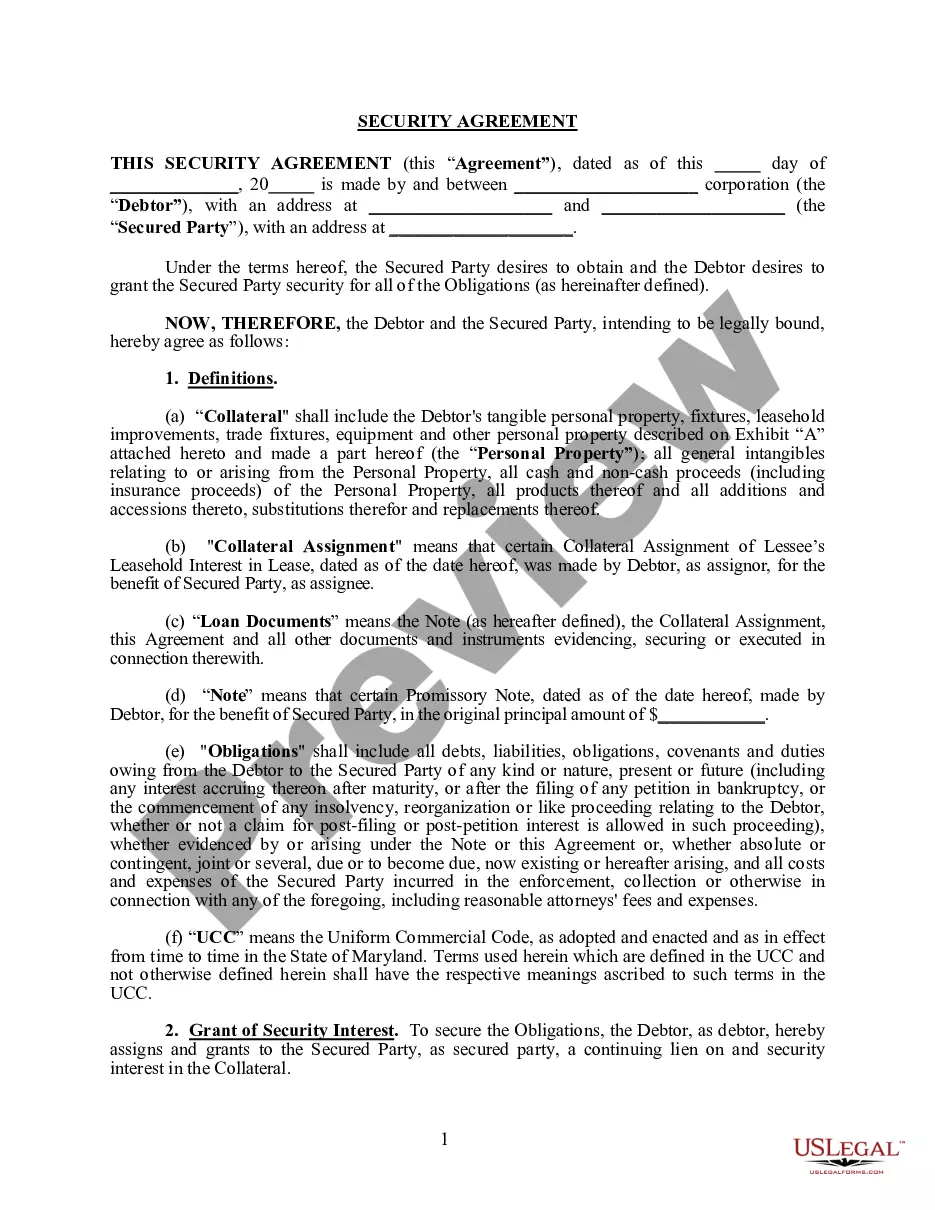

The law categorizes all employees as exempt or non-exempt. Non-exempt employees are entitled to overtime pay, whereas exempt employees are not. There are certain types of employees that are more likely to be non-exempt.

An employer can rescind an offer of employment at any time before a potential employee has accepted it. However once a job offer is accepted and the employment relationship (a binding contract) has been formed, then it can't be retracted even if the employee hasn't yet started work.

Executives, administrators, and other professionals earning at least $455 per week do not have to be paid overtime under Section 13(a)(1) of the Fair Labor Standards Act. External salespeople (who often set their own hours) are also exempted from NC overtime requirements, as are some types of computer-related workers.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

Highly-compensated: Any employee who primarily performs non-manual labor and regularly performs at least one exempt administrative, executive, or professional duty, and makes $100,000 or more per year (including at least $455 per week on salary), can be exempt from overtime.

Some important details about an offer letter are: It is NOT a legally binding contract. It does NOT include promises of future employment or wages. It includes an employment at-will statement.

One of the general requirements is that the salaried-exempt employee must be paid a guaranteed salary of at least $684 a workweek (no salary test for outside sales), which would also be the promised rate of pay for the employee.

What Information can an Employer Release for Employment Verification?Job performance.Reason for termination or separation.Knowledge, qualifications, and skills.Length of employment.Pay level and wage history (where legal)Disciplinary action.Professional conduct.Work-related information

Providing a Reference Many employers will release only basic information when contacted for a reference to protect themselves from lawsuits. They usually confirm employment dates and job responsibilities, salary history, and might include information about whether you were dismissed or chose to leave on your own.

An employer may typically disclose a current or former employee's job title, the period of employment, salary amount, responsibilities, job performance, and whether they resigned or were terminated. There are no federal laws restricting what an employer can or cannot disclose, however, state laws may differ.