North Carolina Agreement to Undertake Purchase of Land by Joint Venturers

Description

How to fill out Agreement To Undertake Purchase Of Land By Joint Venturers?

You have the ability to spend hours online searching for the authentic documents template that satisfies the national and regional requirements you desire.

US Legal Forms offers a vast array of authentic forms that are reviewed by professionals.

You can indeed acquire or create the North Carolina Agreement to Undertake Purchase of Land by Joint Venturers from our service.

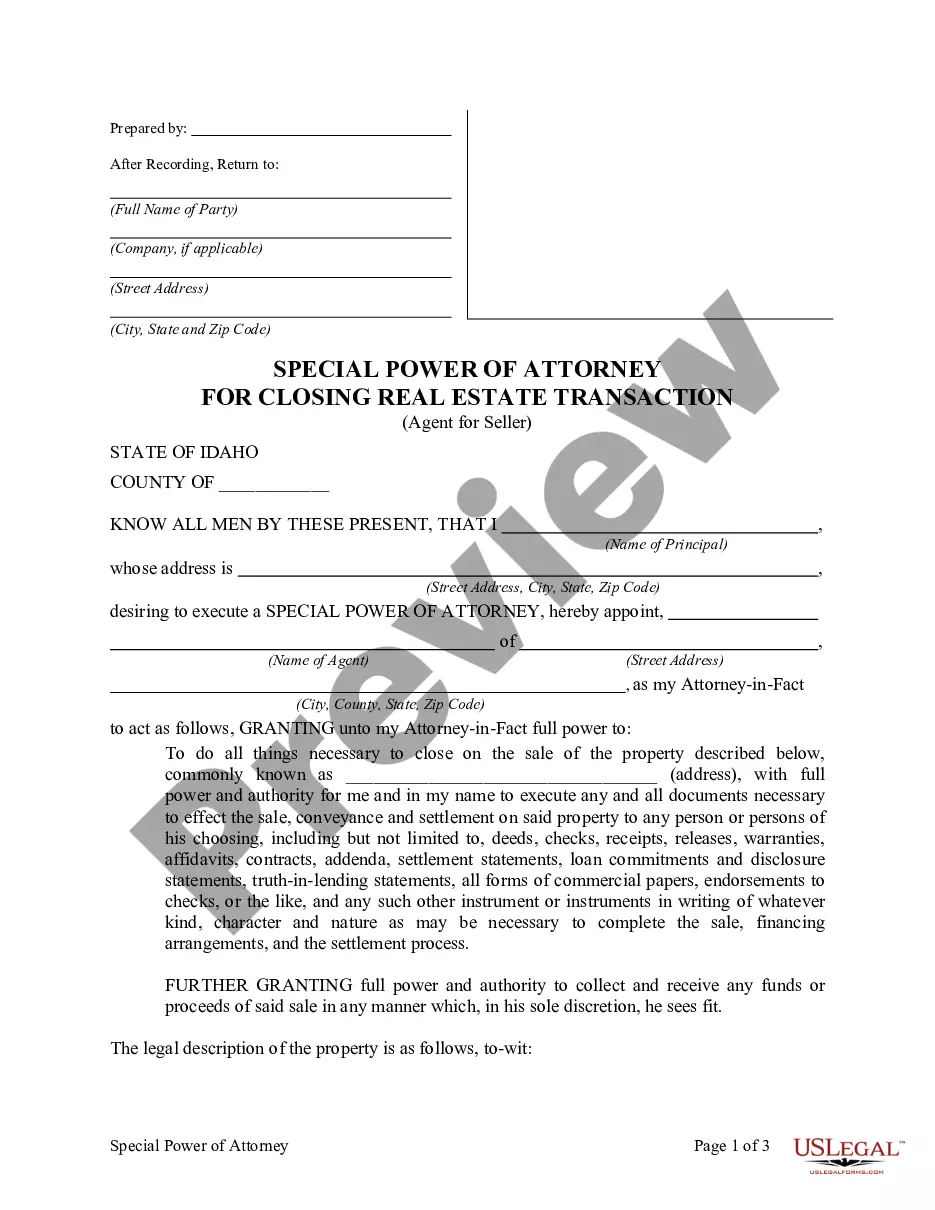

If available, utilize the Review button to examine the document template as well.

- If you possess a US Legal Forms account, you may sign in and then click the Download button.

- After that, you can complete, modify, print, or sign the North Carolina Agreement to Undertake Purchase of Land by Joint Venturers.

- Every authentic document template you obtain is your property indefinitely.

- To receive another copy of any acquired form, visit the My documents section and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow these simple instructions.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the document description to confirm you have chosen the right document.

Form popularity

FAQ

The following is included in a Joint Venture Agreement:Business location.The type of joint venture.Venture details, such as its name, address, purpose, etc.Start and end date of the joint venture.Venture members and their capital contributions.Member duties and obligations.Meeting and voting details.More items...

There must be a definite intention that the joint venture operation be terminated; This intention must be clearly communicated to all parties to the joint venture contract, either through words or unequivocal (clear) acts; Notice of termination must usually be served to all parties.

Things to include in a letter of intent to purchaseThe full names of the buyer and the seller.The complete address of the property.The agreed-upon purchase price.The agreed-upon earnest deposit.The date of signing the SPA.The terms and conditions that surround the earnest deposit.More items...?

(Rupees ), will be received by the FIRST PARTY from the SECOND PARTY, at the time of registration of the Sale Deed, the FIRST PARTY doth hereby agree to grant, convey, sell, transfer and assign all his rights, titles and interests in the said portion of the said property, fully

As discussed above, a purchase agreement should contain buyer and seller information, a legal description of the property, closing dates, earnest money deposit amounts, contingencies and other important information for the sale.

A joint development agreement is a legal contract that sets the terms between two or more parties working together to develop a new product or technology. This type of agreement addresses the joint nature of the parties' collaboration on the research and development of potentially patentable intellectual property.

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?

A joint venture agreement is legally binding like other contracts.

Joint venture members can be sued individually and found liable for damages caused by a joint venture and it should be recalled that a joint venture is, above all, a partnership type entity with unlimited liability imposed upon its members.

In many cases, a joint venture agreement will break apart because one or both companies break the agreement. Furthermore, because this is such a common occurrence among joint venture agreement, most contracts for this type of partnership will have a list of scenarios that defines what actions break the contract.