North Carolina Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage

Description

How to fill out Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage?

US Legal Forms - one of the biggest libraries of lawful kinds in America - provides a variety of lawful file templates you can obtain or print out. Utilizing the site, you can get 1000s of kinds for enterprise and individual reasons, sorted by classes, says, or search phrases.You can find the newest variations of kinds like the North Carolina Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage within minutes.

If you already have a registration, log in and obtain North Carolina Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage from your US Legal Forms library. The Obtain button can look on every single kind you perspective. You have access to all previously downloaded kinds in the My Forms tab of your own profile.

If you wish to use US Legal Forms the first time, listed here are simple directions to help you get started:

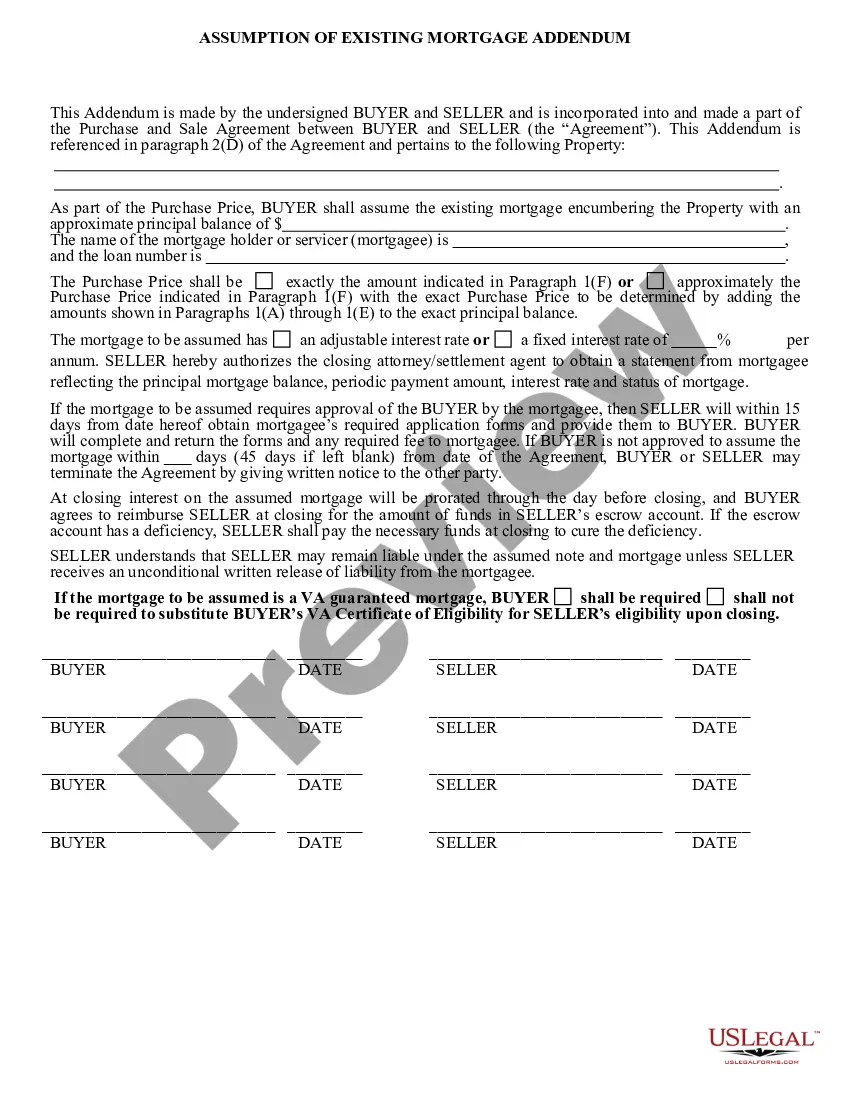

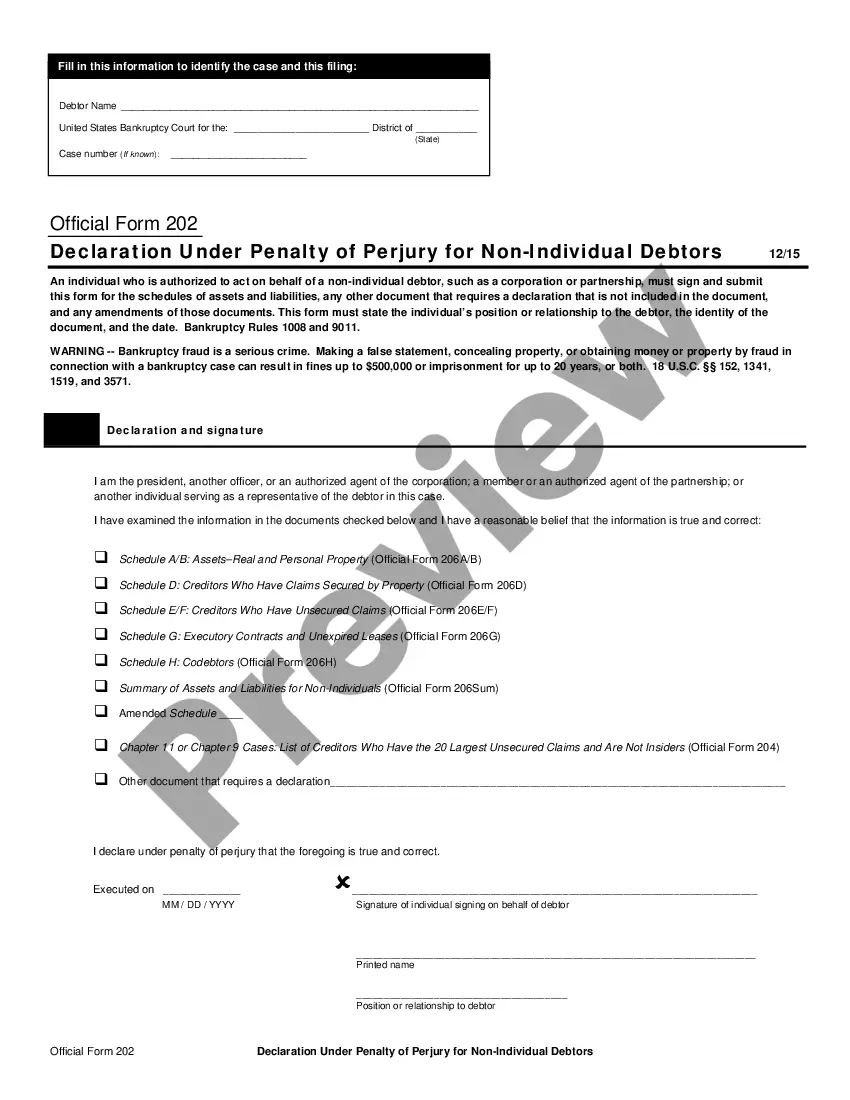

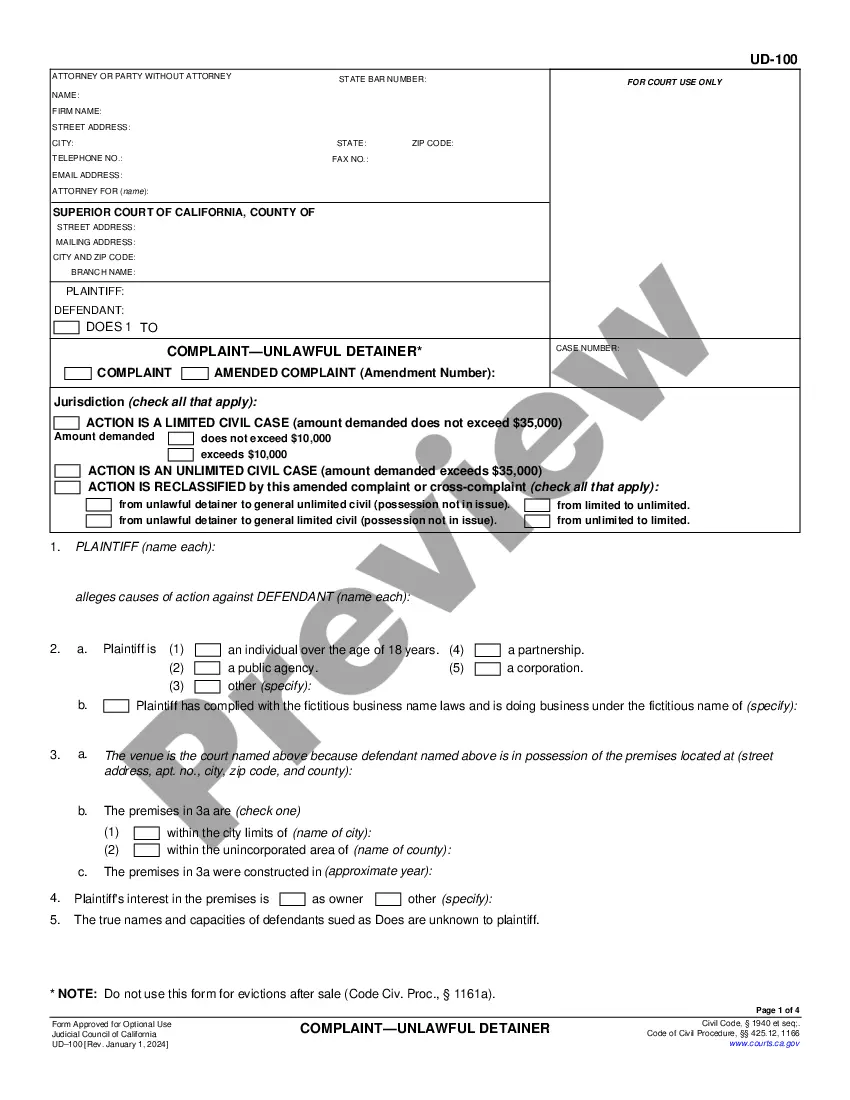

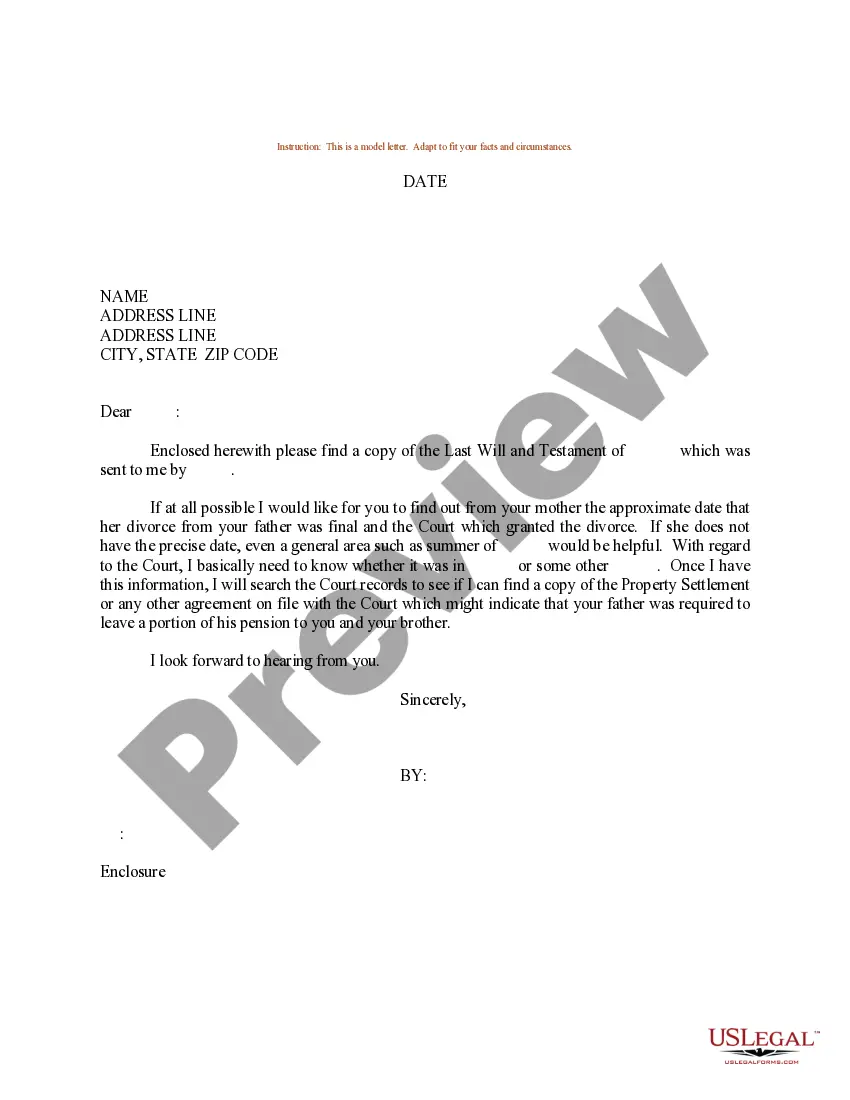

- Make sure you have selected the correct kind for your metropolis/area. Click on the Preview button to review the form`s content material. See the kind information to actually have chosen the proper kind.

- In case the kind does not suit your needs, use the Search discipline at the top of the monitor to obtain the one which does.

- In case you are happy with the shape, confirm your choice by visiting the Buy now button. Then, choose the pricing program you like and provide your accreditations to register for an profile.

- Procedure the deal. Use your charge card or PayPal profile to complete the deal.

- Choose the format and obtain the shape on your gadget.

- Make modifications. Load, revise and print out and indicator the downloaded North Carolina Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage.

Every template you included with your money does not have an expiry time and is also yours forever. So, if you want to obtain or print out yet another backup, just proceed to the My Forms area and then click in the kind you want.

Get access to the North Carolina Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage with US Legal Forms, probably the most substantial library of lawful file templates. Use 1000s of skilled and state-specific templates that meet your small business or individual demands and needs.

Form popularity

FAQ

There's no limit to the number of conventional mortgages you can have for a primary residence. However, you can only have one primary residence at a time. And you're limited to two mortgages if you're using first-time homebuyer conventional loans such as Fannie Mae Home Ready or Freddie Mac Home Possible.

You can get at most two mortgages at the same time for your home in most cases. Depending on the lender you work with, the interest rates and requirements may vary. Also, instead of a second mortgage, you can go for a home refinancing to access more loans without taking on more mortgages on your property.

Since you already have one mortgage, expect the underwriting process to be even tougher when you're trying to get a second. Lenders may ask for larger down payments and charge higher interest rates. Here's a look at how underwriting is different for a second mortgage: Credit score.

A second mortgage provides a way to access the equity in your home. Interest rates are lower than credit cards and personal loans. You can use the funds for any reason, whether improving your home, taking a vacation or paying for a wedding. You can use any lender, even if it's not the same as your primary mortgage.

You can get at most two mortgages at the same time for your home in most cases. Depending on the lender you work with, the interest rates and requirements may vary. Also, instead of a second mortgage, you can go for a home refinancing to access more loans without taking on more mortgages on your property.

Legally, there isn't a limit on how many times you can refinance your home loan. However, mortgage lenders do have a few mortgage refinance requirements you'll need to meet each time you apply for a loan, and some special considerations are important to note if you want a cash-out refinance.