North Carolina Guaranty of a Lease

Description

How to fill out Guaranty Of A Lease?

You can dedicate multiple hours on the web trying to discover the official document format that complies with the federal and state requirements you need.

US Legal Forms offers a vast array of official forms that have been evaluated by professionals.

It is easy to download or print the North Carolina Guaranty of a Lease from this service.

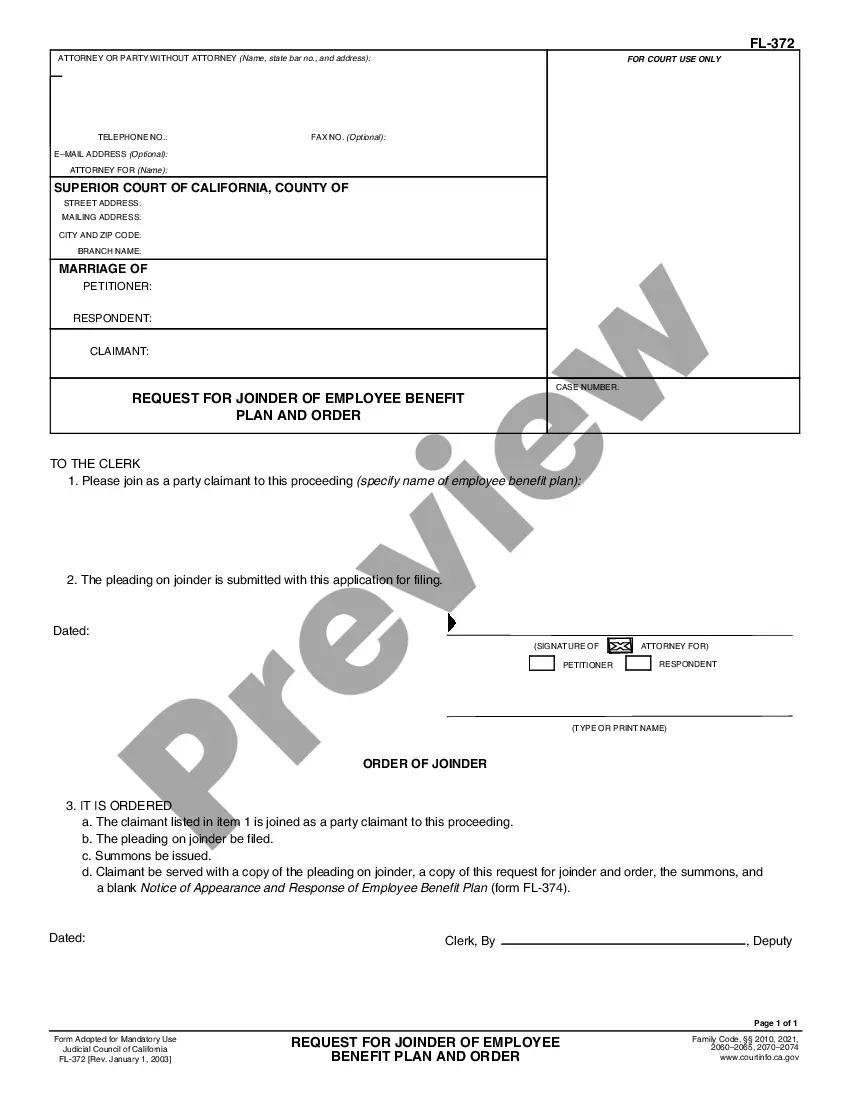

If available, utilize the Review button to view the document format as well.

- If you already possess a US Legal Forms account, you can sign in and then click the Download button.

- After that, you can complete, edit, print, or sign the North Carolina Guaranty of a Lease.

- Every official document format you purchase is yours permanently.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for your chosen county/town.

- Refer to the form outline to confirm you have chosen the appropriate form.

Form popularity

FAQ

A guarantor is not listed as a tenant on the lease agreement; they are a separate entity that agrees to take financial responsibility for the lease. While tenants occupy the property, a guarantor simply provides security to the landlord. Understanding this distinction is essential within the context of the North Carolina Guaranty of a Lease.

To list a guarantor on a lease, fill out the 'Guarantor' section of the lease form with the required details and ensure the guarantor signs the document. It's important to review state regulations to comply with the North Carolina Guaranty of a Lease. This clarity not only protects the landlord's interests but also secures the tenant's agreement on financial responsibilities.

You can list a guarantor on a lease by including their details in the specific section designated for guarantors within the lease agreement. This section usually requires you to provide the guarantor's name, contact information, and signature. Properly documenting this within the North Carolina Guaranty of a Lease ensures clarity and accountability for all parties involved.

To serve as a guarantor under the North Carolina Guaranty of a Lease, individuals commonly need to meet specific financial criteria. This typically includes a stable income, a good credit history, and sufficient assets to cover the lease obligations. Property owners want to ensure that guarantors can fulfill financial responsibilities if the primary tenant cannot.

A guarantor must complete a guaranty of lease form, which typically includes personal information, payment details, and consent to a credit check. Most lease agreements require this information to assess the financial reliability of the guarantor. Providing accurate information helps ensure a smooth leasing process in line with the North Carolina Guaranty of a Lease.

Yes, a lease remains legal in North Carolina even if it is not notarized. What matters most is that both parties willingly agree to the terms and conditions. However, notarization can provide additional protection, ensuring that the agreement is ironclad, particularly when dealing with a North Carolina Guaranty of a Lease.

Exiting a lease guarantee often requires communication with the landlord and a formal request for release. You'll typically need to demonstrate that the tenant can manage lease payments independently or that circumstances have changed significantly. It is essential to refer to the terms outlined in the North Carolina Guaranty of a Lease for processes and stipulations regarding cancellation.

To find a guarantor for your lease, start by reaching out to family members, close friends, or trusted colleagues who can support you financially. Discuss the responsibilities involved in a North Carolina Guaranty of a Lease to ensure they understand the commitment. If personal connections are not an option, consider services that specialize in connecting tenants with willing guarantors.

A guaranty of a lease agreement is a promise made by a third party to take responsibility for lease obligations if the tenant defaults. This legal document safeguards landlords by ensuring that they receive payment even if the tenant cannot fulfill their financial obligations. Understanding the terms of the North Carolina Guaranty of a Lease is crucial for both tenants and guarantors.

In North Carolina, a guaranty generally does not require notarization to be valid. However, having a notary public witness the signing can add an extra layer of authenticity and assurance for all parties involved. This practice ensures both the tenant and the guarantor clearly understand their commitments under the North Carolina Guaranty of a Lease.