North Carolina General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

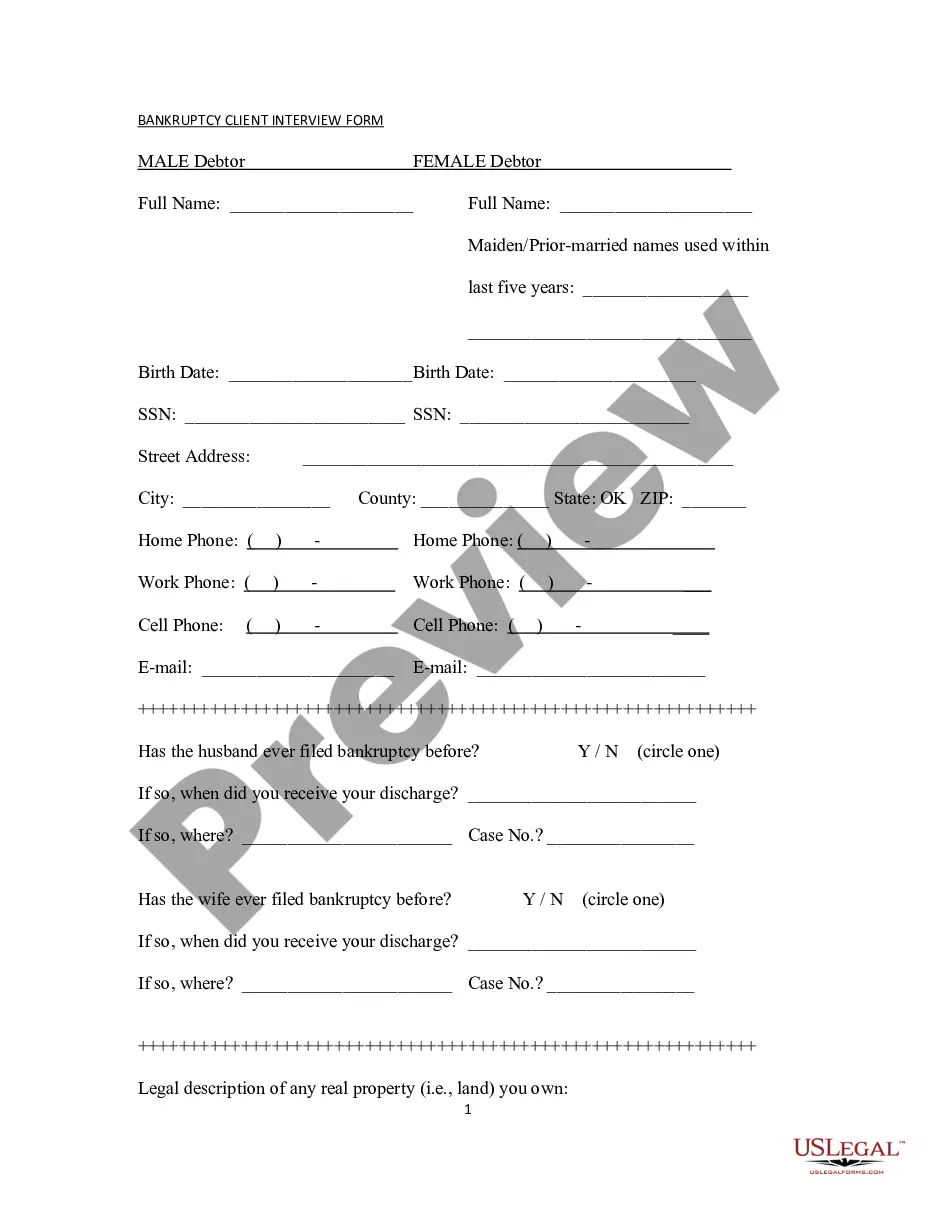

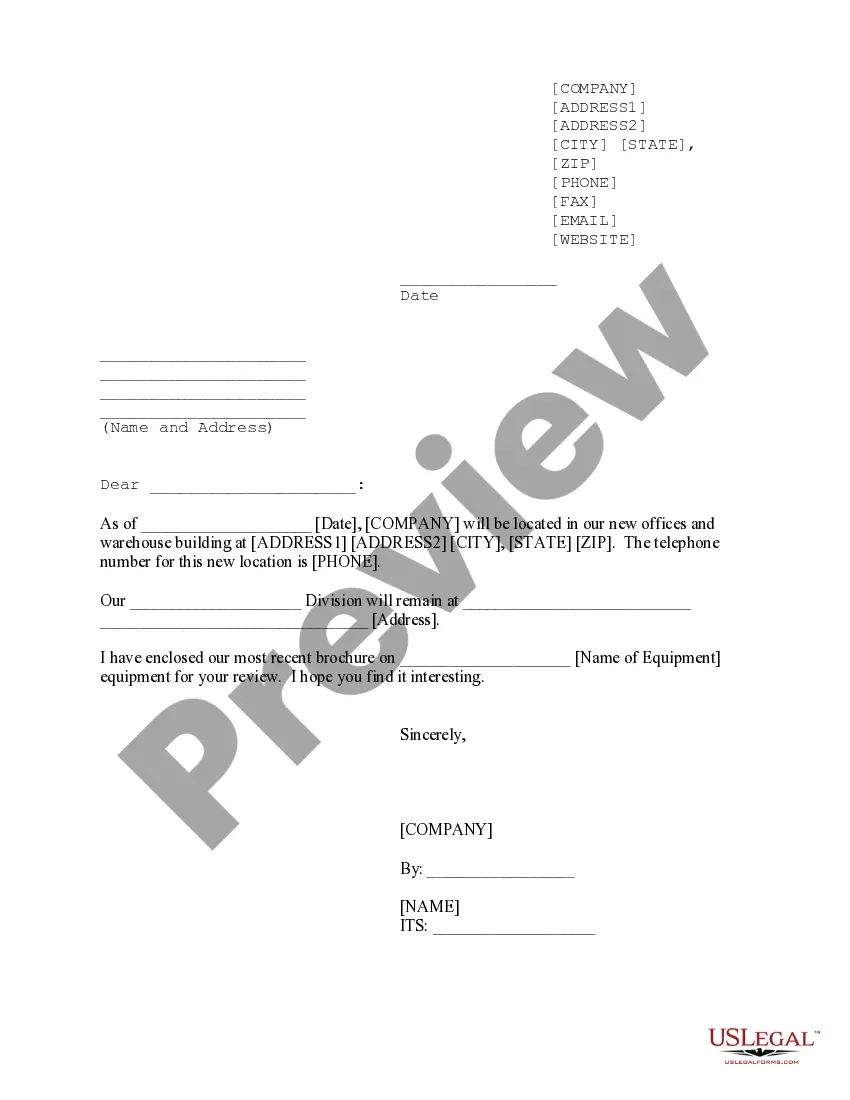

How to fill out General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

Are you currently in a location where you require documents for possibly business or personal purposes frequently.

There are numerous authentic document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms offers thousands of form templates, such as the North Carolina General Form of Factoring Agreement - Assignment of Accounts Receivable, designed to meet state and federal requirements.

Once you find the correct form, simply click Get now.

Choose the pricing plan you prefer, enter the required information to create your account, and pay for the transaction using your PayPal or credit card. Select a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the North Carolina General Form of Factoring Agreement - Assignment of Accounts Receivable template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it matches the correct city/state.

- Use the Preview button to view the form.

- Read the description to ensure you have selected the correct form.

- If the form is not what you're looking for, utilize the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

The accounts receivable step process begins with the issuance of invoices to customers. Next, the company tracks outstanding invoices and follows up on payments. Once payments are received, the company records these transactions in its financial records. By incorporating the North Carolina General Form of Factoring Agreement - Assignment of Accounts Receivable, businesses can enhance this process by efficiently managing their receivables.

Consent to assignment of receivables refers to the approval required from the debtor before an assignment can take effect. This consent ensures that the debtor acknowledges the transfer of payment rights to the assignee. Including this step is vital in a North Carolina General Form of Factoring Agreement - Assignment of Accounts Receivable, as it protects all parties involved by preventing disputes over payment obligations.

The terms 'pledge' and 'assignment' refer to two different ways of using accounts receivable as collateral. In a pledge, the lender holds the receivables as security while the borrower retains ownership and collection rights. In contrast, an assignment involves transferring the rights to collect receivables to another party. Understanding these distinctions is crucial for any agreement related to a North Carolina General Form of Factoring Agreement - Assignment of Accounts Receivable.

The primary difference between factoring and assignment of receivables lies in the financial control and ownership of the receivables. Factoring means selling your receivables to a factor, who then collects payments and assumes the risks. In contrast, an assignment allows you to leverage your receivables for financing while retaining more control over them. Being informed about these differences helps you choose the best solution for your business, such as the North Carolina General Form of Factoring Agreement - Assignment of Accounts Receivable.

A NoA, or Notice of Assignment, is a document that informs your customers that their accounts have been assigned to a factoring company. This notice is essential for ensuring that payments are redirected to the correct party. Utilizing a NoA can streamline the process and ensure smooth operations when executing the North Carolina General Form of Factoring Agreement - Assignment of Accounts Receivable.

Factoring is a financial transaction in which a company sells its receivables to a financial company (called a factor). The factor collects payment on the receivables from the company's customers. Companies choose factoring if they want to receive cash quickly rather than waiting for the duration of the credit terms.

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

Factoring your accounts receivables means that you actually sell them, as opposed to pledging them as collateral, to a factoring company. The factoring company gives you an advance payment for accounts you would have to wait on for payment.

Factoring is the sale of receivables, whereas invoice discounting ("assignment of accounts receivable" in American accounting) is a borrowing that involves the use of the accounts receivable assets as collateral for the loan.